US non-farm data in December exceeded expectations, and financial markets are in turmoil again

- 2025年1月15日

- Posted by: Macro Global Markets

- Category: News

US non-farm data in December exceeded expectations, and financial markets are in turmoil again

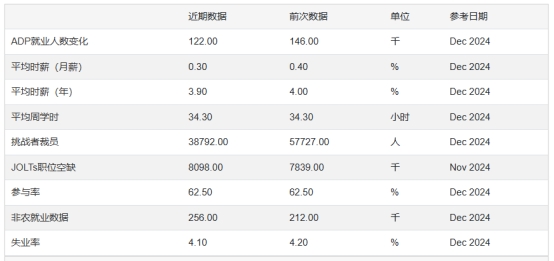

December seasonally adjusted non-agricultural data

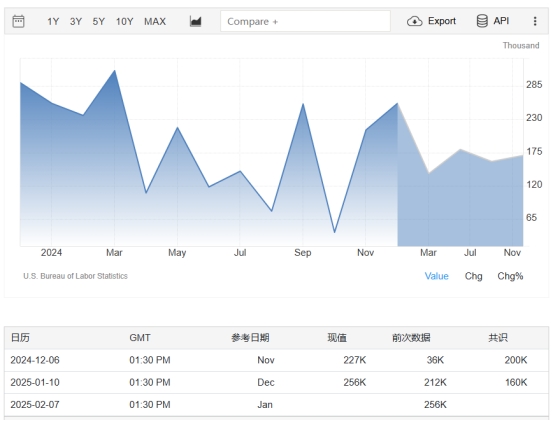

Macro Global Markets:In December 2024, the U.S. economy added 256,000 jobs, which was consistent with market expectations of 160,000 and the highest since April 2024. Adjustments were made, resulting in a total of 8,000 jobs being refunded in October and November.

Non-agricultural data exceeded expectations: US job market is good, bullish for the dollar, bearish for gold

Market changes after non-agricultural

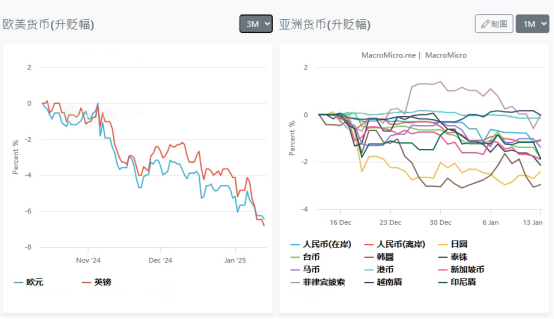

Foreign exchange market

GBP:It fell sharply to its lowest level since November 2023. Options trading volume soared on Wednesday, with hedge funds buying a large number of put options, and the cost of hedging against a decline in the pound in the next week soared.

Japanese Yen:The dollar rose to its highest level against the yen since July 2024 at one point, and the Governor of the Bank of Japan is likely to keep the yen relatively weak.

Asian Currency:The Asian currency index fell to a 20-year low as the dollar rose across the board.

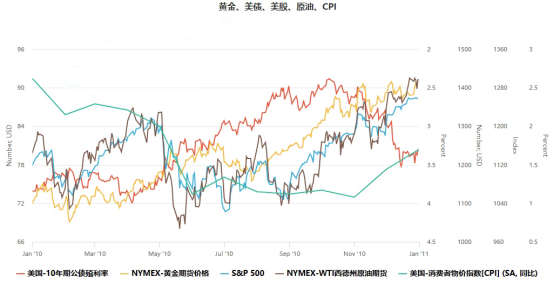

Gold Market

Spot gold rose for four consecutive days this week to a new high, with a cumulative increase of 1.9%. It fell sharply in the short term after the non-farm data on Friday, but the news of the Houthi armed attack on the US rifles quickly recovered the lost ground and turned to rise, closing at about $2,690 an ounce.

Oil Market

International crude oil prices closed higher overall this week, with a sharp increase on Friday, as the cold winter led to strong oil demand and recent adjustments and upgrades may lead to tight supply of Russian and Iranian crude oil.

The Nasdaq fell 2.34% this week, the S&P 500 fell 1.94%, and the Dow Jones Industrial Average fell 1.86%, with all moving averages falling.

Bitcoin

The market fluctuated violently this week. After briefly returning to the $100,000 mark at the beginning of the week, it fell for three consecutive days. On Friday night, more than 12 people had their positions liquidated in 24 hours, with a total liquidation amount of $336 million.

The impact of strong non-farm payrolls on US debt and interest rate cut expectations

Professionals believe that the strong employment data has caused the market to reprice the Fed's short-term expectations, leading to a flattening of the oval bear market. The continued disappearance of the huge "dragon" may prevent the Fed from further rate cuts, but the market has not considered this situation.

Authoritative opinion

Citi:

The rate cut will be 25 basis points, but it will start in May instead of January as previously expected. The interest rate will be cut by 25 basis points each in June and December 2025 (the UAE expects three interest rate cuts), and cut again in June 2026, maintaining the interest rate at 3.5%-3.75%.

CME Group:

CME's "Federal Reserve Data Watch" tool shows that the market expects the probability of at most one interest rate cut this year to rise to more than 60%. Against the backdrop of a possible rate cut, the probability of no rate cut in March has now risen from 56% before the data was released to 70%.

Tony Pasquariello, head of hedge fund research at Goldman Sachs, said U.S. stocks are at all-time highs in both absolute and relative valuations. Fair value. The current U.S. stock market is at the beginning, not the dawn.

BofA Securities:

Aditya Bhave, an American economist at Bank of America Securities, warned that the baseline forecast is that the Fed will keep interest rates unchanged, but the risk of the next move is already tilted towards raising interest rates. The attitude towards interest rates tends to be restrained, but if the inflation indicator PCE (personal consumption expenditure price index) that the Fed is worried about accelerates again, the possibility of raising interest rates will be put on the table.