Analysis report of US non-farm data in March 2025: Gold trend under unexpected data

- 2025年4月9日

- Posted by: Macro Global Markets

- Category: News

Analysis report of US non-farm data in March 2025: Gold trend under unexpected data

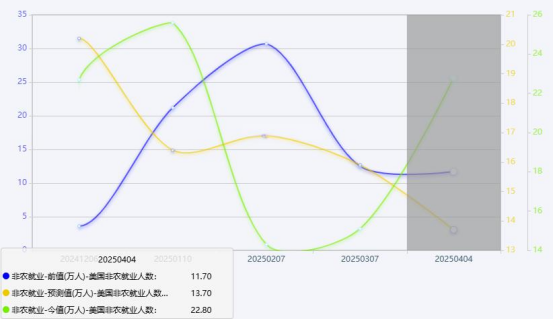

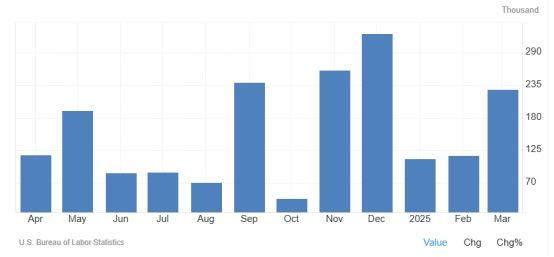

The U.S. non-farm employment market in March showed the characteristics of "total volume exceeding expectations and structural differentiation", with employment resilience and slowing wage growth coexisting, providing complex signals for the Federal Reserve's policy making. Data showed that the seasonally adjusted non-farm payrolls increased by 228,000 in March, far exceeding market expectations of 135,000. The previous value was revised down from 151,000 to 117,000.

The unemployment rate rose slightly to 4.2%, and the labor force participation rate rebounded to 62.5%, mainly affected by the increase in new labor force. Looking at the sectors, the service industry made a significant contribution, with healthcare (+78,000), leisure hotels (+43,000) and retail (+24,000) becoming the main driving factors, while employment in the production sectors generally declined. Federal government employment fell by 4,000, following a loss of 11,000 jobs in February.

Employment in other major industries that remained essentially unchanged over the month included mining, quarrying and petroleum and gas extraction; construction; manufacturing; wholesale trade; information; financial activities; professional and business services; leisure and hospitality; and other services. The wage growth rate slowed to 3.8% year-on-year and 0.3% month-on-month, indicating a marginal easing of inflationary pressure.

2. Interpretation of Small Non-farm ADP and Large Non-farm

Small non-farm ADP: Private sector employment increased by 155,000 in March, higher than the expected 105,000, and the previous value was revised up to 84,000. By industry, the service industry (+132,000) and manufacturing industry (+21,000) made significant contributions, indicating that private enterprises' willingness to recruit has rebounded. However, wage growth slowed down, with the wage increase for those who remained employed falling to 4.6% and the wage premium for those who changed jobs narrowing to 1.9%, reflecting the easing of competitive pressure in the labor market.

Big non-farm data: 228,000 new jobs hit a new high since November 2024, and the unemployment rate of 4.2% was in line with Nomura Securities' forecast. The core reasons why the data exceeded expectations were the recovery in government employment (+19,000) and the rebound in the retail and leisure accommodation industries driven by the resumption of strikes.

Impact of last month's non-farm payrolls on gold prices: After the release of February non-farm payrolls (117,000 new jobs, unemployment rate 4.1%), market expectations for the Fed's rate cut cooled, the U.S. dollar index rebounded to 102.37, and spot gold fell from a high of $3,140/ounce to $3,096/ounce.

But the tariff policy impact in March dominated the market, however, the strong performance of non-farm data in March quickly broke this pessimistic expectation. After the data was released, the US dollar index rose by about 15 points in the short term to 101.9538, and then further climbed to 102.0950, showing a brief recovery in market confidence in the US dollar. The price of gold was under obvious pressure. Spot gold once fell by $12 to $3,088.13 an ounce, and then rebounded slightly to $3,093.55 an ounce.

3. Historical non-agricultural data chart

IV. Forecasts by relevant institutions or banks

Goldman Sachs: It is predicted that the non-farm payrolls will increase by 135,000 in March, and the actual result is far beyond expectations. It points out that the data reflects the "employment buffer period before the tariff policy is implemented", but the impact of subsequent tariffs on the manufacturing industry may lead to a weakening of the job market.

CITIC Securities: We believe that the overall job market is healthy but marginally weakening. Signals such as the decline in the employment rate of the 25-54 age group and the slowdown in wage growth are worthy of vigilance. The Federal Reserve may maintain a hawkish stance due to inflationary pressure.

Citi: Emphasizing that data exceeding expectations may strengthen the Fed’s “higher for longer” policy path, but the economic uncertainty caused by tariffs may offset some of the hawkish impact.

Nomura Securities: The unemployment rate is expected to rise to 4.2%, which is consistent with the actual data. It is believed that the supply and demand relationship in the labor market is improving, but the addition of new labor force may delay the decline in the unemployment rate.

5. Reminders for this small non-agricultural ADP and large non-agricultural transactions

Data interpretation: The consistency between ADP and non-farm data (both exceeded expectations) strengthens the perception of the resilience of the job market, but the slowdown in wage growth may ease the pressure on the Fed to raise interest rates. The market needs to be wary of the expectation gap of "strong data, weak policy".

Gold trading strategy:

Technical analysis: Gold fell below the 20-day moving average (US$3,054) on the daily line, and the short-term bearish trend was established.

Fundamentals: If the non-farm data reinforces the Fed's hawkish stance, a stronger dollar may suppress gold prices; but if the risk of stagflation caused by tariffs increases, gold's safe-haven content may support prices.

Risk warning: As of the opening price of $3023.31 per ounce on April 7, spot gold fell to $2972.26 per ounce during the day, but then rose to $3034.73 per ounce. The volatility is large, and investors need to control their positions and set stop losses.

Trump's tariff policy takes effect: a 25% tariff will be imposed on imported cars from April 5, China announced countermeasures against the United States, and global trade tensions escalated, driving the safe-haven buying demand for gold; Federal Reserve Chairman Powell's speech: On April 4, he stated that "tariffs may push up inflation but more data is needed", dampening the market's expectations of a rate cut, and the US dollar index rebounded to 102.37; US March CPI data: The overall year-on-year growth is expected to be 2.5%, and the core year-on-year growth is 3.0%. If the data exceeds expectations, it may strengthen the Fed's hawkish stance, otherwise it may ease market concerns about inflation; Geopolitical risks: The continued conflict between Russia and Ukraine, the turbulent situation in the Middle East, and the impact of tariff policies have increased market uncertainty, and the attractiveness of gold as a safe-haven asset has increased.

Comprehensive impact: The market is facing the triple driving forces of "data exceeding expectations + policy shocks + geopolitical risks" during the non-farm week. Gold may continue to fluctuate widely. Investors are advised to pay close attention to the breakthrough direction of the US$3000-3094 range.

Summarize

The March non-farm data showed that the U.S. job market remained resilient, but the downward revision of the previous value, the slowdown in wage growth and the impact of tariff policies weakened the data. The Fed’s trade-off between inflation and growth has become more complicated, and the market needs to be wary of rising risks of “stagflation.” Gold is suppressed by technical factors in the short term, but it still has upward potential in the medium and long term supported by geopolitical and policy uncertainties. Investors should combine data and event-driven approaches to flexibly adjust their trading strategies.