-

Trump's tariff stick is still hanging in the balance, Powell has a "perfect excuse" to maintain high interest rates, and gold is under pressure to fall

- 2025年7月11日

- Posted by: Macro Global Markets

- Category: News

No message yet

On July 7, US President Trump signed an executive order to postpone the effective date of "reciprocal tariffs" on 14 countries including Japan and South Korea from July 9 to August 1, and announced the specific tariff rate (25%-40%). Although this policy adjustment gives countries a three-week buffer period, it clearly requires the other party to reach a trade agreement before August 1, otherwise they will face higher tariffs. Affected by this, the Tokyo Stock Exchange Nikkei 225 Index fell 1.2% on July 8, and the share prices of Toyota, Honda and other automakers fell by more than 4%.

-

Trump's tariff deadline extended to August 1! Japan, South Korea and 14 other countries face a minimum tariff of 25%, geopolitical risks resonate with the gold market

- 2025年7月10日

- Posted by: Macro Global Markets

- Category: News

On July 7, local time, US President Trump announced that he would impose tariffs ranging from 25% to 40% on imports from 14 countries including Japan and South Korea from August 1, and signed an executive order to extend the suspension of "reciprocal tariffs" originally scheduled for July 9 to August 1. According to the letter released by Trump, Japan, South Korea, Malaysia and other countries will be subject to a 25% tariff, South Africa and Bosnia and Herzegovina will be 30%, Indonesia will be 32%, Thailand and Cambodia will be 36%, and Laos and Myanmar will be as high as 40%. Trump emphasized that if relevant countries adopt retaliatory tariffs, the United States will "reciprocally increase the tariffs" and encourage companies to build factories in the United States to circumvent tariffs.

-

Gaza ceasefire talks are deadlocked again. Can the meeting between Trump and Netanyahu break the deadlock?

- 2025年7月9日

- Posted by: Macro Global Markets

- Category: News

In the early morning of July 7, local time, the first round of Gaza ceasefire negotiations ended in Doha, Qatar without any results. The Israeli negotiating team failed to reach an agreement with Hamas on the ceasefire due to insufficient authorization. At the same time, Israeli Prime Minister Netanyahu set off for the United States on the 6th and planned to meet with US President Trump on the evening of the 7th to discuss issues such as the Gaza ceasefire, the Iranian issue and the normalization of relations with Arab countries. The market is highly concerned about whether this meeting will release a breakthrough signal, especially whether Trump will make concessions to Israel in terms of tariff policy and military aid.

-

In-depth analysis of the June 2025 non-agricultural report: "false fire" cannot hide employment concerns

- 2025年7月8日

- Posted by: Macro Global Markets

- Category: News

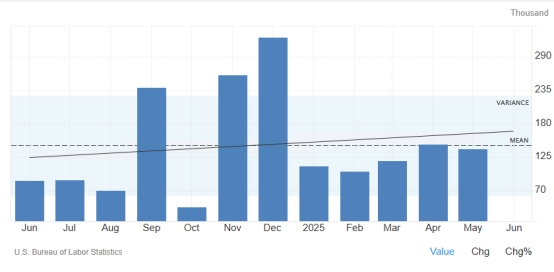

The US non-farm payrolls data for June 2025 exceeded expectations on the surface but was structurally weak, with 147,000 new jobs (expected 110,000, revised to 144,000 before), the unemployment rate dropped to 4.1% (expected 4.3%), and wages increased by 3.7% year-on-year (expected 3.8%). Despite the strong headline data, the private sector only added 74,000 jobs, the lowest level since October 2024, and the government sector contributed nearly half of the new jobs (73,000), mainly concentrated in state and local education.

-

[MACRO Sharp Comments] Panoramic analysis of US non-agricultural data in June: Employment resilience and market ripples under policy games

- 2025年7月7日

- Posted by: Macro Global Markets

- Category: News

The June non-farm data released by the U.S. Bureau of Labor Statistics on Thursday, like a stone thrown into the market lake, not only reflects the complex resilience of the U.S. labor market, but also triggers the financial market to re-examine the policy path of the Federal Reserve. From the employment data itself to asset price fluctuations, from the differentiation of industrial structure to the confrontation of institutional views, this report outlines the current delicate picture of the U.S. economy.

-

The unexpected negative value of ADP tore open the cracks in the job market, and gold waited for direction on the eve of non-farm payrolls

- 2025年7月4日

- Posted by: Macro Global Markets

- Category: News

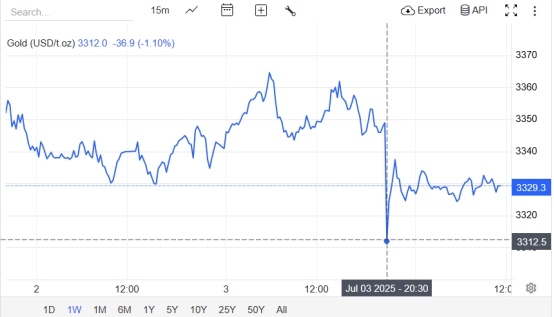

As of the early Asian session on July 3, spot gold fluctuated in the range of $3342.00-3358.00, with the latest price at $3352.30 per ounce. After three consecutive days of gains, the market's attention is focused on the U.S. non-farm payrolls data for June to be released at 20:30 tonight.

-

[MACRO Trends] The global crude oil market game: the complex chess game behind policy swings and strategic production increases

- 2025年7月3日

- Posted by: Macro Global Markets

- Category: News

Recently, the global crude oil market has been impacted by two forces: the United States' policy toward Iran has been inconsistent. Since the Trump administration withdrew from the Iran nuclear agreement and imposed strong sanctions, Iran's crude oil exports have dropped sharply from the 2018 peak of 2.5 million barrels/day to less than 500,000 barrels; although the Biden administration sought negotiations, it was deadlocked due to core differences.

-

The Senate narrowly passed the "Big and Beautiful" bill, and the $3.3 trillion debt bomb set off a battle in the House of Representatives

- 2025年7月3日

- Posted by: Macro Global Markets

- Category: News

On July 1, local time, the U.S. Senate passed the "big and beautiful" tax and spending bill pushed by Trump with a narrow advantage of 51 to 50, and Vice President Pence cast the key tie-breaking vote to break the deadlock. The bill plans to cut taxes by $4 trillion and raise the debt ceiling by $5 trillion over ten years, but the latest assessment by the Congressional Budget Office (CBO) shows that the Senate version will increase the federal deficit by $3.3 trillion over the next decade, far exceeding the version previously passed by the House of Representatives.

-

Non-farm data outlook for June 2025: Employment picture in the fog

- 2025年7月2日

- Posted by: Macro Global Markets

- Category: News

As the core observation of the Federal Reserve's monetary policy, the fluctuation of the US non-farm payrolls data not only reflects the health of the labor market, but also directly affects the pricing logic of global assets. The current market is in a critical period of the game between "high inflation stickiness" and "economic slowdown concerns". The performance of the June non-farm payrolls data will further verify the pace of labor market cooling and affect the pricing of the Federal Reserve's expected interest rate cut in September.

-

Trump's tough stance on Iran's nuclear issue has caused a surge in demand for safe-haven gold! Can bulls break through key resistance?

- 2025年7月1日

- Posted by: Macro Global Markets

- Category: News

On June 29 local time, US President Trump announced on the social media account "Real Social" that the United States has completely destroyed Iran's three nuclear facilities in Fordow, Natanz and Isfahan, and made it clear that "sanctions on Iran will not be lifted". At the same time, he warned that "if Iran continues to provoke, its nuclear facilities will be bombed again."