[MACRO Sharp Comments] Stock market weakness and gold soaring - a complete analysis of the rare divergence phenomenon in the US market

- 2025年3月26日

- Posted by: Macro Global Markets

- Category: News

[MACRO Sharp Comments] Stock market weakness and gold soaring - a complete analysis of the rare divergence phenomenon in the US market

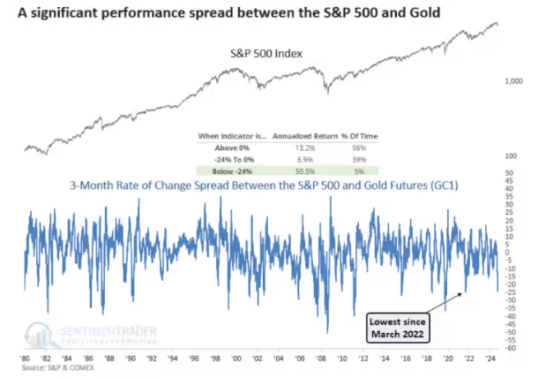

Dean Christians, senior research analyst at SentimenTrader, noted that over the past three months, the S&P 500 has underperformed gold futures by 24%, the largest gap since March 2022. Since 1970, this return gap has been below negative 24% only 5% of the time. This divergence typically reflects growing pessimism among traders and often signals a stock market bottom in the coming months, followed by a potential rebound.

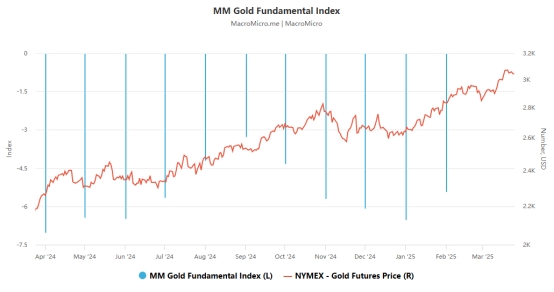

Although gold prices have hit record highs recently, there has been some volatility in the market. According to foreign media reports, gold prices fell on Monday, with spot gold falling 0.4% to $3,010.33 an ounce and U.S. gold futures falling slightly by 0.2% to $3,015.50 an ounce. The dollar index rose 0.2% to a more than two-week high, making gold priced in foreign currencies more expensive for overseas buyers. Bart Melek, head of commodity strategy at TD Securities, said the market is in a consolidation phase, in part due to a stronger dollar.

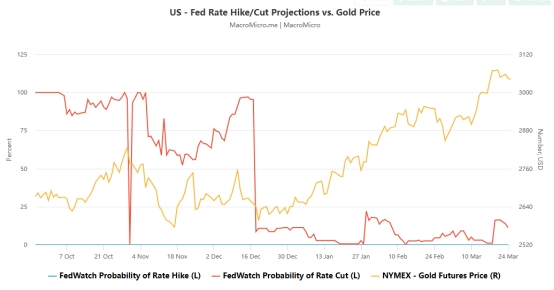

In addition, investors are also assessing U.S. President Trump's cautious stance on tariffs. Last week, Trump hinted at some flexibility on reciprocal tariffs that are about to take effect, which could have further impact on the market. Although gold prices have recently hit new highs, the market remains divided on its future trend. Haworth, senior strategist at U.S. Bank Wealth Management, believes investors should remain cautious at current levels. For the gold price to remain above $3,000 an ounce, market uncertainty needs to increase further.

To sum up, the divergence between the U.S. stock market and the gold market reflects the complex changes in market sentiment. The divergence between the S&P 500 and gold futures may indicate a short-term correction in the stock market, but in the long run, the market still has some potential for a rebound. Although gold prices have hit a new high, future trends still need to focus on the development of the global economic environment and market uncertainties. Investors should remain cautious in the current market environment and focus on changes in fundamental factors to make more informed investment decisions.