[Non-farm Forecast] April Non-farm Employment Report Forecast - Labor Market Under the Impact of Tariffs

- 2025年4月29日

- Posted by: Macro Global Markets

- Category: News

[Non-farm Forecast] April Non-farm Employment Report Forecast - Labor Market Under the Impact of Tariffs

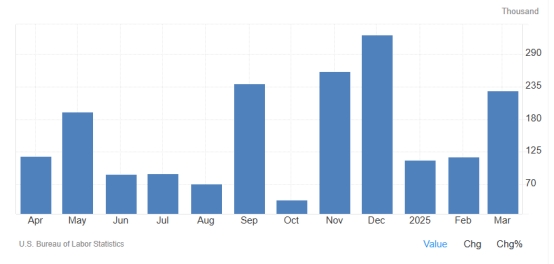

The U.S. non-farm data for May will be released at 20:30 Beijing time on May 2, and the market focus will be on whether the labor market will continue to slow down. In March, non-farm employment increased by 228,000, far exceeding the expected 135,000. The unemployment rate rose slightly to 4.2%, but the wage growth rate slowed to 0.3% month-on-month. The data suggests the labor market remains resilient, but easing wage pressures could provide room for the Fed to shift policy.

2. Small non-farm ADP and large non-farm forecasts

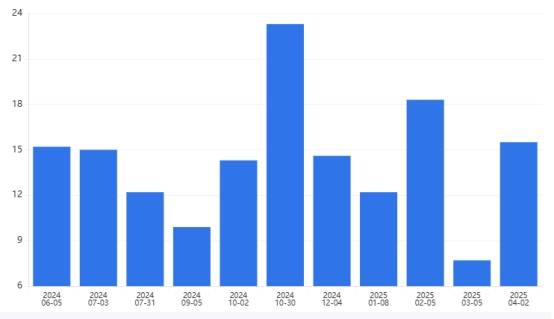

1. Small non-farm ADP

Previous value: ADP added 155,000 jobs in March (expected 118,000), indicating a recovery in private sector employment.

Forecast: ADP expects to add 123,000 jobs in April as tariff policies lead to a decline in companies' willingness to hire and the manufacturing PMI is weak.

Impact: If the ADP data is lower than expected, it may strengthen the market's expectations for a weaker non-farm payrolls and boost safe-haven buying of gold.

The April ADP employment figures will be released on Wednesday, April 30, 2025 at 20:15.

Previous value: In March, non-farm payrolls increased by 228,000, the unemployment rate was 4.2%, and wages increased by 0.3% month-on-month.

Forecast: Non-farm payrolls are expected to increase by 129,000 in April, the unemployment rate will rise to 3.8%, and wages will increase by 0.3% month-on-month. Manufacturing employment may decrease due to tariff shocks, but employment in the service industry will remain the main support.

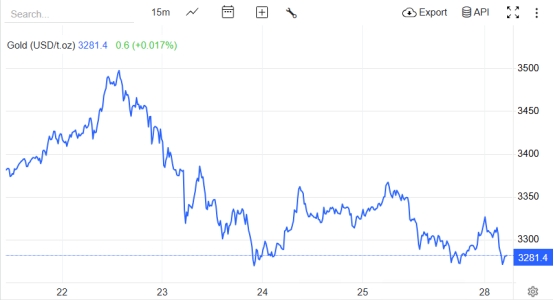

Impact last month: After the release of the March non-farm payrolls, gold prices were briefly under pressure to $3,260 an ounce, but as wage growth slowed and market expectations for rate cuts increased, gold prices quickly rebounded to $3,318 an ounce.

The April non-farm payrolls change data will be released on May 02, 2025 (Friday) at 20:30.

(1) Non-farm data is lower than expected: the weak U.S. job market is bearish for the dollar and bullish for gold;

(2) Non-farm data exceeded expectations: The U.S. job market is good, which is bullish for the U.S. dollar and bearish for gold.

Goldman Sachs: It is expected that the non-farm employment will increase by 180,000 in May, the unemployment rate will be 3.8%, and the salary will increase by 0.3% month-on-month. The tariff policy has led to corporate inventory adjustments, putting pressure on manufacturing employment; Morgan Stanley: It is predicted that 220,000 new employees will be added, the unemployment rate will be 3.7%, and the salary will increase by 0.4% month-on-month. The resilience of service industry demand supports employment, but wage growth may slow down; Federal Reserve: Emphasizes data dependence, if the job market continues to overheat, interest rate cuts may be postponed; if employment weakens, expectations for interest rate cuts will increase.

5. Reminders for this small non-agricultural ADP and large non-agricultural transactions

1. Small non-farm ADP (April 30, 20:30)

Key points: If ADP increases > 170,000, the U.S. dollar may rebound and gold may come under pressure; if < 150,000, gold may rise to the resistance level of $3,370.

2. Non-agricultural data (May 2, 20:30)

Key points: Non-farm payrolls > 220,000, unemployment rate 0.4% month-on-month → bearish for gold, target $3,250;

Non-farm payrolls 3.8%, month-on-month wages <0.3% → bullish for gold, target $3,370.

6. Forecast and analysis of important market information for the non-agricultural week

1. ISM Manufacturing PMI (May 1, 22:00)

Expectation: 49.0 (previous value 49.1), manufacturing industry has contracted for three consecutive months, and the tariff impact has led to a decline in new orders.

Impact: If PMI < 49, the US dollar may weaken and gold will be supported; if there is an unexpected rebound, it may suppress expectations of interest rate cuts.

2. U.S. PCE price index for March (April 30, 22:00)

Expectation: Core PCE will increase by 3.8% year-on-year (previous value 3.9%), and inflationary pressure will ease marginally.

Impact: If PCE is lower than expected, expectations of a Fed rate cut will increase and gold may break through $3,370.

Summarize

The May non-farm data will be a key window for the Fed’s policy shift. If employment growth slows and wage pressure eases, market expectations for interest rate cuts will strengthen and gold is expected to continue its upward trend; conversely, if employment is stronger than expected, the timing of interest rate cuts may be delayed and gold will come under pressure in the short term. Investors are advised to pay close attention to changes in market sentiment before and after the data is released and strictly control risks.

Risk warning: The above analysis is based on current market information and does not constitute investment advice. Non-farm data may be affected by unexpected events, so trading should be cautious.