Geopolitical risks and policy games resonate, gold prices fluctuate at high levels and then retreat after hitting a record high

- 2025年2月24日

- Posted by: Macro Global Markets

- Category: News

Geopolitical risks and policy games resonate, gold prices fluctuate at high levels and then retreat after hitting a record high

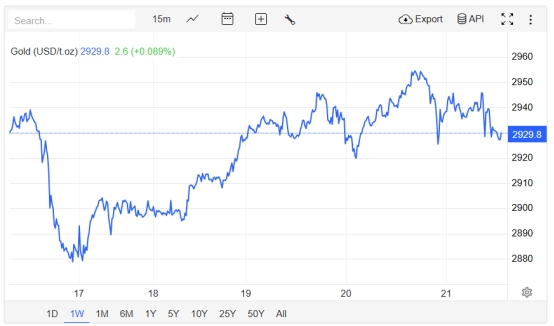

Macro Global Markets On February 21, 2025, the international gold market continued its violent fluctuations. The London spot gold price fell below $2,930 an ounce during the Asian session, down nearly 1.5% from the historical high of $2,954.72 set the previous trading day, and then stabilized around $2,940.

Behind this fluctuation, multiple factors are intertwined: US President Trump's threat to impose a 60% tariff on China continues to ferment, and the risk premium of the global trade war is injected into gold pricing; differences in the Federal Reserve's monetary policy path have intensified, and the rebound of the US dollar index has suppressed the rise in gold prices; although the geopolitical situation shows signs of easing, the Red Sea shipping crisis and the Middle East conflict still pose a foreshadowing of uncertainty for the market.

On February 19, the Trump administration announced that it would implement a "reciprocal tariff" policy starting April 1, targeting the negotiation process of the China-EU trade agreement. This move triggered market concerns about the disruption of the global supply chain, and the open interest of COMEX gold futures surged to 520,000 lots, a record high.

Although the annual growth rate of US CPI in January exceeded expectations by 3%, Chicago Federal Reserve Bank Chairman Goolsbee sent a signal of a 50 basis point interest rate cut this year, which is in sharp contrast to Powell's position of "maintaining restrictive policies". Federal funds rate futures showed that the probability of a rate cut in June rose to 78%, and the real interest rate (10-year TIPS) fell to an 11-month low of 1.62%, highlighting the opportunity cost of holding gold.

Central bank gold purchases reshape market structure

Data from the World Gold Council shows that in 2024, global central banks' net gold purchases exceeded 1,000 tons for the second consecutive year, with emerging markets such as China and Poland leading the "de-dollarization" process. In January 2025, the People's Bank of China implemented a "step-by-step increase" strategy, purchasing 21 tons of gold in a single month, a surge of 162% from the monthly average level in 2024.

This structural demand resonates with the rapid rise in gold inventories at the New York Mercantile Exchange (COMEX), triggering expectations of a resulting market run. Based on this, Goldman Sachs raised its gold price forecast for the end of 2025 to $3,100 per ounce, and UBS even believed that if geopolitical risks intensify, gold prices may exceed $3,200.

"Black Swan" hidden on the supply side, mineral risk premium rises

South Africa's national power company Eskom announced the launch of level 6 power rationing, and the country's gold production may be reduced by 12% (about 45 tons); the Russian government imposed a temporary 15% tariff on gold exports, affecting the global annual supply by 2.3%. Affected by this, the London Bullion Market Association (LBMA) gold forward rate premium widened to 0.8%, the highest since March 2020, showing tension in the spot market.

At the same time, gold inventories at the New York Mercantile Exchange increased to 862 tons, up 19% from the beginning of the year. The price gap between futures and spot prices widened to $12 per ounce, and arbitrage transactions exacerbated short-term fluctuations.

Market focus on Fed's extraordinary meeting

On the evening of February 21, Beijing time, the Federal Reserve will hold an emergency meeting to discuss the transmission mechanism of geopolitical risks to monetary policy. Investors can pay attention to this meeting. If the meeting sends a signal of ending the balance sheet reduction ahead of schedule or adjusting the inflation target, it may trigger a new round of gold price offensive.

In addition, the US January existing home sales data and the Eurozone consumer confidence index are also worth paying attention to. Weak data may strengthen expectations of easing. At present, gold has transformed from a single commodity into a composite pricing carrier of geopolitical risks, real interest rates and monetary credit, but we need to be wary of the key watershed of $2,920.