12 U.S. states jointly accuse Trump of unconstitutional tariff policy! The gold market faces another double test of geopolitical policy

- 2025年4月25日

- Posted by: Macro Global Markets

- Category: News

12 U.S. states jointly accuse Trump of unconstitutional tariff policy! The gold market faces another double test of geopolitical policy

On April 23rd local time, a coalition of 12 U.S. states filed a lawsuit with the New York International Trade Court, accusing the Trump administration's "reciprocal tariff" policy of violating the Constitution and asking the court to rule that the policy is illegal and block its implementation. States involved in the lawsuit include New York, California (which had previously filed a separate lawsuit), Arizona, etc., covering major economic centers on the east and west coasts, representing nearly 40% of the U.S. population and 50% of import trade volume.

New York Attorney General Letitia James bluntly stated: "The president has no right to arbitrarily impose taxes through social media and executive orders. This is a blatant violation of the legislative power of Congress." Arizona Attorney General Chris Meyers emphasized: "These crazy tariffs are destroying small and medium-sized enterprises, and American consumers will ultimately bear up to $50 billion in additional costs."

The White House responded strongly: Tariff policy is "a necessary measure to protect American industries"

In response to the lawsuit, White House spokesman Kush Desai said at a press conference that day that the states' lawsuits were "political manipulation" and that the government "will use all legal means to protect American workers." He stressed that the Trump administration's tariff policy is aimed at addressing "unfair foreign trade practices," especially "industrial dumping" in key areas such as transistors and new energy vehicles, and said that 34 countries have agreed to participate in this week's tariff consultations in an attempt to reconstruct global trade rules through the "principle of reciprocity."

It is worth noting that this is another collective resistance by local governments in the United States against the federal tariff policy after California took the lead in filing a lawsuit on April 16, indicating that the Trump administration’s trade policy has triggered a double backlash in domestic politics and economy. Members of Congress from both parties also spoke out at the same time. The Senate Banking Committee is drafting a bill requiring the president to notify Congress 48 hours before implementing new tariffs, further limiting the expansion of executive power.

Gold market fluctuates violently: policy uncertainty pushes up safe-haven demand, while a stronger dollar suppresses

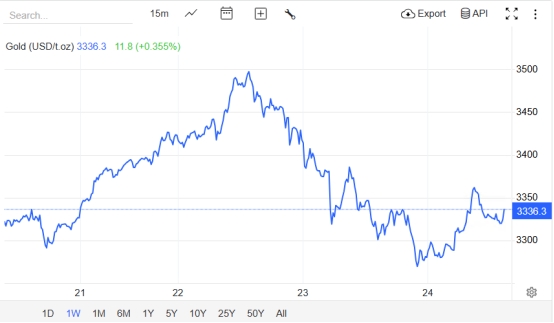

Affected by this incident, the international gold market showed a roller coaster trend of "rising first and then falling" on April 23:

Phiên giao dịch châu Á: Sau khi tin tức được công bố, giá vàng giao ngay nhanh chóng tăng 12 đô la, đạt mức cao nhất là 3.368,45 đô la một ounce, do thị trường lo ngại rằng sự bế tắc về chính sách thuế quan sẽ làm trầm trọng thêm sự chia rẽ chính trị tại Hoa Kỳ và tâm lý sợ rủi ro tăng cao trong thời gian ngắn; Phiên giao dịch châu Âu: Khi Nhà Trắng phát đi tín hiệu "đàm phán thuế quan vẫn đang tiến triển", chỉ số đồng đô la Mỹ phục hồi lên 99,85 và vàng chịu áp lực giảm, xuống mức thấp nhất là 3.313,51 đô la một ounce, với biên độ trong ngày là 1,7%.

In its latest report, Goldman Sachs pointed out that the joint lawsuit filed by state governments marks the "concentrated release of legal risks" of Trump's tariff policy. If a settlement cannot be reached before June, it may lead to the breakdown of global trade negotiations, and gold is expected to break through $3,600 in the third quarter. However, in the short term, we need to be wary of the shock to US dollar liquidity - CME data shows that the trading volume of tariff-related option contracts has surged by 40%, and market concerns about gold volatility (the one-month VIX gold index rose to 28) have intensified.

The joint accusation by 12 U.S. states against the Trump administration is not only a legal lawsuit, but also a head-on confrontation between the U.S. system of separation of powers and the expansion of executive power. For gold, the policy uncertainty premium will support prices in the short term, but in the medium term we still need to observe the pace of the Fed's interest rate cuts and the final direction of global trade reconstruction. Investors need to pay close attention to the results of the preliminary hearing of the U.S. Court of International Trade on April 26, which may trigger a new round of violent fluctuations in the gold market.