Markets are "blunting" on Trump's tariff policy; gold's safe-haven properties hide strategic opportunities

- 2025年2月25日

- Posted by: Macro Global Markets

- Category: News

Markets are "blunting" on Trump's tariff policy; gold's safe-haven properties hide strategic opportunities

Event-driven: The marginal pricing effect of tariff policy is declining

The impact of the Trump administration's recent tariff threats on global capital markets has shown a significant blunting effect. Although policy uncertainty remains, the market volatility index (VIX index) has fallen from 22 at the beginning of the year to around 15, indicating that investors' immediate reaction to trade frictions is weak.

In terms of cross-asset performance, the MSCI Asia Pacific Technology Index rose by 18% this year, and the European STOXX 600 Industrial Index hit a seven-month high. The trend of funds shifting from safe-haven assets to risky assets is obvious. State Street Global Research pointed out that the contribution of the trade war to stock market volatility has dropped from 38% at its peak to less than 2%, reflecting that the market has digested policy shocks through the risk re-pricing mechanism.

The current market sentiment is "selectively optimistic": investors have shifted their policy focus from tariffs to Trump's promised tax cuts (corporate tax rates may be reduced to 20%) and energy industry deregulation, pushing the S&P 500 index risk premium to 4.2%, close to the lower limit of the ten-year average.

The US dollar index fell below the 102 mark, and non-US currency volatility converged simultaneously, with the 30-day implied volatility of the Canadian dollar falling to a year-low of 8.5%. However, the Westpac Bank model warned that current asset prices only reflect about 35% of the potential tariff impact. If the intensity of policy implementation exceeds expectations, it may trigger a sharp rise in risk premiums and liquidity stratification.

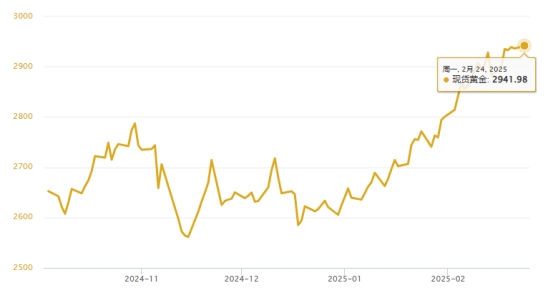

Golden Logic: Revaluation of the Composite Hedging Attribute

Under the blunt surface of policy disturbances, the safe-haven value of gold is experiencing a structural upgrade:

Real interest rate environment supports:The 10-year TIPS yield fell to 1.45%, the lowest since September 2023. The actual cost advantage of holding gold continued to expand, driving global gold ETFs to see net inflows for five consecutive weeks.

Currency credit anchoring function:The proportion of US dollars in global central bank foreign exchange reserves fell to 58% (the lowest since 2000), and the proportion of gold reserves rose to 15.2%. China and India increased their holdings by 21 tons and 18 tons respectively in January, strengthening the "de-dollarization" hedging value of gold.

Volatility Cross-Asset Hedging:The 90-day correlation between gold and the S&P 500 index dropped to -0.38. When the equity volatility (VIX) broke through the 20 threshold, the hedging effect of gold increased nonlinearly.

Outlook:Tactical Window in Expectation Difference Game

The current market's "blunt adaptiveness" to tariff policies is actually a reflection of inadequate risk pricing. Jack Janasiewicz, portfolio manager at Natixis, pointed out that there is a "gap between words and deeds" in Trump's policies. If the intensity of the tariff list in April exceeds expectations, it may still cause market fluctuations, thereby pushing up gold prices.

For gold prices, market complacency and a weak dollar provide potential upside momentum. Investors need to remain vigilant and pay close attention to policy trends to respond to possible market changes.