【MACRO Trends】Trump’s tariffs hit global markets, and risk aversion swept the investment sector

- 2025年4月8日

- Posted by: Macro Global Markets

- Category: News

【MACRO Trends】Trump’s tariffs hit global markets, and risk aversion swept the investment sector

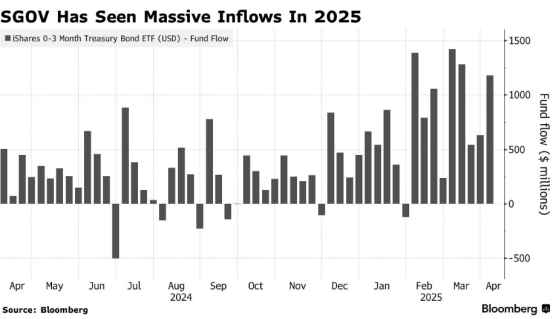

Trump's new tariff system has had a widespread impact on the global economy, and investors have flocked to safe-haven assets. Data shows that gold ETFs (such as GLD and IAU) attracted more than US$650 million in inflows last week, and the cumulative inflows since the beginning of the year have reached US$9.9 billion. At the same time, ultra-short bond ETFs (such as SGOV and BIL) also recorded an inflow of US$3.5 billion, showing investors' strong demand for cash proxy tools.

Market analysis pointed out that Trump's tariff policy not only exacerbated trade tensions, but also triggered concerns about a global economic recession. Bank of America called it the "biggest shock to global trade in modern times," while UBS Group AG warned that U.S. economic conditions could deteriorate further if tariffs persist.

2. Global stock markets plummeted and panic spread

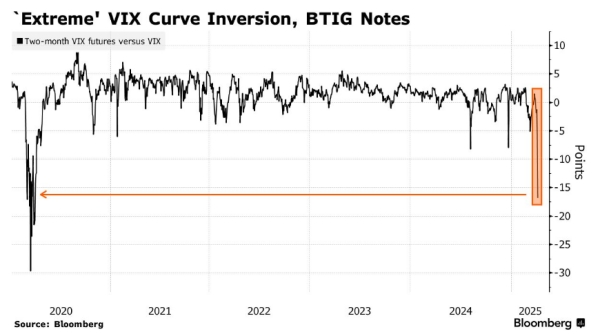

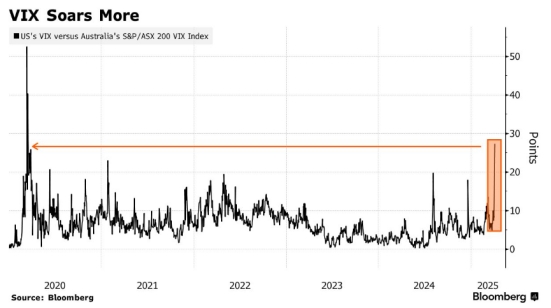

Global stock markets suffered a "Black Monday"-style plunge at the opening of trading on Monday. S&P 500 index futures fell more than 4.7%, Nasdaq futures fell more than 5.5% at one point, and Dow Jones index futures fell more than 4%; Asian markets also suffered heavy losses, with the A-share ChiNext Index falling nearly 10% and the Hong Kong stock Hang Seng Index closing down 10.7%. The VIX fear index of the U.S. stock market soared to above 40, reaching its highest level since the 2020 epidemic.

3. Risk aversion differentiation between precious metals and currency markets

Although gold is often viewed as a safe-haven asset, the precious metal has not been immune to extreme market panic. In early trading on Monday, spot gold fell 0.56% at one point, while silver fell more than 2%. Analysts believe that investors are selling precious metals to make up for losses in other assets.

IV. Market Forecast and Investor Strategies

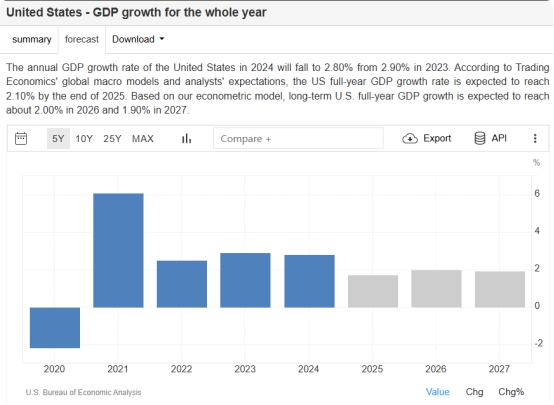

Faced with the violent market turbulence, analysts have different views on the outlook. JPMorgan Chase expects the U.S. economy to fall into recession due to tariffs, with full-year GDP growth rate lowered from 1.3% to -0.3%. UBS Global Wealth Management downgraded its rating on U.S. stocks to neutral and advised investors to remain cautious.

V. Conclusion: Investment Decisions in Uncertainty

The global market turmoil caused by Trump's tariff policy is still continuing, and risk aversion has become the main theme of the current market. From the influx of funds into gold ETFs to the sharp correction in the stock market, investors are re-examining the balance between risk and reward. In a market environment shrouded in uncertainty, short-term volatility may intensify, but long-term investors need to pay attention to potential opportunities for policy shifts and economic recovery. As Cramer said, “Recognize that there will be some pain, but you can’t avoid it — staying the course is key.”