-

Trump's repeated tariff policies highlight the risk aversion in the gold market

- 2025年3月10日

- Posted by: Macro Global Markets

- Category: News

No message yet

On March 6, local time, US President Trump signed a tariff amendment, announcing the suspension of the 25% tariff on Canadian and Mexican goods that comply with the US-Mexico-Canada Agreement, with the exemption period lasting until April 2. This policy shift came just two days after it announced on March 3 that "tariffs will take effect on the 4th", triggering severe fluctuations in global financial markets. As a traditional safe-haven asset, gold has demonstrated significant anti-inflation and hedging properties amid policy uncertainty.

-

Gold prices fluctuate, and major institutions have new views on the gold market

- 2025年3月7日

- Posted by: Macro Global Markets

- Category: News

Last week, international gold prices experienced a sharp drop. The price of the main gold futures contract on the New York Mercantile Exchange fell by 3.55% in total, ending the previous nine-week rally. This was also the largest single-week drop in international gold prices since November last year.

-

The U.S. ADP data for February was a surprise, and non-farm data became the key focus

- 2025年3月6日

- Posted by: Macro Global Markets

- Category: News

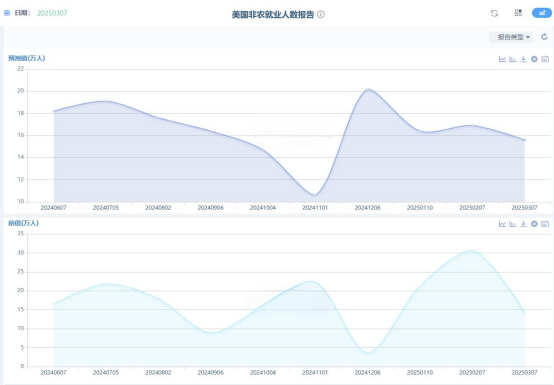

The U.S. ADP employment data for February was unexpectedly disappointing, far below market expectations. This result instantly ignited investors' sensitive nerves. The gold market was the first to react violently, and prices fluctuated sharply. At the same time, the evolution of expectations for the Fed's rate cut has entered a new stage, and the upcoming non-farm data is seen by the market as a key factor in determining the next direction of gold.

-

February Non-Farm Employment Report Forecast - New Trends in the Labor Market and Economic Outlook

- 2025年3月5日

- Posted by: Macro Global Markets

- Category: News

In January, non-farm employment increased by 143,000 (previous value revised up to 307,000), and the unemployment rate dropped to 4.0%, but the unexpected wage growth rate (4.1% year-on-year) raised inflation concerns. The market needs to verify whether the February data continues the combination of "strong employment + high wages" or shows signs of economic slowdown.

-

Trudeau responds strongly to Trump's tariff threat, and global trade tensions escalate again

- 2025年3月4日

- Posted by: Macro Global Markets

- Category: News

On February 27, local time, Canadian Prime Minister Trudeau issued a strongly worded response to the tariff policy that the Trump administration may implement. He made it clear that if the Trump administration implements "unreasonable tariff policies", Canada will immediately and strongly retaliate. This statement has made the already tense global trade situation even more tense.

-

The ever-changing gold market: short-term pullbacks and long-term support factors

- 2025年3月3日

- Posted by: Macro Global Markets

- Category: News

週四,由於美元走強且投資者等待關鍵通膨數據以獲取聯準會貨幣政策線索,金價下跌至兩週來的最低水平。美盤初短線下挫近13美元,跌破2870美元/盎司,日內跌超1.60%,週五更是迎來新低點跌破2860美元/盎司。美元指數則是上漲超0.5%,站上107關口,進一步脫離近期的11週低點,使得以美元計價的黃金對其他貨幣持有者來說更加昂貴。美國10年期公債殖利率一度上漲逾1%,削弱了無息資產黃金的相對吸引力。

-

The United States and Ukraine are about to sign a rare earth mineral agreement, adding uncertainty to the international situation

- 2025年2月28日

- Posted by: Macro Global Markets

- Category: News

On February 26, local time, US President Trump confirmed that Ukrainian President Zelensky will visit the United States on February 28 to sign an important rare earth mineral agreement. This news has attracted international attention. The agreement is not only about Ukraine's efforts to gain US support, but also adds uncertainty to US-Russia diplomatic interactions.

-

The Fed is taking a "wait-and-see" approach to the impact of tariff policies, and the interest rate cut decision remains uncertain

- 2025年2月26日

- Posted by: Macro Global Markets

- Category: News

The Federal Reserve maintains a "wait-and-see" stance, and the impact of Trump's policies becomes a key variable in the decision to cut interest rates. Chicago Fed President Austan Goolsbee clearly pointed out that the Federal Reserve is currently in a "wait-and-see" state and will not take rash action until the comprehensive impact of a series of new policies of the Trump administration on the economy becomes clear. These policies cover multiple dimensions, including trade tariff adjustments, immigration policy changes, tax structure optimization, government spending cuts, and federal employee layoffs. He emphasized that before making a decision to cut interest rates, the Federal Reserve must wait for the policy effects to be fully released until the situation is "settled."

-

Markets are "blunting" on Trump's tariff policy; gold's safe-haven properties hide strategic opportunities

- 2025年2月25日

- Posted by: Macro Global Markets

- Category: News

The impact of the Trump administration's recent tariff threats on global capital markets has shown a significant blunting effect. Although policy uncertainty remains, the market volatility index (VIX index) has fallen from 22 at the beginning of the year to around 15, indicating that investors' immediate reaction to trade frictions is weak.

-

Geopolitical risks and policy games resonate, gold prices fluctuate at high levels and then retreat after hitting a record high

- 2025年2月24日

- Posted by: Macro Global Markets

- Category: News

On February 21, 2025, the international gold market continued its violent fluctuations. The London spot gold price fell below $2,930 an ounce during the Asian session, down nearly 1.5% from the historical high of $2,954.72 set the previous trading day, and then stabilized around $2,940.