【MACRO Comments】Complex factors behind gold price fluctuations: tariff policy and Chinese market demand

- 2025年2月11日

- Posted by: Macro Global Markets

- Category: News

People tend to use simple narratives to explain the rise and fall of assets, but the truth is often far more complicated than it seems. MarketWatch columnist Mark Hulbert recently wrote an article analyzing the relationship between gold prices and U.S. tariff policies.

Historically, gold has underperformed when tariffs are higher. This finding nicely refutes the widely held view that high tariffs are good for gold. To be sure, gold has been on a strong bull run as tariff threats have escalated in recent months — surging to nearly $2,900 an ounce last week for the first time ever. Gold prices have risen nearly 10% since the beginning of the year and nearly 45% in the past 12 months.

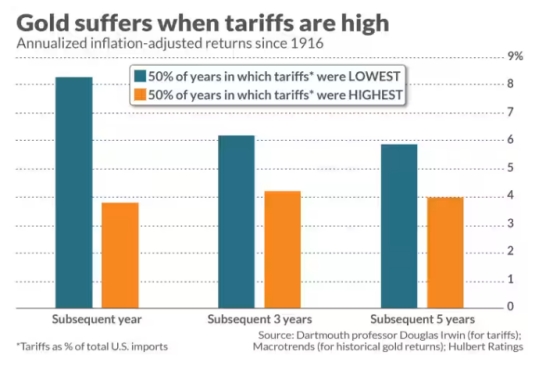

However, it would be a mistake to attribute gold’s recent gains to tariffs. Historical data suggests the opposite may be true. To test this, Herbert analyzed data since 1916, dividing all years into two groups based on their average tariff levels: above the median and below the median. Average tariffs, measured as a percentage of total imports, come from Douglas Irwin, an economics professor at Dartmouth College. For each group, Herbert calculated gold's average inflation-adjusted return over the following one, three and five years (data from MacroTrends). The results are shown in the chart below, with gold generally performing better during periods of low tariffs.

Furthermore, as statisticians remind us, correlation does not equal causation. Dartmouth’s Irving noted in an email that before the 1960s, most tariffs were “specific duties,” which are fixed amounts levied on each unit of imported goods, rather than calculated as a percentage. Thus, when tariffs are expressed as a percentage of total imports, tariffs before the 1960s were generally negatively correlated with import prices (and possibly economic activity). We therefore need to accept the possibility that any simple correlation "tells us nothing".

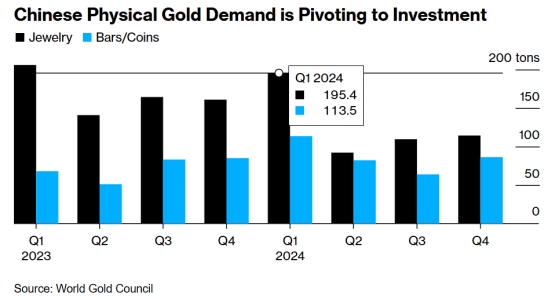

Chinese buyers may again be scared off by high prices, but there is one big buyer that continues to support market sentiment. As gold prices soar to around $3,000 an ounce, Chinese buyers may once again be scared off by high prices. One of the main drivers of gold's rise over the past year has been Chinese demand. But record prices and extra costs from a stronger dollar have made the goods too expensive for many consumers in the world's largest importer.

After Trump took office as president, investors sought safe havens to avoid the possible impact of the new government's more confrontational foreign policy, and international gold prices were greatly stimulated. That includes the prospect of a trade war between the U.S. and other countries, which lifts the dollar and makes gold more expensive. “It’s an affordability issue ... consumers can’t open their wallets or purses like they used to,” said Philip Klapwijk, Hong Kong-based general manager at consultancy Precious Metals Insights Ltd.

"Domestic savers may prefer the simplicity and relative transparency of gold," said Nicholas Frappell, global head of institutional markets at ABC Refinery in Sydney. "But given household constraints, I don't expect any surprise moves." Meanwhile, wholesalers have also withdrawn less than usual from exchange inventories. "People are cutting back on spending," said Fenny Zeng, founder of Shenzhen-based Royer Jewelry. "More and more people like smaller pieces with better designs."

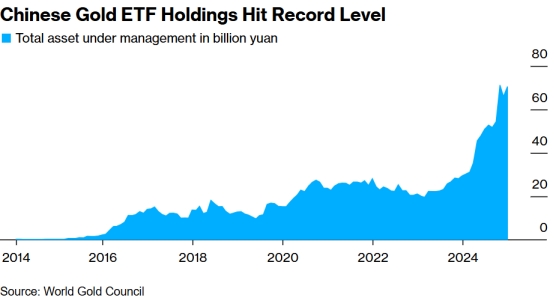

Paper gold investing, however, is another story, with exchange-traded funds (ETFs) backed by the yellow metal having risen to record levels. China's gold ETF holdings hit a record high. Additionally, there is one big buyer that continues to support market sentiment. China’s central bank resumed gold purchases in November after a six-month pause as it seeks to diversify its reserves, and increased purchases in January, according to the latest data on Friday.