-

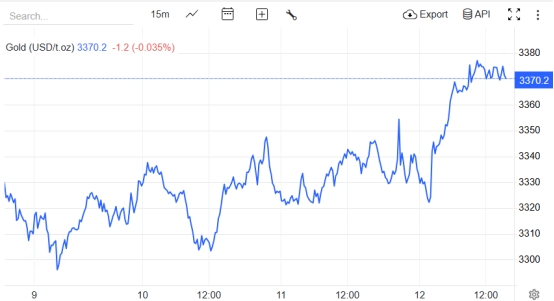

Lightning raid! Israeli army seizes air supremacy in western Iran within 48 hours, and demand for gold as a safe haven surges

- 2025年6月17日

- Posted by: Macro Global Markets

- Category: News

No message yet

The Israeli army had previously destroyed more than 40 key targets in Iran, including the Natanz nuclear facility, missile factories and the Revolutionary Guard headquarters in Tehran. Iran's air defense system was paralyzed in the first round of attacks, and Israeli fighter jets then penetrated deep into Iran's hinterland and continued to operate over Tehran for 2.5 hours, completely controlling the air supremacy from western Iran to the capital.

-

Fighting breaks out in the Middle East, Netanyahu declares "action continues to the end", Iranian F-14s take off and standby, gold soars

- 2025年6月16日

- Posted by: Macro Global Markets

- Category: News

Spot gold reached a high of $3,440 per ounce, up 1.83% on the day, a new high in nearly a month; Brent crude oil soared to $89.65 per barrel, up 6.2%. After Israeli Prime Minister Netanyahu made a tough statement on the 13th, all flights at Tehran Airport in Iran were suspended, and F-14 fighter jets carrying "Faith-90" missiles took off urgently. The situation in the Middle East was on the verge of getting out of control, and safe-haven assets soared across the board.

-

US CPI is lower than expected, triggering expectations of interest rate cuts! Gold soars, and the 10-year US Treasury yield falls below 4.5%

- 2025年6月16日

- Posted by: Macro Global Markets

- Category: News

On the evening of June 11, the U.S. Department of Labor released the CPI data for May. The total CPI increased by 2.4% year-on-year (expected 2.5%), the core CPI increased by 2.8% year-on-year (expected 2.9%), and the month-on-month increase was only 0.1% (expected 0.2%), both lower than market expectations. After the data was released, spot gold soared by $12 in the short term to $3,376.3 per ounce (the highest in the Asian session on June 12), a new high this week; the 10-year U.S. Treasury yield plummeted by 5 basis points to 4.38%, and the market's expectation that the Federal Reserve would cut interest rates twice this year rose to 72%.

-

Tariffs strangle inflation VS immigration tears apart employment - the US economy is trapped in a policy paradox trap

- 2025年6月13日

- Posted by: Macro Global Markets

- Category: News

As the Trump administration's tariff policy and immigration restrictions are affecting the U.S. economy at the same time, a set of seemingly contradictory data is causing the market to think deeply about the true health of the economy. The changes in the consumer price index (CPI) and the job market in May are essentially a microcosm of the distortion of economic signals under policy intervention, and this phenomenon is making the Federal Reserve's monetary policy regulation fall into an unprecedentedly complex situation.

-

The Western camp is no longer monolithic! Britain, Canada and five other countries jointly sanctioned Israel's far-right minister, and the demand for gold as a safe haven heats up

- 2025年6月12日

- Posted by: Macro Global Markets

- Category: News

On June 10, local time, the United Kingdom, Canada, Australia, New Zealand and Norway issued a joint statement announcing asset freezes and travel bans on Israeli National Security Minister Itamar Ben-Gvir and Finance Minister Bezalel Smotrich. The reason for the sanctions is that the two have repeatedly incited extreme violence against Palestinians, including supporting settlement expansion and advocating forced displacement of Palestinians. This is the first time that Western countries have imposed sanctions on Israeli cabinet ministers, marking a significant divergence in the Western camp's policy toward Israel.

-

Trump dispatches more National Guard soldiers to Los Angeles, constitutional crisis and safe-haven demand in gold market heat up

- 2025年6月11日

- Posted by: Macro Global Markets

- Category: News

On June 9, local time, US President Trump announced that he would send an additional 2,000 National Guard soldiers to Los Angeles to deal with the ongoing riots caused by conflicts over immigration enforcement. This deployment is a further intervention by the Trump administration in the situation in California after the first dispatch of 2,000 National Guard troops on the 7th. As of June 10, 1,700 National Guard soldiers and 700 Marines have been deployed in the greater Los Angeles area, focusing on protecting federal agencies and personnel.

-

In-depth analysis of the May 2025 non-farm report: Employment resilience supports economic expectations, gold is under pressure in the short term but still has opportunities in the long term

- 2025年6月10日

- Posted by: Macro Global Markets

- Category: News

The non-farm payrolls data for May released by the U.S. Department of Labor on June 6 showed that the number of new jobs was 139,000, slightly higher than the market expectation of 130,000, but slower than the revised 147,000 in April. The unemployment rate remained stable at 4.2% for the third consecutive month, in line with expectations. The wage growth rate exceeded expectations, with the average hourly wage increasing by 3.9% year-on-year and 0.4% month-on-month, indicating that labor cost pressures still exist.

-

Fed hawks warn of inflation risks, gold is under pressure but long-term support remains

- 2025年6月9日

- Posted by: Macro Global Markets

- Category: News

On June 6, local time, Federal Reserve Board member Michelle W. Bowman and Kansas City Fed President Jeffrey Schmid gave speeches respectively, clearly identifying inflation as the "number one threat" to the current economy. Kugler pointed out that the Trump administration's tariff policy has had a substantial impact on prices, and it is expected that inflationary pressure will continue to worsen in 2025.

-

Crimea bridge attacked again! Conflict breaks out again after negotiations, senior Russian official vows "full retaliation"

- 2025年6月6日

- Posted by: Macro Global Markets

- Category: News

In the early morning of June 4, the Ukrainian military launched a new round of attacks on the Crimean Bridge using an improved TB-2 drone, blowing up two lanes of the bridge and interrupting road traffic. This is the third major attack on the bridge since it was first attacked in October 2022. The Ukrainian Ministry of Defense said the operation was aimed at "cutting off the Russian military's logistical supply lines."

-

ADP hits a two-year low! The dollar plummeted and gold soared, and the expectation of interest rate cuts ignited the bull carnival

- 2025年6月6日

- Posted by: Macro Global Markets

- Category: News

On the evening of June 4th, Beijing time, the U.S. ADP employment data for May (commonly known as "small non-farm") shocked the market with 37,000 new jobs, only one-third of the expected value of 110,000, the lowest increase since March 2023. After the data was released, the U.S. dollar index plunged 20 basis points in the short term, once falling below the 99 mark to 98.9783, and spot gold soared by $6 to $3,354.52 per ounce, highlighting the market's concerns about the economic outlook and the surge in risk aversion demand.