Intensified geopolitical rifts reshape gold pricing logic: Analysis of the risk aversion transmission chain of Trump's tough stance on Ukraine

- 2025年2月21日

- Posted by: Macro Global Markets

- Category: News

Intensified geopolitical rifts reshape gold pricing logic: Analysis of the risk aversion transmission chain of Trump's tough stance on Ukraine

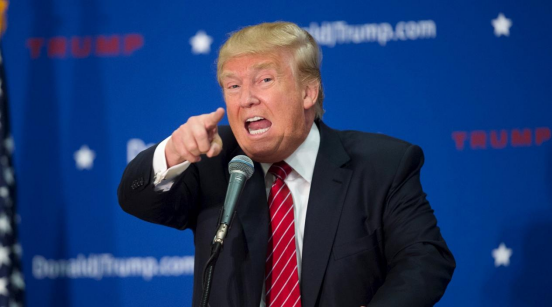

Former US President Donald Trump launched a sharp accusation against Ukrainian President Volodymyr Zelenskyy via social media on February 20, calling him an "unelected dictator" and demanding urgent action. Gold, as a non-sovereign credit anchor, has its political weight in its price formation mechanism being accelerated by the market.

Escalation of conflict narratives catalyzes risk aversion transmission mechanism

The long-distance confrontation between Trump and Zelensky reflects a triple game pattern: first, the vacillation of the US policy toward Ukraine during the election cycle has exacerbated the decision-making cracks within NATO and shaken the credibility of the West's collective security commitments; second, the order debate over the attribution of responsibility for the Russia-Ukraine war highlights the complexity of the conflict between major powers and prolongs the cycle of geopolitical uncertainty; third, the successful infiltration of Russia's information system into the coordinated political relationship of the Western information system has weakened the Western war strategy. Such structural contradictions force institutional investors to re-evaluate the hedging effectiveness of gold in their asset portfolios, and its monetary attributes as the ultimate means of payment are strategically strengthened.

The golden dual-track pricing logic of crisis evolution

No matter where the situation in Eastern Europe goes, there is a path for gold to be revalued: if the intensification of the US-Ukraine conflict leads to a reduction in Western military aid, the risk of collapse of Ukraine's defense system will directly boost safe-haven demand; if Trump sends a signal of easing relations with Russia, market expectations for the repair of the energy supply chain may temporarily suppress gold prices, but concerns about the reconstruction of the global order caused by the US strategic contraction will form a more lasting support. This dual-track mechanism means that gold is transforming from a cyclical asset to a structural strategy asset.

Conclusion: The Path to Peace and the Outlook for Gold Prices

Trump's remarks are by no means an isolated incident, but an inevitable product of the global power transition period. When the game between major powers enters a new form of "narrative war", information fog and policy changes will become the norm in the market. In this context, gold, as a hard currency that transcends the ideological divide, may see its price volatility center permanently move upward, marking that global capital has officially entered the "risk pricing 3.0" era.