[MACRO Sharp Comments] Trump's tariff policy takes a sharp turn: safe-haven asset game after the market's violent shock

- 2025年4月14日

- Posted by: Macro Global Markets

- Category: News

[MACRO Sharp Comments] Trump's tariff policy takes a sharp turn: safe-haven asset game after the market's violent shock

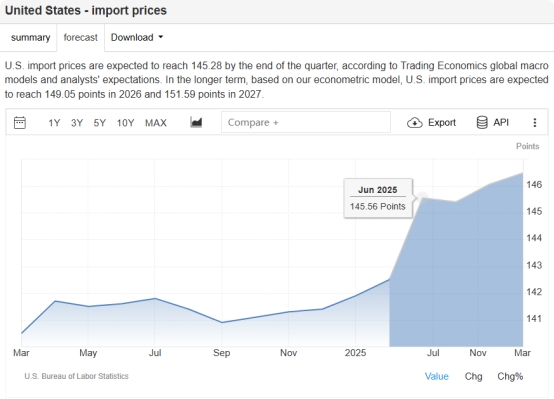

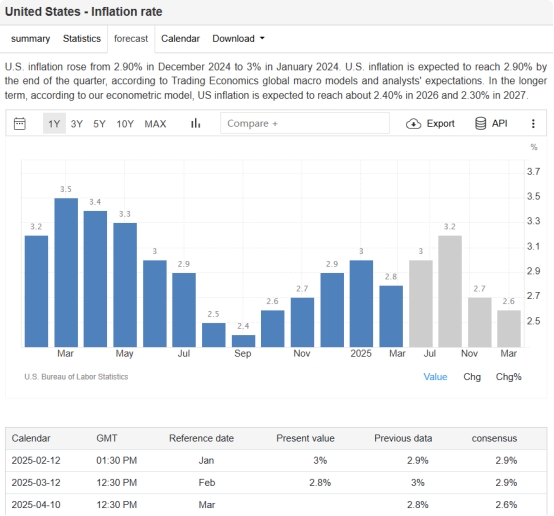

On April 9, 2025, just 13 hours after the high "reciprocal tariffs" imposed by the United States on dozens of trading partners came into effect, the Trump administration suddenly announced a 90-day suspension of tariffs, reducing the tax rate to 10%. The dramatic turn stems from the violent turmoil in financial markets - trillions of dollars evaporated from U.S. stocks in a single day after the tariffs came into effect, and Treasury yields soared to levels at the beginning of the epidemic, forcing the Trump administration to make an emergency turn.

According to a statement from the White House, the suspension measures cover 75 countries and regions and are intended to buy time for trade negotiations, but Canada and Mexico are exempted due to the US-Mexico-Canada Agreement, and tariffs on specific industries such as automobiles, steel, and aluminum remain unchanged. In addition, the 25% steel and aluminum tariffs that took effect in March and the 25% auto tariffs implemented on April 2 remain in effect, and Trump has also hinted that tariffs may be imposed on the pharmaceutical industry in the future. This policy adjustment was seen by the outside world as a microcosm of "chaotic governance", and Senate Democratic leader Schumer criticized him for "treating governance as a joke."

The policy shift triggered a sharp market rebound. The three major U.S. stock indices recorded historic gains: the Dow Jones Industrial Average closed up 7.87%, the S&P 500 rose 9.52%, and the Nasdaq soared 12.16%, all of which were the largest single-day gains in recent years. WTI crude oil soared 8% to break through $62 per barrel, and Brent crude oil rose nearly 7%; spot gold rose 3.75% during the session, the largest intraday fluctuation since 2020. On April 10, the gold price in the Asian session once hit $3,120 per ounce, approaching its historical high.

The reversal in sentiment reflects expectations of a short-term de-escalation in the tariff conflict. Traders sharply cut bets on a May rate cut by the Federal Reserve and are now pricing in three rate cuts starting in June. However, Wall Street generally warned that "the tariff war is far from over": the 90-day suspension period is only a negotiation window, and companies still face long-term uncertainties. CME data showed that investors are cautious about risky assets, and the rebound may only be short-covering.

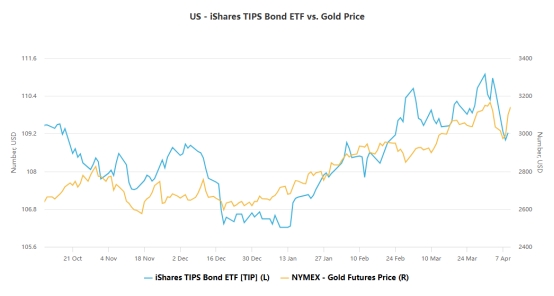

Amid policy fluctuations, gold has become the biggest winner. Since 2025, the price of gold has risen by 18%. After breaking through the $3,000 mark, TD Securities pointed out that its "hedge against instability" properties continued to strengthen. The World Gold Council emphasized that tariff uncertainty, expectations of a Federal Reserve rate cut and central bank gold purchases have jointly pushed gold prices higher. Bank of America maintained its target price of $3,500, believing that "the trend of de-dollarization is good for gold."

In contrast, traditional safe-haven assets performed differently: the US dollar index fell 1% amid tariff turmoil, and Deutsche Bank questioned its safe-haven status due to the widening US current account deficit and declining correlation with risky assets; the Japanese yen and Swiss franc were supported by capital inflows. U.S. Treasuries were sold off, with the 30-year yield soaring to 4.96%, the highest since March 2020. Scholars from Pepperdine University pointed out that the dual pressures of inflation and economic recession are undermining the "risk-free" label of U.S. Treasuries.

Defensive stocks and cash have also become choices for some investors. Consumer staples stocks such as Costco have performed steadily this year, while growth stocks such as Amazon have been more affected by market volatility; although cash has no volatility risk, the erosion effect of inflation still exists, and institutions are more inclined to allocate high-yield bonds in the medium term.

The market's interpretation of the tariff suspension is polarized. The National Investment Management Group in Philadelphia believes that "progress has been made in the negotiations", but warns that "surges are as dangerous as plunges"; Oxford Economics in New York pointed out that policy ambiguity has not been eliminated and "daily changes in tariff levels are the biggest risk." B. RILEY Wealth Management mentioned that the buying of 2 trillion US dollars in 8 minutes was caused by "fake news", and the current carnival after the implementation of the policy reflects the market's extreme desire for certainty.

Gold analyst Nicky Shiels raised his gold price forecast for 2025 to $2,950, arguing that "gold is the best protective asset in a stagflation environment," but lowered his silver forecast to $34.50 as industrial demand was dragged down by the trade war. Former Treasury Secretary Summers warned that "reckless policies are not out of danger", and the Federal Reserve meeting minutes also showed that policymakers were concerned about the "difficult trade-off between rising inflation and slowing growth."

The Trump administration’s “sudden brake” on tariffs has given the market a short-term respite, but it is essentially the product of policy swings. In the next 90 days, global trade negotiations, the Federal Reserve's monetary policy and US economic data will become key variables. Gold's safe-haven appeal continues to stand out amid uncertainty, but whether the U.S. stock market carnival can continue and whether traditional safe-haven assets can regain confidence still depends on the final outcome of this "tariff marathon." For investors, the risk premium behind the short-term rebound has not disappeared, and maintaining caution and diversified allocation remain the core strategies for dealing with turbulence.