[MACRO Sharp Comments] Trump administration's unilateralism and its damage to the international order and the gold market's response

- 2025年2月10日

- Posted by: Macro Global Markets

- Category: News

The Trump administration has ignored the core principle of the World Trade Organization (WTO) rules - the most-favored-nation treatment, and imposed a 10% tariff on Chinese exports to the United States in accordance with the International Emergency Economic Powers Act, a domestic law of the United States. This behavior is a typical unilateralism, which seriously tramples on the international order based on international law and undermines multilateralism and international rule of law. Since World War II, multilateralism has been the basic and dominant institutional arrangement and value concept of the international community, promoting world peace, stability, development and prosperity.

However, the unilateral behavior of the Trump administration not only ignores the WTO's most-favored-nation treatment principle, but also repeatedly withdraws from international organizations and agreements, such as UNESCO, the UN Human Rights Council and the Paris Agreement on Climate Change, which seriously undermines multilateralism and international rule of law. Against this backdrop, the intensification of geopolitical tensions and trade wars has driven the surge in gold prices. Citigroup expects gold prices to reach a record high of $3,000 per ounce within three months.

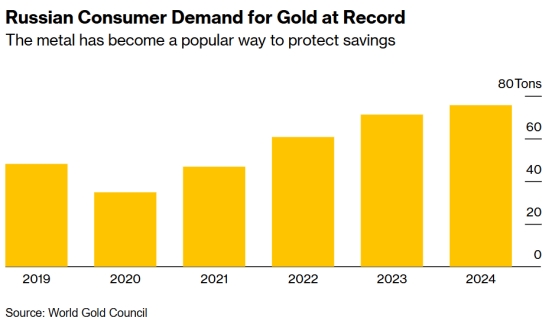

Meanwhile, Russian consumers bought record amounts of gold in 2024 to protect their savings amid sanctions. Russian consumers bought 75.6 tonnes (2.7 million ounces) of gold in 2024, including bars, coins and jewelry, ranking fifth globally, according to the World Gold Council. That was up 6% from the year before and more than 60% since Putin sent troops into Ukraine nearly three years ago. Russia is the world's second-largest gold producer, mining more than 300 tonnes of the precious metal each year. Russian gold has received a cold shoulder in the West since the outbreak of the Russia-Ukraine conflict, with flows to trading hubs such as London and New York all but halted.

The escalation of Western sanctions against Russia has made gold purchases an attractive alternative to traditional investments as the ruble has fallen to an all-time low since the conflict began. Cross-border payment restrictions have also made it harder for Russian citizens to diversify their investments abroad. Citigroup also noted that a stronger dollar would increase the incentive for central banks in emerging economies to increase their gold reserves to support their currencies, while investors would turn to physical gold and gold ETFs at the same time. Trade war concerns have also led London-based traders to move gold to the United States as they worry that gold may not be excluded from potential tariffs. Citigroup said the premium as of Wednesday implied about a 20% chance that Trump would include gold in a 10% global tariff.

At present, we can intuitively realize that the global economy is in a critical period of recovery, and "working together" is the only way out. The importance of practicing multilateralism and defending international rule of law has never been more prominent. All countries in the world, especially truly responsible major countries, should adhere to the principles of equal consultation, mutual benefit and win-win results, resolve disputes and differences through dialogue and consultation, and jointly maintain the stability of the international economic and trade order. Only in this way can we promote inclusive growth of the global economy and promote common prosperity of human society.