The "crossroads" dilemma under Trump's tariff policy - the choice between rising inflation expectations and interest rate cuts

- 2025年3月27日

- Posted by: Macro Global Markets

- Category: News

[MACRO Trends] The "crossroads" dilemma under Trump's tariff policy - the choice between rising inflation expectations and interest rate cuts

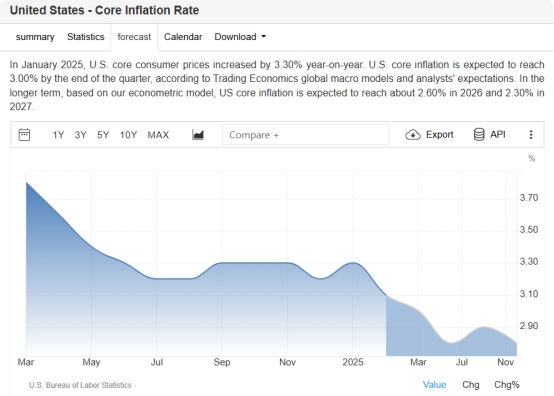

Recently, the economic situation in the United States has become complex, with factors such as rising inflation expectations, declining consumer confidence and fluctuations in the gold market intertwined, bringing a lot of uncertainty to the economic outlook. Chicago Federal Reserve Bank President Goolsbee warned that investors in the U.S. bond market are pricing in higher inflation, which would be a "major danger signal" that could derail policymakers' plans to cut interest rates.

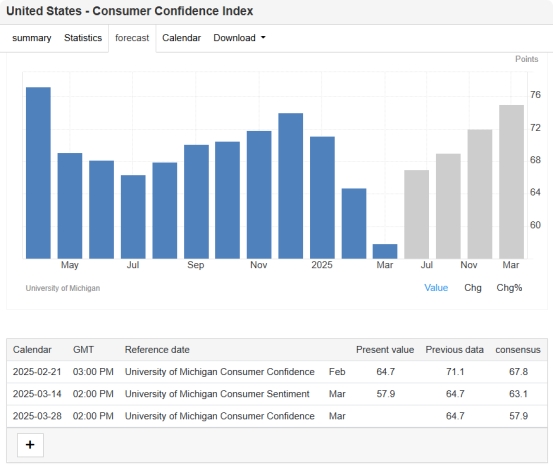

A University of Michigan poll showed that American households' long-term inflation expectations have hit their highest level since 1993. Goolsbee stressed that if investors' expectations converge with those of American households, the Fed must take action because once people lose confidence in the central bank's ability to control inflation, a vicious cycle of rising wages and prices could occur.

It can be said that the Fed is no longer on the "golden path" of 2023 and 2024, when inflation moved closer to the 2% target without disrupting economic growth. Now the economy has entered "another chapter" and faces more uncertainties. Fed officials had forecast two 25 basis point rate cuts this year, but last week's meeting kept rates unchanged for the second straight time, with Powell acknowledging that progress on inflation could be delayed.

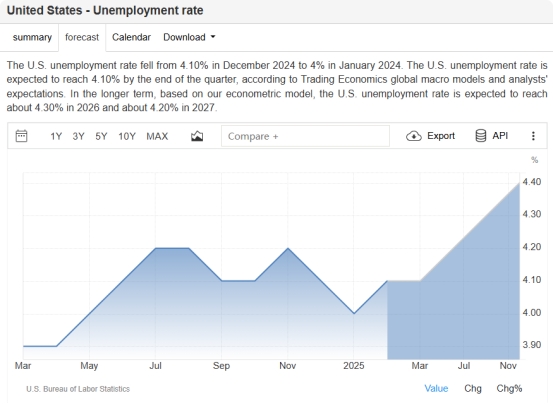

U.S. consumer confidence fell to a four-year low in March amid concerns that the Trump administration's escalating tariffs would lead to higher prices and an uncertain economic outlook. The Chamber of Commerce's consumer confidence index fell 7.2 points to 92.9, and expectations for the next six months fell to 65.2, the lowest level in 12 years. Consumers' optimism about future income has largely disappeared, and concerns about the economy and the labor market are beginning to affect their assessment of their personal situations.

Gold prices have risen 15% this year as the escalating trade war has sparked safe-haven demand. Although gold rose slightly in the short term after the data was released, it then fell back to around $3,030. Investors are concerned about global developments, especially U.S. policies, and are buying gold as an alternative asset to hedge against the risk of a global recession that could be triggered by the U.S. government.

Daniel Pavilonis, senior market strategist at RJO Futures, said that the possibility of a Fed rate cut has decreased, and overall, anti-inflation metals such as gold are still bullish, and the next level is expected to be around $3,125. Some experts pointed out that the next three to six weeks will be a critical period for resolving a series of policy uncertainties, and April 2, the "Liberation Day" when Trump plans to impose reciprocal tariffs on US trading partners, has attracted much attention. Business executives expressed concern about uncertainty surrounding the tariffs, including their size, exemptions and impact on the auto industry.

To sum up, the United States is currently facing multiple challenges, including rising inflation expectations, declining consumer confidence, and volatility in the gold market. The Federal Reserve faces a difficult choice between balancing economic growth and inflation control, and Trump's tariff policy has further increased economic uncertainty. The future direction of the economy will depend on the interaction of these complex factors and the response strategies of policymakers. Investors and consumers need to pay close attention to these developments in order to make rational decisions.