[MACRO Sharp Comments] The changing gold market: an in-depth analysis of the price plunge and the bull market outlook

- 2025年4月27日

- Posted by: Macro Global Markets

- Category: News

The gold market has experienced dramatic volatility recently, with Wednesday suffering its biggest one-day drop in nearly four years, sparking widespread doubts in the market about whether its strong rally can continue. After this dramatic fluctuation, the future direction of the gold market has become unclear, and investors and analysts have engaged in in-depth discussions on its trends and prospects.

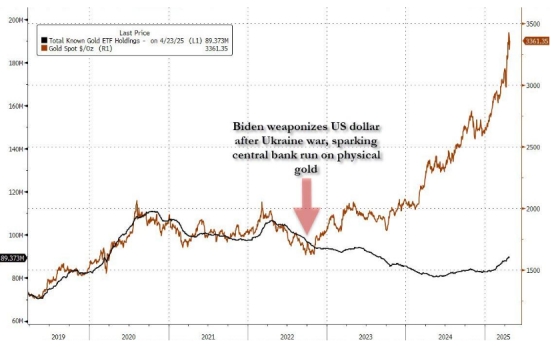

The plunge in gold prices can be attributed to several key factors. First of all, the background of the global trade war has changed. The Trump administration seems to have adopted a more moderate attitude on trade policy, which has caused gold to lose an important supporting factor. The news that the White House is considering a significant reduction in tariffs on Chinese imports, according to the Wall Street Journal, directly hit the sentiment in the gold market.

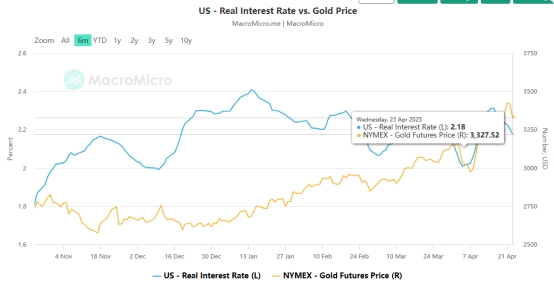

In addition, the trend of the US dollar also has a significant impact on the price of gold. The dollar appears to have found support again after the heat of the "quarrel" between Trump and Powell died down. If the U.S. dollar stabilizes, demand for panic-driven safe-haven assets will decrease, further exacerbating the decline in gold prices.

Is the gold bull market over?

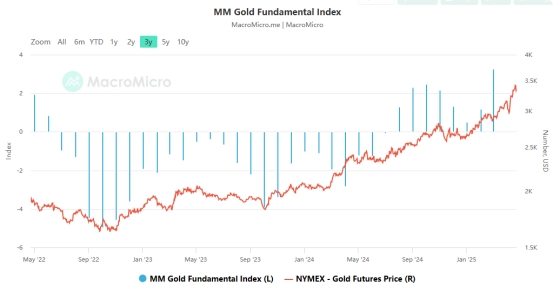

Although gold prices have experienced a sharp correction in the short term, many analysts do not believe that this marks the end of the gold bull market. Michael Armbruster pointed out that the current gold price trend may just be a normal correction in the bull market, the trend is still upward, and in the long run, prices still have the potential to rise further.

Jim Wyckoff also believes that the gold market is "close to a climax, but not necessarily from a price perspective," and prices may still rise sharply in the short term. He pointed out that the recent sharp fluctuations in gold prices show that this bull market is running out of time, but it does not mean that the final peak of prices has arrived.

Gold ETF Market Dynamics

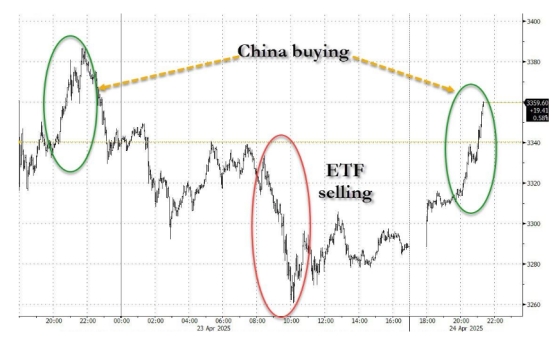

Chris Luccas, an ETF expert at Goldman Sachs, noted that in the past few weeks, the market's demand for gold spot exposure (such as GLD) has increased significantly, mainly due to the outstanding performance of gold as a tool to hedge against uncertainty. However, as the S&P 500 recorded its third strongest performance in two years, the gold market suddenly released huge pressure, and GLD became the third most traded ETF in the entire market, and the transaction amount was the third highest since its establishment in 2004.

Despite this, physical buying from China showed strong resilience. Physical gold demand in the Chinese market emerged quickly after Wednesday's plunge, pulling gold prices up nearly $100 from overnight lows, suggesting that demand for physical gold remains strong and could provide support for gold prices.

Future Outlook for the Gold Market

After experiencing this wave of dramatic market fluctuations, the future outlook of the gold market is full of uncertainty. In the short term, gold prices may continue to be affected by factors such as the trend of the US dollar, the trade situation and the Federal Reserve's policies. However, in the long term, gold's fundamentals remain supported by factors such as geopolitical conflicts, high inflation and market uncertainty.

Jim Wyckoff and other analysts believe that the current pullback could provide a fairly attractive entry point for long-term investors. Strong demand for physical gold, especially buying from major markets such as China, is likely to continue to support gold prices during future market fluctuations.