February Non-Farm Employment Report Forecast - New Trends in the Labor Market and Economic Outlook

- 2025年3月5日

- Posted by: Macro Global Markets

- Category: News

[Non-farm Forecast] February Non-farm Employment Report Forecast - New Trends in the Labor Market and Economic Outlook

1. Non-agricultural summary: data divergence and market focus

The non-agricultural data in February 2025 faces two core variables:

Verification of labor market resilience:In January, non-farm employment increased by 143,000 (previous value revised up to 307,000), and the unemployment rate dropped to 4.0%, but the unexpected wage growth rate (4.1% year-on-year) raised inflation concerns. The market needs to verify whether the February data continues the combination of "strong employment + high wages" or shows signs of economic slowdown.

Historical data revision shock:The U.S. Department of Labor will make annual baseline revisions to household survey data, and it is expected that the net immigration data for 2023-2024 will be revised upward by 3.5 million, and the household employment data may increase significantly by 2.3 million. This could lead to a narrowing of the long-standing divergence between nonfarm and household payrolls, triggering a reassessment of the true strength of the labor market.

New employment:The market forecast is 153,000 (previous value: 143,000).

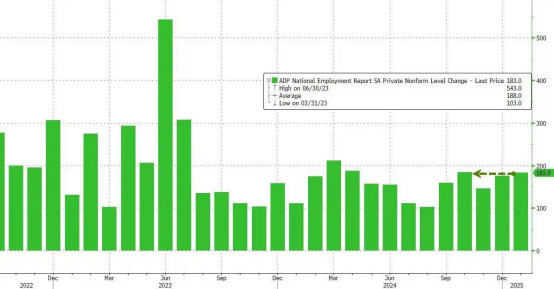

Small non-farm ADP forecast

Previous value:ADP employment in January was 183,000;

Predicted value:ADP is expected to be 140,000 in February (the market is worried that high interest rates will suppress recruitment by small and medium-sized enterprises).

The ADP data reflects the employment situation of small and medium-sized enterprises. The 183,000 new ADP jobs in January far exceeded the 143,000 non-farm jobs, showing that layoffs in large companies (such as the technology industry) coexist with expansion of small and medium-sized enterprises. If ADP falls back to 140,000 in February, it may indicate that small and medium-sized enterprises are affected by credit tightening and the momentum of the job market is weakening.

The ADP employment figures for February will be released on Wednesday, March 05, 2025 at 21:15.

New non-farm employment:Forecast: 153,000 (previous value: 143,000);

unemployment rate:The expectation is to maintain 4.0%. If it unexpectedly rises to 4.1%, it will strengthen the expectation of a rate cut;

Salary growth rate:If the year-on-year growth rate exceeds 4.0%, it may exacerbate concerns about the "wage-inflation spiral" and support the strengthening of the US dollar.

Review of last month’s non-agricultural impact:After the release of January data, gold briefly fell to $2,888, but rebounded to $2,917 in late trading as the conflict between falling unemployment and wage growth triggered a game between bulls and bears.

The February non-farm payrolls change data will be released on March 07, 2025 (Friday) at 21:30

(1) Non-agricultural data released is lower than expected:The weak U.S. job market is bearish for the dollar and bullish for gold;

(2) Non-agricultural data exceeded expectations:The good U.S. job market is bullish for the dollar and bearish for gold.

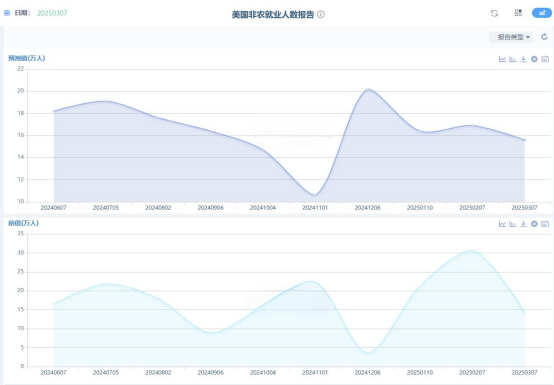

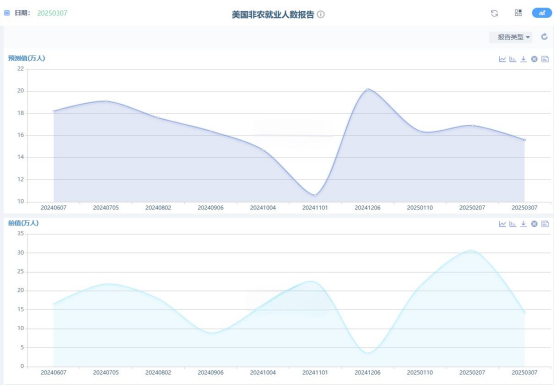

Historical non-agricultural data chart

3. Differences between institutional and bank forecasts

Goldman Sachs (120,000): Structural weakness dominates

Core basis:The lag effect of high interest rates is accelerating, with JOLTS job vacancies falling to 8.6 million in January (previous value: 8.9 million), and corporate recruitment demand cooling down;

