[MACRO Trends] Gold prices soared - market competition and outlook driven by risk aversion

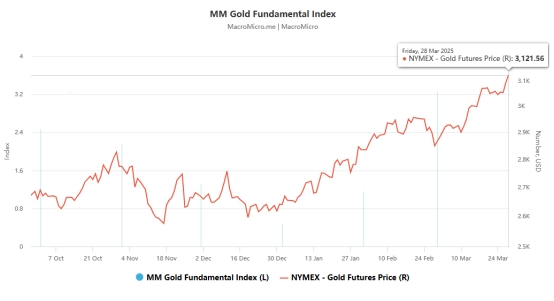

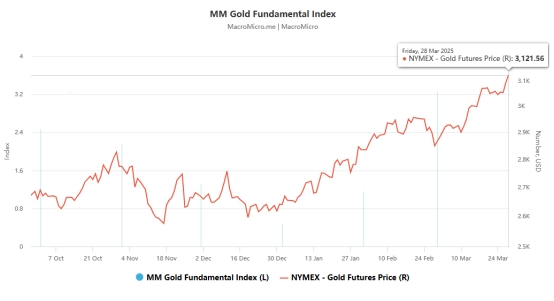

Recently, the global financial market has shown a complex and changeable situation under the intertwined influence of trade tensions and economic uncertainties. Against this backdrop, the price of gold has continued to rise, becoming the focus of the market. On Friday, spot gold continued to rise in the European session and successfully stabilized at $3,080 per ounce, breaking the historical record again. New York gold futures also stood at $3,100 per ounce.

Judging from price performance, the gold market has achieved remarkable results. On Thursday, spot gold prices rose 1.2% to $3,054.72 an ounce, hitting an intraday all-time high of $3,059.5. The year-to-date increase has exceeded 16%, and it has set a new all-time high 17 times. COMEX gold futures also performed strongly, rising 1.1% to $3,056.10 and hitting an intraday record high of $3,065.50. The June contract even exceeded the $3,100/ounce mark, with a daily increase of more than 1.5%.

The main driver of the surge in gold prices is global trade tensions. US President Trump announced a 25% tariff on imported cars, a move that triggered strong reactions from countries around the world. From Canada to Europe, governments have threatened to retaliate, global stock markets have fallen, and stocks of many automakers have suffered heavy losses. Not only that, Trump also plans to announce reciprocal tariffs on the major countries he identifies as causing the US trade deficit, exacerbating market concerns about the expansion of the trade war.

Investors' risk appetite is greatly affected under this uncertainty. As a traditional safe-haven asset, gold has become a safe haven for investors, and a large influx of funds has pushed its price higher and higher. Bob Haberkorn, senior market strategist at RJO Futures, pointed out that safe-haven buying caused by uncertainty surrounding Trump's tariff plan is the main catalyst for gold futures to break through $3,100.

In addition to trade factors, the Federal Reserve's policy dynamics also have an important impact on the gold market. The Federal Reserve kept its benchmark interest rate unchanged last week and signaled a possible rate cut later this year. Against this backdrop, investors are paying close attention to U.S. personal consumption expenditures (PCE) data due on Friday to assess the likelihood of further interest rate cuts. Haberkorn said that if the PCE data is better than expected, it could provide more upside for gold as it would give the Federal Reserve more reason to cut interest rates. Gold tends to perform strongly in a low-interest rate environment as it is an effective hedge against economic and political uncertainty.

Judging from market analysis and institutional forecasts, major institutions are generally bullish on gold. Goldman Sachs on Wednesday raised its gold price forecast for the end of 2025 to $3,300 an ounce from $3,100, citing stronger-than-expected ETF inflows and continued central bank demand for the metal. ANZ analysts also maintained their bullish view on gold, although they believe some correction may be in sight after the recent rapid rise to $3,040 an ounce.

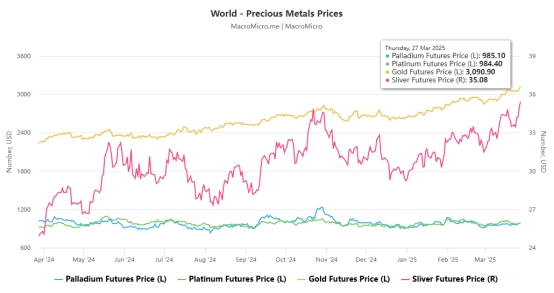

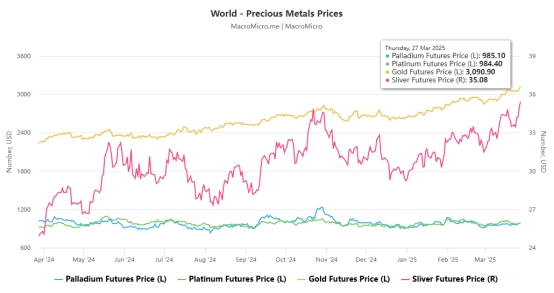

It is worth noting that spot precious metals such as silver, platinum, and palladium also rose with the price of gold, increasing by 1.3%, 0.2%, and 0.9% respectively. However, despite faster-than-expected U.S. economic growth in the fourth quarter of last year, investor concerns about Trump's new auto tariffs remain strong. Wells Fargo economists pointed out that although the U.S. economy had certain growth momentum at the beginning of the year, there was uncertainty in companies' response to trade headwinds. Affected by Trump's economic policies, consumers and businesses are becoming increasingly cautious. Forecasters generally expect that US economic growth will slow down in 2025. Federal Reserve officials and Wall Street giants have also lowered their economic growth forecasts.

Overall, the surge in gold prices reflects the market's strong demand for safe-haven assets, driven by the uncertainty brought about by the escalation of global trade tensions and the stock market crash. In the future, the market will pay close attention to US economic data and policy developments, especially PCE data and further actions of the Federal Reserve. These factors will largely determine the trend of gold prices. In the current complex economic and political environment, investors need to remain cautious and rationally allocate assets according to their own risk tolerance and investment objectives to cope with potential market fluctuations.