The "epic escape" of US stocks and the "historic expansion" of German finances under the impact of Trump's policies

- 2025年3月21日

- Posted by: Macro Global Markets

- Category: News

[MACRO Sharp Comments] The "epic escape" of US stocks and the "historic expansion" of German finances under the impact of Trump's policies

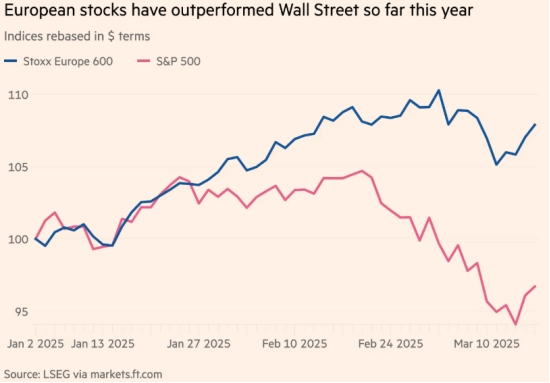

Meanwhile, European stocks benefited, with allocations to eurozone stocks jumping 27% to the highest level since July 2021, the most dramatic shift in funds from the U.S. to Europe since U.S. banks began recording in 1999. Trevor Greetham, head of multi-asset at Royal London Asset Management, said it was not surprising that fund managers were leaving the U.S. market because the policies introduced by the White House were not what they expected.

Nearly 70% of investors believe the "American exceptionalism" theme, which pushed the S&P 500 and Nasdaq to record highs in the weeks after Trump's election victory last November, has peaked. Investors surveyed were particularly pessimistic about technology stocks, with a net reduction of 12%, and the allocation ratio dropped to the lowest level in more than two years. Fund managers were more optimistic on utilities and banks, while increasing their exposure to UK stocks.

German lawmakers approved a landmark spending package that took a major step toward freeing up hundreds of billions of euros in debt financing for defense and infrastructure, heralding an end to decades of budget austerity. The legislation, pushed by conservative Chancellor-designate Merz, which passed the lower house of parliament with support from the Social Democrats and the Greens, would largely remove debt constraints on defense spending, create a potentially unlimited supply of money for rearmament to deter Russia and establish a 500 billion euro fund to invest in the country's aging infrastructure.

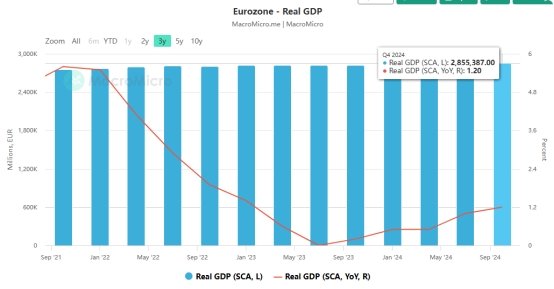

The historic decision, spurred by Trump's push to distance himself from the transatlantic alliance, is expected to help boost economic growth across the region. Peter Adrian, chairman of Germany's DIHK industry lobby group, said German politicians now had a huge responsibility but the huge borrowing mandates approved would help stimulate economic growth and improve competitiveness. Following approval by the lower house, the legislation will be voted on in the Bundesrat on Friday and, if approved there as well, it will then be signed into law by President Frank-Walter Steinmeier.

The final fiscal compromise could bring huge fiscal benefits to the federal states. In addition to raising the net borrowing limit for the federal states from 0% of GDP to 0.35%, up to 200 billion euros in off-budget infrastructure funds will be made available to the federal states. And time is tight, as Merz seeks to pass the measure before the new parliament takes office next week. Changing the constitution will become more difficult after the far-right Alternative for Germany and the anti-capitalist Left party gained more support in the February 23 election.

Both parties oppose the spending plans and have gained more support in recent polls. The passage of the plan is a milestone for Merz, who was discredited during his campaign over budget overhaul. The financing plan will help in negotiations with the Social Democrats, led by outgoing Chancellor Olaf Scholz, on forming a governing coalition. Merz aims to form a government by mid-April. Bloomberg economists commented that reasonable assumptions about how spending grows suggest Germany’s growth rate could reach 1.6% in 2026, double our previous forecast. Emphasizing unity, Merz said Germany's move to free up hundreds of billions of euros in military spending should be seen as a "great first step" toward a broad European defense community that would include non-EU countries such as Britain and Norway.