The ever-changing gold market: short-term pullbacks and long-term support factors

- 2025年3月3日

- Posted by: Macro Global Markets

- Category: News

[MACRO Trends] The ever-changing gold market, short-term pullbacks and long-term support factors

U.S. President Trump's statement on tariff policy further exacerbated market uncertainty. He said on social media that new tariffs on Mexico and Canada will take effect on March 4, and he had previously proposed a 25% tariff on European cars and other goods. The uncertainty prompted investors to flock to the U.S. dollar, further pressuring gold, which was already under pressure from profit-taking after hitting an all-time high. Spot gold hit an all-time high of $2,956.15 an ounce on Monday on safe-haven inflows. However, a pullback in gold this week would end its eight-week winning streak, its longest such streak since 2020.

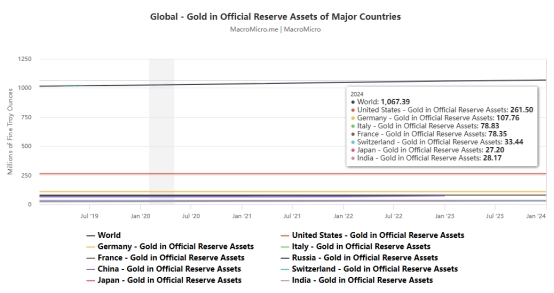

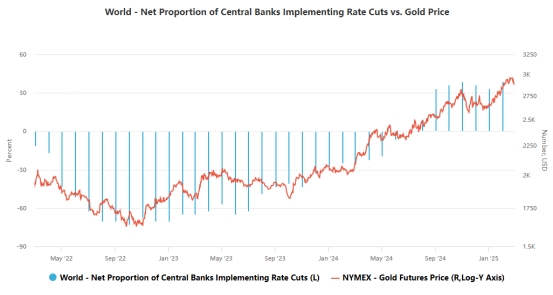

From a technical perspective, if gold fails to hold the $2,878 area and the $2,860-2,855 area, the price of gold may further accelerate its corrective decline to the $2,834 area and all the way down to the $2,800 round number. On the other hand, a break above the immediate barrier of $2,920 could attract sellers near the overnight high, around the $2,930 area. If gold prices can move firmly upward, they could move further towards the 2950-2955 resistance level or the record high hit on the first day of this week. Central banks around the world have been buying large amounts of gold in recent years, pushing prices of the precious metal to record levels.

Gold is widely viewed as a safe-haven asset in times of uncertainty. In recent years, various geopolitical events have continued to occur around the world - including the conflict in Ukraine, the Gaza War and the regional banking crisis in the United States. Concerns about continued inflation and global tensions remain, and concerns supporting the rise in gold prices are not expected to disappear soon. Other growing threats, such as a ballooning U.S. deficit and protectionist rhetoric around tariffs, have also left central banks around the world searching for alternatives. But what alternatives are there to gold? How should I respond to my own situation and the global situation? There are many reasons why gold prices have hit record highs. But one major driver of gold demand lately – central bank buying – shows no signs of slowing down!

Gold prices have seen a certain degree of correction recently, mainly affected by the strengthening of the US dollar and the market's wait for key inflation data. However, in the long term, factors such as continued purchases by global central banks, geopolitical tensions, and inflation and trade concerns will continue to support gold prices. Investors should pay close attention to market developments, especially the Federal Reserve's monetary policy and geopolitical events, to formulate reasonable investment strategies.