The Fed’s dilemma under the tariff stranglehold: How does Powell dance on the tightrope between inflation and recession? Gold becomes the ultimate safe haven

- 2025年4月15日

- Posted by: Macro Global Markets

- Category: News

The Fed’s dilemma under the tariff stranglehold: How does Powell dance on the tightrope between inflation and recession? Gold becomes the ultimate safe haven

1. Tariff storm: a policy farce from exemption to tariff increase

1. The smokescreen of tariff exemption for electronic products

Although Trump announced on the 14th that electronic products such as smartphones and transistor devices would be exempted from "reciprocal tariffs", Commerce Secretary Lutnick immediately clarified: "This is only a temporary measure. The transistor tariffs will be introduced within one or two months." This policy has repeatedly caused violent market fluctuations - U.S. technology stocks fell 4% before the market opened, Nasdaq futures hit a technical bear market, and gold prices soared to $3,247/ounce due to safe-haven demand.

2. Intensified divisions within the government

The White House's core economic team is divided: Trade adviser Navarro and Tesla CEO Musk have engaged in a public war of words, and Treasury Secretary Bessant and Commerce Secretary Lutnick have diametrically opposed interpretations of the impact of tariffs. The Washington Post revealed that the Trump camp was even accused of using tariff news to manipulate the stock market, with the share prices of its companies tripling hours before the policy was announced.

2. The “Death Cross” of Inflation and Recession

1. Tariffs are the “invisible killer” that pushes up inflation

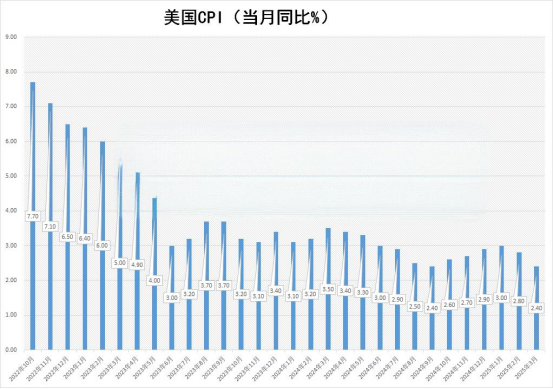

The U.S. CPI rose 2.4% year-on-year in March, but after excluding the impact of tariffs, the core inflation rate reached 3.5%. JPMorgan Chase estimates that comprehensive tariffs will increase the inflation rate by an additional 1.8 percentage points in 2025, while the minutes of the Federal Reserve's March meeting showed that officials were generally concerned that "tariffs could cause inflation expectations to get out of control."

The Federal Reserve is facing the most severe stagflation pressure since the 1970s: if it raises interest rates to fight inflation, it will exacerbate the economic recession; if it cuts interest rates to stimulate growth, it may trigger hyperinflation. Former Federal Reserve Chairman Ben Bernanke warned: "The cost of policy mistakes will far exceed the 2008 financial crisis."

3. The Fed’s “ammunition depot” is running out of steam

1. The “ceiling” of interest rate policy

The Federal Reserve kept interest rates unchanged at 4.25%-4.5%, but the dot plot showed that interest rates could only be cut by 50 basis points in 2025, and the policy space would be less than one-third of that in 2019. Powell admitted: "We are close to the limit of interest rate adjustment."

2. The “double-edged sword” of the balance sheet

Although the Fed has slowed its Treasury bond reduction limit from $25 billion per month to $5 billion per month, the size of its balance sheet is still as high as $8.5 trillion, accounting for 32% of GDP. If quantitative easing is restarted, it may trigger a US dollar credit crisis, while continued balance sheet reduction will drain market liquidity.

3. Policy-anticipated “trust crisis”

Market confidence in the Federal Reserve has dropped to freezing point: federal funds rate futures show that investors expect the actual interest rate cut in 2025 to be 50 basis points more than the Fed's forecast. Former Treasury Secretary Summers blamed: "Powell's policy communication has lost credibility."

4. Risks and Outlook: The Calm Before the Storm?

1. The “time bomb” of policy risks

Trump may announce the details of transistor tariffs on April 14. If they are expanded to key areas, they may trigger a new round of safe-haven buying in the market. In addition, the US debt ceiling negotiations have reached a deadlock. If no agreement is reached before June, it may trigger a sovereign credit crisis.

2. The mirror of history

During the stagflation of the 1970s, the price of gold rose by 2,300%; under the impact of the epidemic in 2020, the price of gold rose by 25%. The current environment is highly similar to history. The only difference is that the Federal Reserve has smaller policy space, and gold’s “ultimate safe-haven” nature will become more prominent.

Powell is standing at a crossroads of history: if he chooses to raise interest rates, he may become the "executioner who kills the US economy"; if he chooses to lower interest rates, he may become the "scapegoat for out-of-control inflation." The gold market has become the biggest winner in this policy game. Driven by the dual forces of stagflation and the US dollar credit crisis, the gold price is expected to hit the 3,300 US dollar mark. Investors need to pay close attention to the implementation of the tariff policy on April 14, as well as the "dovish" signals from the Federal Reserve's April interest rate meeting. In this era of frequent "black swans", gold may be the only "certainty".