-

[MACRO Trends] Global financial market turmoil: the changing dynamics of U.S. Treasuries and safe-haven assets

- 2025年4月27日

- Posted by: Macro Global Markets

- Category: News

No message yet

Recently, global financial markets have been caught in turmoil, with the U.S. Treasury market being the hardest hit. The performance of safe-haven assets has also attracted attention.

-

12 U.S. states jointly accuse Trump of unconstitutional tariff policy! The gold market faces another double test of geopolitical policy

- 2025年4月25日

- Posted by: Macro Global Markets

- Category: News

On April 23rd local time, a coalition of 12 U.S. states filed a lawsuit with the New York International Trade Court, accusing the Trump administration's "reciprocal tariff" policy of violating the Constitution and asking the court to rule that the policy is illegal and block its implementation. States involved in the lawsuit include New York, California (which had previously filed a separate lawsuit), Arizona, etc., covering major economic centers on the east and west coasts, representing nearly 40% of the U.S. population and 50% of import trade volume.

-

Trump's attitude changes 180 degrees! Gold price plunges from $3,500

- 2025年4月25日

- Posted by: Macro Global Markets

- Category: News

On April 23, Beijing time, US President Trump suddenly changed his tone during a media interview at the White House, making it clear that he "has no intention of firing Federal Reserve Chairman Powell" and emphasized that "he hopes he will be more proactive on the issue of interest rates." This statement is in stark contrast to his public criticism on April 17 that Powell "acted too late and made mistakes" and "left as soon as possible."

-

Trump "forces Powell to abdicate": the US dollar credit crisis and the historic reconstruction of the gold market

- 2025年4月24日

- Posted by: Macro Global Markets

- Category: News

On April 22, 2025, the international financial market was plunged into severe turbulence due to the fierce game between the Trump administration and the Federal Reserve. U.S. President Trump has repeatedly blasted Federal Reserve Chairman Powell on social media, calling him "the biggest loser" and "Mr. Too Late" and threatening to "fire him immediately."

-

Democrats warn Trump that "Fixing Powell = stock market crash"! Gold soars against the trend, and 90% of Wall Street funds suffer losses

- 2025年4月23日

- Posted by: Macro Global Markets

- Category: News

The game between the Democrats and the White House over "control of the Federal Reserve" has intensified: Senate Democratic leader Chuck Schumer publicly warned on April 18 that if Trump forcibly fires Powell, the U.S. stock market may repeat the mistakes of "Black Monday" in 1987.

-

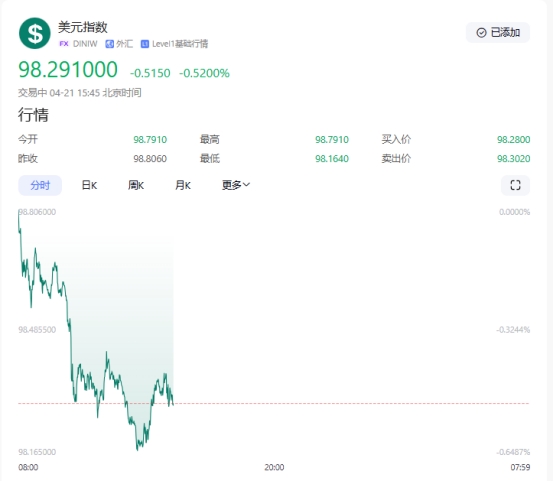

The US dollar plummeted to a three-year low! Multinational US companies launched a "super long defense war"

- 2025年4月22日

- Posted by: Macro Global Markets

- Category: News

On April 21, 2025, the U.S. dollar index (DXY) continued to fall, hitting an intraday low of 98.164, a sharp drop of 1.03% from the previous trading day's closing price, setting a new three-year low since April 2022. As a result, the euro soared to 1.1485 against the US dollar, the pound broke through 1.3350 against the US dollar, and the yen strengthened to 141.80 against the US dollar due to expectations of intervention by the Bank of Japan.

-

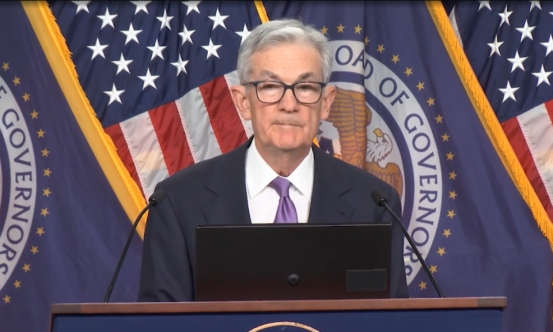

Powell's "no rescue" declaration set off the market! The signal of the Fed's policy shift is evident

- 2025年4月21日

- Posted by: Macro Global Markets

- Category: News

In the early morning of April 17, Federal Reserve Chairman Powell delivered a strongly worded speech at the Chicago Economic Club, explicitly rejecting the promise of "rescue the market" and bluntly stating that the Trump administration's tariff policy has exceeded expectations and may push up price pressures through supply chain disruptions and cost transmission.

-

[MACRO Sharp Comments] Global economic turmoil and challenges: Behind the ECB's interest rate cut and US-Japan trade negotiations

- 2025年4月18日

- Posted by: Macro Global Markets

- Category: News

On the global economic stage today, a storm caused by tariff tensions and uncertainty is brewing quietly, posing a serious threat to economic growth in the eurozone. The European Central Bank is facing unprecedented pressure and is widely expected to cut interest rates for the third time this year to cope with this complex situation.

-

[MACRO Trends] Trump's tariff policy triggers market turmoil: weak dollar, soaring gold prices and global economic uncertainty

- 2025年4月17日

- Posted by: Macro Global Markets

- Category: News

US President Trump recently signed an order to investigate tariffs on key mineral products, marking a further escalation of his trade war strategy. The move not only set off a chain reaction in the global economy and exacerbated the decoupling of the traditional relationship between the dollar and U.S. Treasury yields, but also drove a historic rise in gold prices.

-

Trump's criticism of Zelensky intensifies Russia-Ukraine conflict

- 2025年4月16日

- Posted by: Macro Global Markets

- Category: News

On April 14, 2025, U.S. President Trump once again blasted Ukrainian President Zelensky during a meeting with Salvadoran President Bukele at the White House, saying that he "recklessly provoked a war" and was "ungrateful" for U.S. aid.