Gold prices surge to record high as Trump's tariff storm roils global markets

- 2025年2月12日

- Posted by: Macro Global Markets

- Category: News

【Macro Global Markets】Gold prices surge to record high as Trump's tariff storm roils global markets

Global markets were once again on edge after U.S. President Trump announced new tariff plans. Investors flocked to safe-haven assets, pushing gold prices to a record high.

This article will explore the impact of Trump’s tariff policy on the gold market and the response of global investors.

Trump said on Sunday he would announce new tariffs of 25% on all steel and aluminum imported into the United States on Monday. This would build on existing metals tariffs and would represent another major escalation in its trade policy reforms.

He also said he planned to announce reciprocal tariffs on Tuesday or Wednesday and have them take effect immediately. The relevant tariff measures will apply to all countries and will be consistent with the tariff rates imposed by each country.

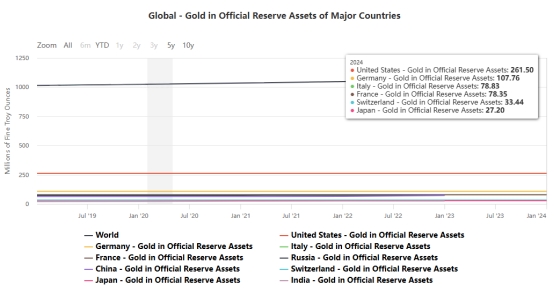

Trump, who is inherently unpredictable and disruptive, has threatened tariffs on allies and adversaries alike, and has threatened to impose 100% tariffs on the BRICS countries if they diversify away from the dollar, all of which suggests that gold's safe-haven appeal will increase. "

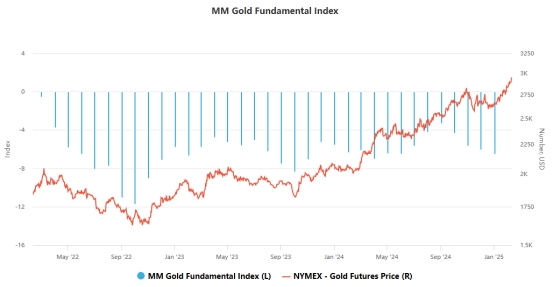

Affected by market turmoil, spot gold hit a new all-time high on Monday, reaching the $2,900 mark. Spot silver followed gold's rise and stood above $32 per ounce.

Gold and silver both rose by more than 1% during the day. Gold prices soared even more on Tuesday, with spot gold rising sharply to $2,920 an ounce, setting a new record high.

Since the beginning of 2025, the highest increase in spot gold prices has exceeded 11%. COMEX gold futures have also repeatedly broken historical highs.

As of press time, COMEX gold futures also rose sharply to $2,945 per ounce.

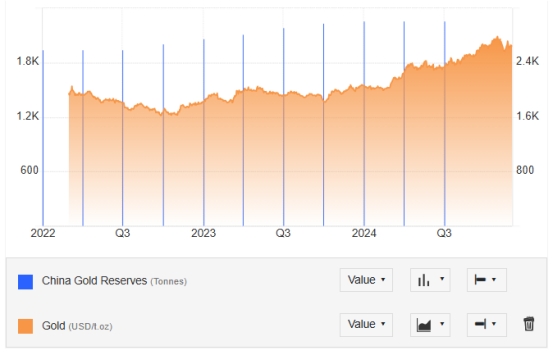

Surging global gold demand, especially in China, has provided significant support for gold prices.

Last Friday, according to the official reserve asset data updated on the People's Bank of China's official website, as of the end of January 2025, my country's central bank gold reserves were 73.45 million ounces, an increase of 160,000 ounces from the previous month, marking the third consecutive month of increase.

China also launched a pilot program allowing insurance companies to invest in gold for the first time, which is expected to unlock billions of dollars in potential funds and further boost gold's record rally.

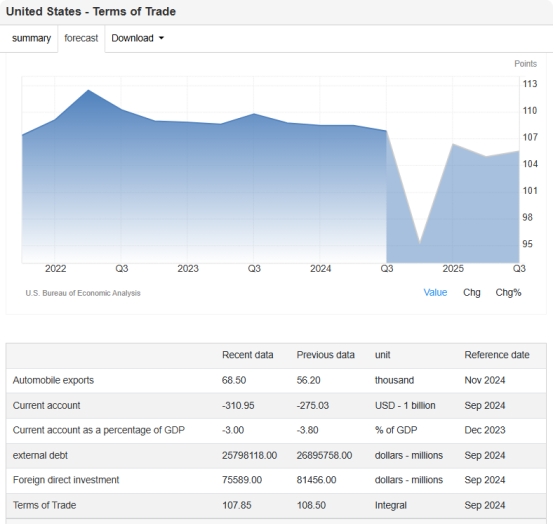

Due to vigilance against US President Trump's tariff policy, the "one product, two prices" phenomenon has emerged in the United States.

Gold futures on the New York Mercantile Exchange (COMEX) reached $2,872 per ounce on February 3, setting a new record high and gradually approaching the $3,000 mark.

When the economic and international situation is uncertain, gold can easily be bought as a "safe asset". Still, gains in New York stood out.

The widening price gap is symbolic. From October to November 2024, the maximum price difference between New York futures and London spot was only about US$20 per ounce.

Starting in December, the price gap widened, and by January 20, 2025, New York futures were about $40 higher. Although the price gap narrowed for a time due to factors such as different delivery months, it reached about US$40 on the 30th and 31st, and reached US$37.6 on February 3rd.

“It’s probably the first time since the COVID-19 pandemic that the price gap has been so large,” said Yuichi Ikemizu, representative director of the Japan Precious Metals Market Association.

"The fear of tariffs is also growing in the gold market," said Tsutomu Kosuge, a representative of Japan's MarketEdge.

The surge in gold inventories held by the New York Mercantile Exchange supports the market's judgment.

As of February 3, the New York Mercantile Exchange's certified inventory totaled 32.29 million ounces (about 1,004 tons), an increase of about 90% compared to the end of October 2024.

This is the highest level in a year and a half since July 2022.

In the non-ferrous metal industry, which is closely related to industry, the sense of crisis about tariffs is more prominent.

The price gap between copper futures on the New York Mercantile Exchange and three-month futures on the London Metal Exchange (LME) reached nearly $600 per ton on January 16, before Trump took office, expanding to about eight times the level at the beginning of the year.

Copper inventories at the New York Mercantile Exchange also reached their highest level in about six years.

What is foreseeable at this stage is that global trade tensions will continue, pushing gold prices to the $2,900 to $2,920 level in the short term. Unless uncertainty about tariff policy is eliminated, market "distortions" will continue. Investors should closely monitor further moves by the Trump administration and the reactions of global markets.