Modification Impact:An upward revision of 2.3 million to the household survey would result in a “statistical decline” in the unemployment rate, but the actual labor market may be weaker than the data suggests;

Industry Weighting:It is expected that the manufacturing industry will decrease by 15,000, the construction industry will remain unchanged, and the service industry will slow down to 135,000 new jobs.

Moody's (180,000):Resilience of the service industry

Logical chain:Health care (+60,000), educational services (+30,000) and government employment (+40,000) remained strong, offsetting the decline in manufacturing;

Immigration Effect:The revised immigration data may explain about 40% of the new jobs, masking the weakness of the local labor market;

Cycle positioning:It is believed that the US economy is in the "late stage of expansion" rather than on the eve of recession, and that companies' demand for labor still has inertia.

Citigroup (125,000):Credit tightening is transmitted to employment

Financial conditions:The interest rate of BBB-rated corporate bonds has risen to 6.7% (average value of 5.2% in 2024), and the rising financing costs of small and medium-sized enterprises have suppressed the expansion of enrollment;

Leading position:In February, the number of layoffs in challenger companies increased by 35% year-on-year, and layoffs in the technology and retail industries spread;

Policy Relevance:If the data is below 130,000, it will reinforce expectations that the Federal Reserve will cut interest rates by 50 basis points in June.

4. Interpretation of gold and bank market trends

Gold market analysis

Risk appetite was suppressed by weak U.S. economic data (January new housing starts and initial jobless claims were lower than expected) and the Fed's policy divergence, while the geopolitical situation (Russia-Ukraine conflict, Red Sea shipping crisis) and Trump's tariff policy disturbances exacerbated risk aversion volatility.

On the technological front, gold rebounded from a low of $2,921.34 to $2,944.00 during the Asian session. The daily line still stood firm on the 20-day moving average ($2,925.00), but the Bollinger Bands on the 4-hour chart narrowed to the $2,930.00-2,945.00 range. The shortening of the MACD momentum column suggested an intensification of the game between bulls and bears. The key resistance above is at $2955.00 (three attempts this year have not been broken). After breaking through, it may open up upside space of $3000.00; the strong support below is at $2900.00 (daily cloud bottom + central bank cost line).

In terms of short-term operation, sell high and buy low in the range of US$2930.00-2945.00, and chase longs if it breaks through US$2955.00, with the target at US$2980.00-3000.00; if it breaks below US$2920.00, you can short to US$2900.00, with a stop loss of US$5.

As silver's industrial content makes it more sensitive to economic cycles, the weak manufacturing PMI (47.3) suppressed demand expectations, but the growth in demand in the photovoltaic and new energy sectors provided a hedge. Risk aversion and the correlation with gold remain the dominant factors in the short term.

From a technical perspective, silver tested the support of $32.350 and then rebounded to $32.590. The hourly chart is subject to resistance at $32.780, which needs to be broken to confirm a trend reversal. The daily line is approaching the 20-day moving average ($32,150). If it effectively falls below the psychological level of $32,000, it may open up space to fall to $31,300.

The operation suggestion is to operate in the range of 32.350-32.780 US dollars. If it breaks through 32.780 US dollars, go long to 33.200 US dollars; if it falls below 32.000 US dollars, go short. The target is 31.300 US dollars and the stop loss is 0.200 US dollars.

5. Non-agricultural related market conditions

March 4: US JOLTS job openings

Forecast value: 8.55 million (previous value: 8.86 million)

Impact path: If it falls below 8.5 million, it will strengthen the narrative of "rebalancing labor supply and demand", indicating a downward trend in wage growth, which is bullish for gold;

Historical correlation: The 90-day correlation between JOLTS data and non-farm payrolls is 0.68.

March 5: ISM non-manufacturing PMI

Forecast: 53.5 (previous 54.2)

Sector mapping: The service industry accounts for more than 80% of the US GDP. If the reading falls below 53, it will increase concerns about economic slowdown and hedge against non-agricultural optimism;

Gold sensitivity: For every 1 point that PMI is lower than expected, gold may rise by $8-10 in the short term.

Transaction risk warning: Any investment involves risks, including the risk of financial loss. This advice does not constitute specific investment advice and investors should make decisions based on their own risk tolerance, investment objectives and market conditions.