[MACRO Trends] Trump's tariff policy triggers market turmoil: weak dollar, soaring gold prices and global economic uncertainty

- 2025年4月17日

- Posted by: Macro Global Markets

- Category: News

[MACRO Trends] Trump's tariff policy triggers market turmoil: weak dollar, soaring gold prices and global economic uncertainty

Trump's tariff policy expansion

The order follows Trump's tariffs on steel, aluminum, auto parts and semiconductors. At the same time, the US government also announced an investigation into drug imports and plans to support domestic mineral processing capabilities through financing and loans to reduce dependence on foreign imports. Although Trump has sought to protect U.S. manufacturing and energy production through tariffs, markets have reacted strongly to them, with investors concerned that they could disrupt international supply chains and raise costs for consumers.

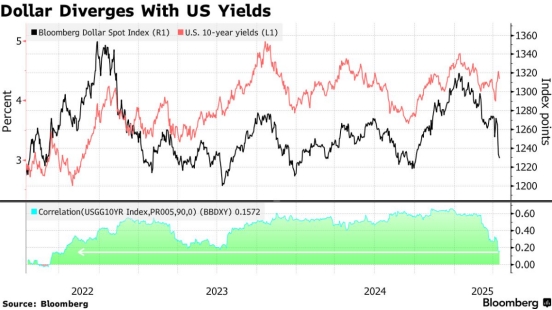

Divergence between the US dollar and US Treasury yields

The Bloomberg Dollar Spot Index posted its biggest drop since November 2022 last week as traders bet on further dollar weakness. The options market shows that investors expect the dollar to remain weak in the coming months. At the same time, long-term U.S. Treasury yields are close to a 17-month high, but the dollar has not benefited from it. This decoupling phenomenon shows that market confidence in the dollar is waning.

Analysts pointed out that investors are accelerating their withdrawal from US dollar assets, fearing that Trump's trade war may push the global economy into recession. The weakness of the US dollar not only weakens its status as a global reserve currency, but also exacerbates market concerns about the outlook for the US economy.

Historic rise in gold prices

Since 2025, the price of gold has risen by more than 23% and has set new historical highs many times. Wall Street giants such as Goldman Sachs and UBS have raised their gold price forecasts, predicting that gold prices will reach $3,700 per ounce by the end of the year and $4,000 per ounce by mid-2026. UBS strategists noted that as the global trade and geopolitical landscape changes, demand for gold will remain strong, especially among central banks, asset managers and private wealth.

A weaker dollar and a possible rate cut from the Federal Reserve provided further support for gold. The market expects the Federal Reserve to cut its policy rate by 100 basis points this year, which will reduce the opportunity cost of holding gold and attract more funds to flow into gold ETFs.

Summary and Outlook

Trump's tariff policy has not only exacerbated global economic uncertainty, but also had a profound impact on the US dollar and gold markets. The dollar's weakness reflects market concerns about the U.S. economy and policies, while gold's surge highlights its importance as a safe-haven asset.

In the future, as the Trump administration continues to push forward its tariff policy, the market may face greater volatility. Investors need to pay close attention to the dynamic relationship between the US dollar, US Treasury yields and gold, as well as changes in the global economic landscape, in order to cope with potential risks and opportunities.