Non-farm payrolls are worse than expected, and the dollar's fragility is beginning to show! Trump's impact has not yet fully appeared

- 2025年3月12日

- Posted by: Macro Global Markets

- Category: News

【Macro Global Markets Current Situation】Non-farm payrolls are lower than expected, and the dollar's fragility is beginning to show! Trump's impact has not yet fully appeared

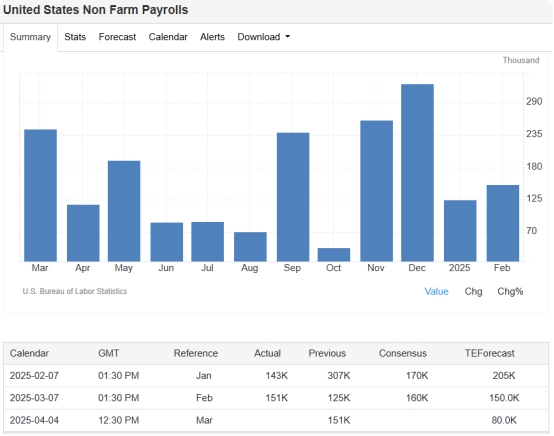

The first nonfarm report of Trump's presidency released on Friday showed that U.S. job growth accelerated in February and the unemployment rate rose slightly to 4.1%, but increased uncertainty in trade policy and large layoffs in the U.S. federal government may weaken the resilience of the labor market in the coming months. The U.S. nonfarm payrolls increased by 151,000 in February, seasonally adjusted, lower than the expected 160,000. The total number of new jobs in December and January was 2,000 lower than before the revision. In addition, the U.S. unemployment rate in February was 4.1%, higher than the expected 4%, the highest since November 2024. The annual rate of average hourly wages in the United States in February was 4%, lower than the expected 4.1%, and the previous value was revised down from 4.10% to 3.9%; the monthly rate was 0.3%, in line with expectations, and the previous value was revised down from 0.5% to 0.4%.

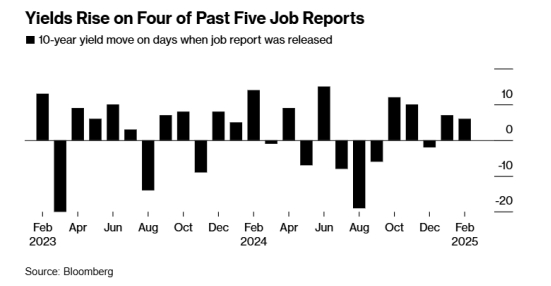

Bond investors are wary of any signs of weakness in the U.S. economy in Friday's U.S. jobs report as they assess whether a recent rally in Treasuries has further upside. The 10-year U.S. Treasury note was headed for its first weekly drop in nearly two months ahead of the release of key labor data. The labor report will provide clues as to whether Trump’s trade wars and moves to cut the size of the government are hurting employment and whether that’s enough to warrant the Federal Reserve resuming interest rate cuts. U.S. Treasury yields have risen in four of the past five nonfarm payroll reports.

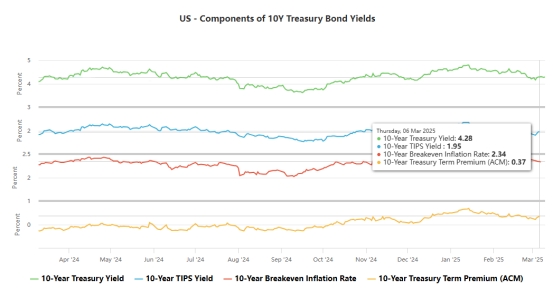

After concerns in recent days that the bond rally was overdone, recent expectations of further rate cuts by the Federal Reserve could inject confidence into bullish investors. JPMorgan Chase & Co. strategists are advising clients to short two-year Treasuries, in part because bullish positions are "too aggressive." In the options market, some traders who had been betting on further bond gains, even betting that the 10-year U.S. Treasury yield would fall below 4%, have begun to close their positions to take profits. The two-year Treasury yield, which is most sensitive to Fed policy, hit a five-month low of 3.84% this week before rebounding. As of press time, the two-year Treasury bond yield was around 3.95%, while the 10-year Treasury bond yield was around 4.27%.

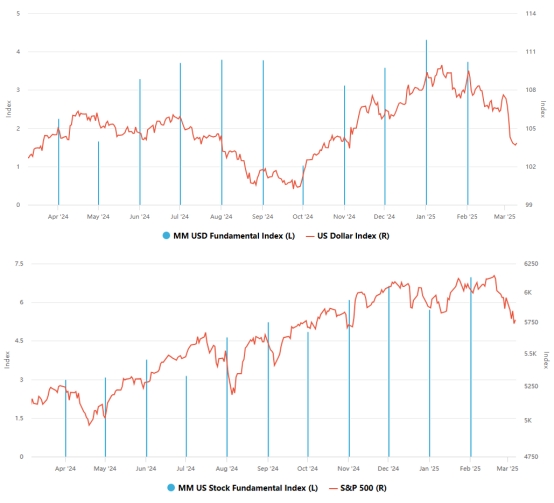

The United States may be facing a similar situation, with businesses and consumers craving certainty that is currently not being satisfied. Recent weak U.S. economic data, coupled with a fall in U.S. stocks since the start of the year, has caused short-term U.S. swap rates, which are crucial for pricing the dollar, to fall 45 basis points from their peak last month. The market currently expects the terminal interest rate of the Fed's easing cycle to be below 3.50%. Although this expectation may be a bit too fast, the February non-farm payrolls data to be released tonight will provide more clues. The market generally expects the non-farm population to increase by 160,000 and the unemployment rate to remain at a low of 4.0%. Weather factors and changes in government education funding could weigh on the jobs data, while the impact of DOGE government layoffs may take months to show.

After the release of non-agricultural data, spot gold continued to rise, with short-term gains expanding to nearly $15, currently trading at $2,922.94 per ounce. The US dollar index fell more than 20 points in the short term before rebounding. Non-US currencies rose, with the euro rising nearly 30 points against the US dollar in the short term, the pound rising nearly 40 points against the US dollar in the short term, the US dollar falling more than 20 points against the Canadian dollar in the short term, and the US dollar falling more than 40 points against the Japanese yen in the short term. U.S. short-term interest rate futures fell. Traders of U.S. interest rate futures are now betting the Fed will have to wait until June to start cutting rates again, but still expect the central bank to cut rates by about 75 basis points this year.

Overall, the global foreign exchange market is at a critical turning point. The US dollar's vulnerability has increased, the euro's revaluation has begun, and the Canadian dollar and Central and Eastern European currencies are facing short-term volatility but a bullish medium-term outlook. Investors should pay close attention to policy changes and economic data, and flexibly adjust strategies to cope with uncertainties.