[MACRO Trends] The Fed's inaction hides differences, and the ECB sets off a wave of easing! The global policy cycle is facing a sharp divergence

- 2025年6月24日

- Posted by: Macro Global Markets

- Category: News

[MACRO Trends] The Fed's inaction hides differences, and the ECB sets off a wave of easing! The global policy cycle is facing a sharp divergence

At the June 2025 monetary policy meeting, the Fed kept the federal funds rate unchanged as expected by the market, while reiterating its policy inclination to cut interest rates twice this year. The signals released by this meeting were relatively mild, and the market reaction was flat. Citigroup described it as a "lackluster" policy meeting. The Fed's updated economic forecasts showed only slight adjustments to expectations for GDP growth, unemployment and inflation, but the "dot plot" revealed clear differences among internal decision-makers: 8 policymakers expected two interest rate cuts by the end of 2025, reflecting concerns about slowing economic growth and pressures in the job market; 7 policymakers tended to keep the balance unchanged, highlighting the clarity of the balance between inflation and response policies.

At the press conference after the meeting, Fed Chairman Powell deliberately downplayed the predictive significance of the dot plot, emphasizing that the current economic environment is highly uncertain, and factors such as geopolitical risks and trade policy fluctuations make it difficult to predict the policy path. He pointed out: "In a period full of confusion, different decision makers have different assessments of risks. As more economic data is disclosed, policy differences will gradually converge." Michael Feroli, an economist at JPMorgan Chase, also holds a similar view, believing that only one interest rate cut may be implemented in December this year, and recommends that the market should not over-interpret the dot plot signals.

In sharp contrast to the Fed's cautious attitude, the European Central Bank system launched a wave of easing within 24 hours. The Swiss National Bank cut its policy rate by 25 basis points to zero, becoming the first major central bank to return to zero interest rates; the Norwegian Central Bank unexpectedly cut interest rates by 25 basis points, exceeding market expectations; the Swedish Central Bank continued the easing cycle. This series of actions highlights that the global economic stimulus effect has faded in the post-epidemic era, and the European economy is facing the dilemma of weak growth. Switzerland's CPI fell by 0.1% year-on-year in May, and the full-year inflation forecast was only 0.2%, mainly affected by the appreciation of the safe-haven currency franc; the Swedish krona soared 15% against the US dollar, and the pressure of imported inflation eased; although Norway's core inflation fell to 2.8%, policymakers are still cautious about the economic outlook.

The collective interest rate cut by the European Central Bank has attracted the attention of the US political circles. Trump has repeatedly expressed dissatisfaction with the loose policy of the European Central Bank, believing that it has exacerbated global trade imbalances. Bloomberg analysis pointed out that the global central bank's shift to easing is essentially an inevitable choice to cope with the decline in economic momentum in the post-epidemic era, and trade policy uncertainty has only exacerbated this trend. It is worth noting that although the Bank of England kept interest rates unchanged, the voting results showed that dovish forces were strengthened, resulting in pressure on the pound exchange rate.

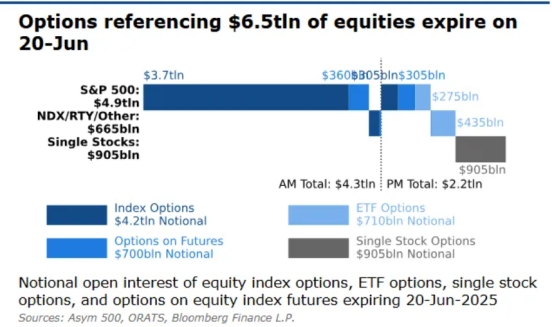

While the dynamics of global central bank policies have attracted market attention, the U.S. stock market "Triple Witching Day" on June 20 (Friday) has come. Stock option contracts with a nominal value of $6.5 trillion have expired, including $4.2 trillion index options, and $710 billion ETF option contracts have expired, including $4.2 trillion index options. Rocky Fishman, founder of research firm Asym 500, pointed out that the scale of this expiration is rare in history and may break the low volatility of U.S. stocks since early May.

Since the beginning of May, the S&P 500 index has formed a "pegging effect" near 5981 points, and a large number of put option transactions have caused the price of the underlying asset to converge to the high-volume strike price. The positive gamma strategy adopted by market makers to hedge risks has formed a trading model of "selling when rising and buying when falling", which has suppressed market volatility. However, as options expire in a concentrated manner, this stabilization mechanism may fail.

Citigroup strategists pointed out that although the volatility of quarterly option expirations is usually not much different from that of monthly expirations, the large scale of this expiration, coupled with geopolitical risks (Middle East situation, Russia-Ukraine conflict) and trade policy uncertainties (the tariff suspension period expires on July 9), may pose a hidden danger to market volatility next week.

Multiple factors interweave and the market enters a high volatility window period

The current global financial market is in a period of policy divergence, rising geopolitical risks and option expiration. The uncertainty of the Federal Reserve's policy is in sharp contrast to the aggressive easing of the European Central Bank, reflecting the unevenness of the global economic recovery. The expiration of U.S. stock options may break the low volatility calm, and the potential escalation of trade policies and geopolitical conflicts will further amplify market volatility. As Powell said, the economic outlook is still in a "confused period", and both policymakers and investors need to make decisions in a highly uncertain environment. The market may be difficult to get rid of the high volatility in the short term.