Asset allocation shift under the failure of traditional 60/40 portfolio: the struggle between gold, crude oil and Bitcoin

- 2025年5月30日

- Posted by: Macro Global Markets

- Category: News

The Dilemma of Traditional Stock-Bond Portfolios and the Rise of Alternative Assets

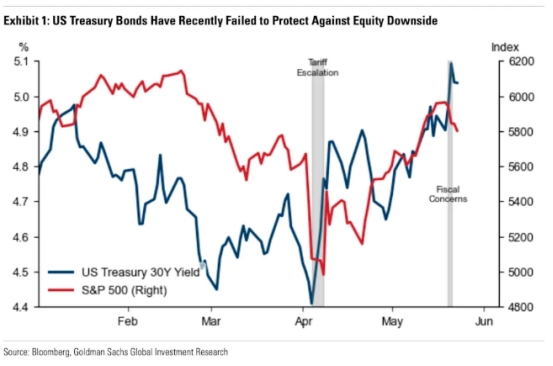

In recent years, the traditional 60/40 investment portfolio that focuses on stocks and bonds has gradually become ineffective under the impact of tariff policies and economic uncertainty. Goldman Sachs pointed out that long-term US Treasury bonds have failed to play a role in hedging the downside risks of the stock market recently. Whether it is the recession concerns caused by the tariff escalation in April or the surge in borrowing costs caused by fiscal sustainability concerns in May, US Treasury bonds have not reflected their safe-haven value. This phenomenon is not accidental. In historical inflation or commodity shocks, the stock and bond markets often fall simultaneously.

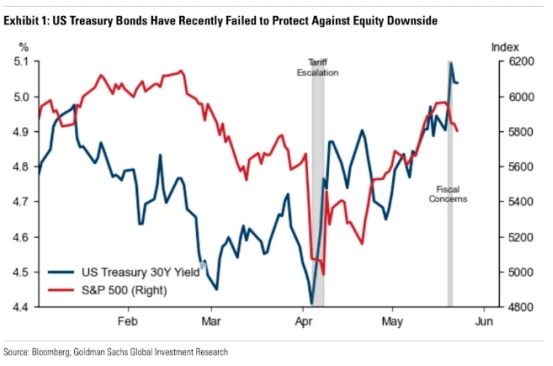

In response to this challenge, Goldman Sachs recommends that long-term investors allocate gold and crude oil futures. Gold can hedge against central bank policy mistakes and fiscal credit risks, while crude oil can resist negative supply shocks. Data shows that by adding these two types of assets to the 60/40 portfolio, the annualized volatility can be reduced from 10% to below 7%. For investors with a holding period of more than five years, Goldman Sachs recommends overweighting gold - since 2025, the price of gold has risen by 26.6% to a record high. Market concerns about the stability of US policies (such as fiscal debt and threats to the independence of the Federal Reserve) and the global trend of de-dollarization (central banks continue to increase their holdings of gold) have become the main driving forces. Goldman Sachs predicts that if concerns intensify, the price of gold may break through the target of $3,700 per ounce at the end of the year and $4,000 per ounce in mid-2026.

Bitcoin's substitution effect on gold and market differentiation

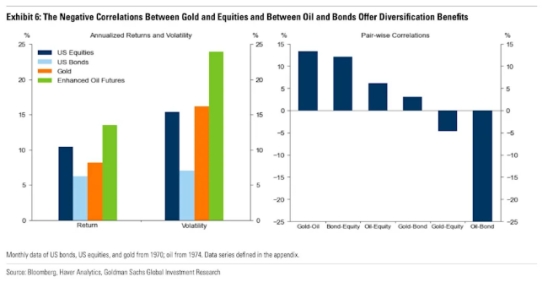

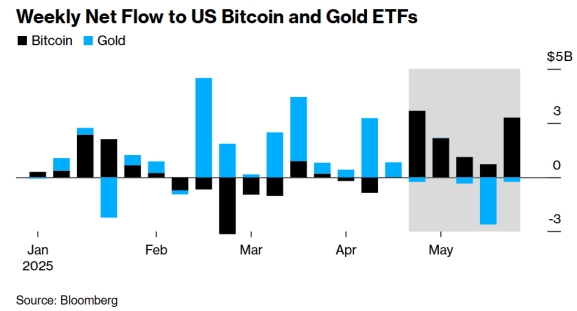

At the same time, there is a clear fund rotation in the US ETF market: investors are turning from gold to Bitcoin. In the past five weeks, US Bitcoin ETFs have attracted more than $9 billion in inflows, with IBIT under BlackRock taking the lead, while gold ETFs have seen outflows of more than $2.8 billion during the same period. This phenomenon stems from two factors:

l Changes in the macro environment: The easing of trade tensions has weakened the safe-haven demand for gold, while concerns about US fiscal stability (such as Moody's downgrading the US credit rating to non-AAA) have promoted the recognition of Bitcoin as "digital gold". Bitcoin recently broke through $110,000 to a record high, partly due to regulatory benefits such as the progress of the stablecoin bill, and the demand for value storage brought about by macro uncertainties.

