Trump's attitude changes 180 degrees! Gold price plunges from $3,500

- 2025年4月25日

- Posted by: Macro Global Markets

- Category: News

Trump's attitude changes 180 degrees! Gold price plunges from $3,500

On April 23, Beijing time, US President Trump suddenly changed his tone during a media interview at the White House, making it clear that he "has no intention of firing Federal Reserve Chairman Powell" and emphasized that "he hopes he will be more proactive on the issue of interest rates." This statement is in stark contrast to his public criticism on April 17 that Powell "acted too late and made mistakes" and "left as soon as possible."

Previously, Trump pressured the Federal Reserve to cut interest rates for several consecutive days and hinted that Powell might be removed from his post, causing market concerns about the independence of the Federal Reserve to rise. Bloomberg data shows that on April 21, gold ETFs saw a single-day inflow of $1.2 billion, and COMEX gold futures open interest surged 15%, reflecting the extreme risk aversion sentiment. However, Trump's "dovish" reversal quickly reversed the market trend. The US dollar index rebounded 0.634% to 98.98 on the day. The three major U.S. stock indices all closed up more than 2.5%. The Nasdaq China Golden Dragon Index soared 3.69%, and funds withdrew from the gold market on a large scale.

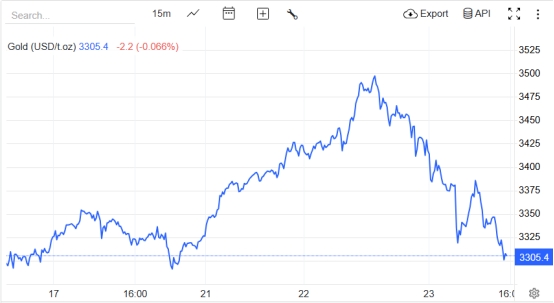

2. The gold market fluctuated violently: the historical high of $3,500 became a "one-day trip"

Influenced by Trump's remarks, the price of gold staged a "roller coaster" market: April 22: London gold spot price once exceeded US$3,500/ounce during the session, setting a record high, but then plummeted by US$130 to close at US$3,380.93, a single-day drop of 1.24%. Asian session on April 23: Gold opened lower and hit a low of $3,289.09, a cumulative decrease of 5.3% from yesterday's high of $3,500. It is currently trading around $3,310.

Fed policy expectations shift

After Trump changed his words, CME's "Federal Reserve Watch" data showed that the probability of maintaining interest rates in May rose from 85% to 91.7%, and expectations for a rate cut dropped significantly. Federal Reserve Board Governor Kugler emphasized that "tariff policies have complicated the economic outlook and the Federal Reserve needs to maintain its independence," further strengthening its hawkish stance.

Changes in interest rate expectations directly weaken the attractiveness of gold. As a non-interest-bearing asset, the holding cost of gold increases as interest rate expectations rise, causing some investors to turn to yield-generating assets such as U.S. Treasuries.

The “siphon effect” of the U.S. dollar and U.S. stocks

The US dollar index rebounded to 98.98, its highest level since March, directly suppressing the price of gold denominated in US dollars. At the same time, the rebound in U.S. stocks prompted funds to shift from safe-haven assets to risky markets. The Dow Jones Industrial Average rose 2.66% in a single day, and the S&P 500 index regained 5,287 points. The rebound in risk appetite intensified the selling pressure on gold.

Geopolitical desensitization and profit-taking

Despite the continued tension in the Middle East (Iran warned six countries not to support the US military) and the escalation of fierce fighting on the Russia-Ukraine conflict front, the market's sensitivity to geopolitical risks has declined marginally. In the medium and long term, central bank gold purchases (over 1,000 tons in 2024) and the de-dollarization trend will continue to provide strategic support for gold, but the short-term decline in risk aversion will lead to a price pullback.

Trump's dramatic change in attitude caused severe fluctuations in the gold market, and the historical high of $3,500 was fleeting. In the short term, the strengthening of the US dollar, the rebound of US stocks and the hawkish stance of the Federal Reserve suppressed gold prices, but medium- and long-term supporting factors still exist. Investors need to be wary of data shocks and policy changes. It is recommended to focus on short-term range operations and then make trend layouts after the market direction is clear.