l Controversy over asset attributes: Although gold has still risen by 25% this year (higher than Bitcoin's 15%), its short-term performance has fallen from its peak, while Bitcoin is trying to get rid of the label of "tech risk asset". Pepperstone research shows that the correlation between Bitcoin and Nasdaq, the US dollar and even gold has dropped significantly in the past month, and it is gradually being regarded as an independent safe-haven tool. Standard Chartered Bank pointed out that Bitcoin plays a dual role through "hedging private sector risks" (such as banking crises) and "government agency risks" (such as concerns about the stability of government bonds). Its decentralized nature makes it more advantageous in hedging financial system risks.

Asset allocation logic under macro risks

The core contradiction in the current market lies in the competition for the positioning of traditional safe-haven assets (gold) and emerging digital assets (Bitcoin). The differences between Goldman Sachs and Standard Chartered and other institutions reflect the differences in investors' judgments on "risk types":

l Advantageous scenarios for gold: In geopolitical conflicts, when local wars or international tensions escalate, market risk aversion rises sharply, and gold, as a "safe-haven asset in troubled times", tends to rise rapidly in value; if the central bank's monetary policy becomes disordered, such as excessive money issuance causing inflation expectations to get out of control, or frequent changes in the direction of monetary policy lead to confusion in market expectations, gold's anti-inflation and value-preserving properties will become prominent; under the long-term trend of de-dollarization, central banks of various countries continue to increase gold reserves to optimize the foreign exchange reserve structure. This change in supply and demand will provide long-term support for gold prices.

l Bitcoin's advantageous scenarios: In the face of a fiscal credit crisis, when government debt is high and sovereign credit ratings are downgraded, investors' confidence in traditional legal tender is shaken, and Bitcoin's decentralized and constant total volume characteristics make it a potential safe haven for funds; if there are stability concerns in the financial system, such as bank runs, its systemic constant characteristics make it a potential safe haven for funds; if there are stability concerns in the financial system, such as bank runs and exposure to systemic financial risks, Bitcoin, as a digital asset independent of traditional financial institutions, can provide investors with alternative configuration options; with the advancement of regulatory compliance, Bitcoin is gradually incorporated into the mainstream financial regulatory framework, the entry threshold for institutional investors is lowered, liquidity and market recognition are improved, and its price center is also expected to move up.

l Long-term investors: It is recommended to use gold as a core safe-haven asset. Based on its millennial currency attributes and its value-preserving characteristics during low inflation, a 10%-15% position can be allocated. At the same time, given that the crude oil market is frequently hit by supply shocks due to geopolitical factors, OPEC+ production cut agreements, etc., it is advisable to adopt a low allocation strategy (less than 5%) and diversify the risk of a single target through energy ETFs. In addition, it is appropriate to increase the allocation of ultra-long-term varieties with positive real yields of US Treasury bonds to form an anti-cyclical combination of "hard assets + safe assets".

l Short-term traders: Although cryptocurrencies such as Bitcoin have high elasticity, a strict risk management system needs to be established. It is recommended to pay close attention to global regulatory developments (such as the US SEC's approval of spot ETFs and the implementation of the EU MiCA Act), and dynamically adjust positions based on sentiment indicators such as the Fear and Greed Index and the volume of open contracts. Given its annualized volatility of over 60%, the stop loss for a single transaction should be controlled in the range of 8%-12% to avoid a sharp decline in net value under extreme market conditions.

Regardless of the strategy adopted, asset allocation in the post-60/40 era needs to construct a hedging matrix across asset classes: hedge inflation risk through commodity futures, use treasury futures to respond to monetary policy shifts, and allocate emerging market bonds to mitigate sovereign debt crises, ultimately forming a three-dimensional protection system that can withstand multiple macro risks (inflation, policy, and debt).