Global financial markets are in turmoil again: An in-depth analysis of the monetary policies of the Federal Reserve and the Bank of England

- 2025年3月24日

- Posted by: Macro Global Markets

- Category: News

【MACRO Current Affairs】Global financial markets are in turmoil again: In-depth analysis of the monetary policies of the Federal Reserve and the Bank of England

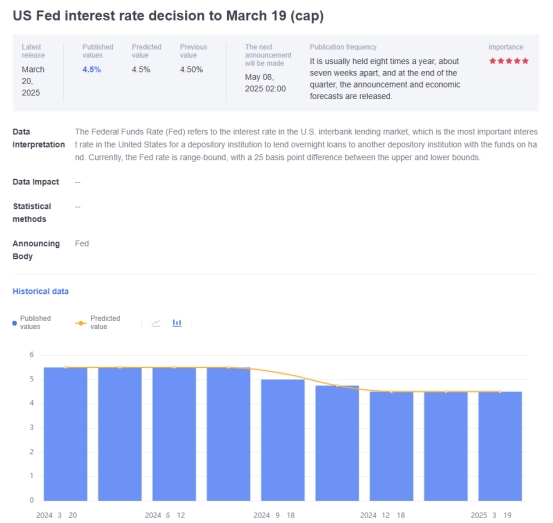

1. Federal Reserve: Maintaining stable interest rates and slowing the pace of balance sheet reduction

On March 20, 2025, the Federal Reserve announced that it would maintain the benchmark interest rate at 4.25%-4.50%. This decision is in line with market expectations and shows the Fed's cautious and stable attitude under the current economic situation. The Fed's interest rate decision was made after a comprehensive assessment of a series of economic indicators. Recent data show that US economic activity is expanding at a steady pace, the unemployment rate is stable at a low level, and the labor market remains strong. These factors provide strong support for maintaining stable interest rates. However, the inflation level is still high, which requires the Fed to remain highly vigilant in adjusting monetary policy.

The Fed's policy adjustments not only affect the U.S. domestic economy, but also trigger chain reactions around the world. Capital flows, exchange rate fluctuations, and global trade patterns in emerging market countries may all change due to the direction of the Fed's monetary policy. Investors need to pay close attention to further signals of the Fed's future policies so as to adjust their investment strategies in a timely manner.

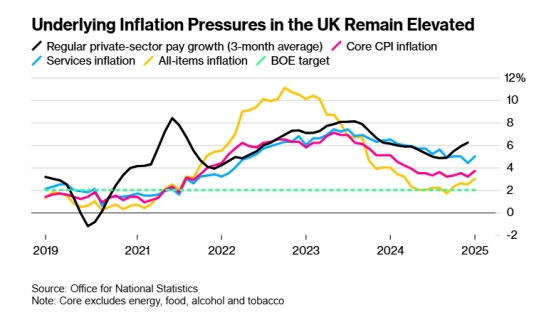

2. Bank of England: Interest rate decision is imminent, market expects cautious rate cut

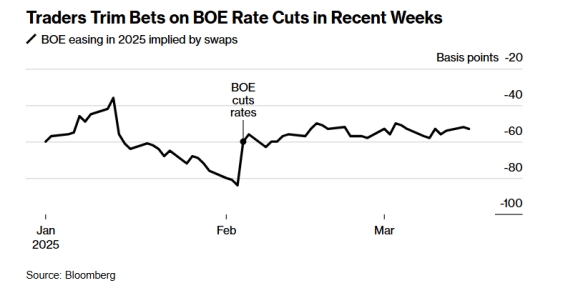

Almost at the same time as the Fed, the Bank of England will also announce its interest rate decision and meeting minutes at 20:00 Beijing time on Thursday. The market and economists generally expect that the Bank of England's Monetary Policy Committee (MPC) will keep the benchmark interest rate unchanged at 4.5% and once again emphasize a cautious attitude towards further interest rate cuts. This expectation reflects the current complex economic situation in the UK.

On the other hand, differences within the Bank of England on monetary policy have gradually emerged. At the February meeting, MPC member Catherine Mann unexpectedly changed from an extreme hawk to supporting a sharp interest rate cut of 50 basis points, which attracted widespread attention from the market. However, as economic data becomes clearer and the international situation changes, the market expects that the voting differences at this meeting will be narrowed, with seven members voting to maintain interest rates unchanged and the remaining two members supporting a 25 basis point interest rate cut. This distribution indicates that the Bank of England will be more cautious and gradual in adjusting its monetary policy.

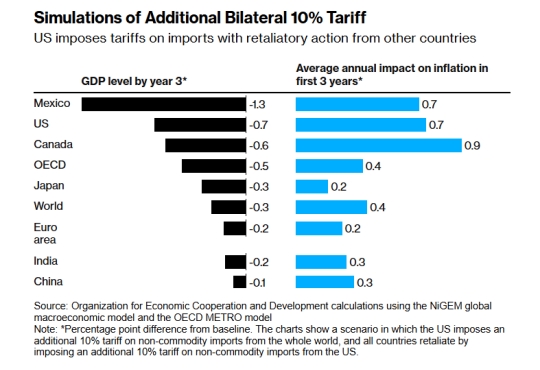

3. Financial Market Outlook: Policy Divergence and Market Volatility

The monetary policy trends of the Federal Reserve and the Bank of England not only reflect the current situation and challenges of the domestic economies of the two countries, but also, to a certain extent, reflect the differentiation and uncertainty of the global financial market. In the context of globalization, the policy adjustments of central banks in various countries affect each other, forming a complex policy game pattern.

The monetary policy trends of the Federal Reserve and the Bank of England not only reflect the current situation and challenges of the domestic economies of the two countries, but also, to a certain extent, reflect the differentiation and uncertainty of the global financial market. In the context of globalization, the policy adjustments of central banks in various countries affect each other, forming a complex policy game pattern.

In the ever-changing global financial market, the monetary policy decisions of the Federal Reserve and the Bank of England are undoubtedly the key weathervanes. Through in-depth interpretation and analysis of these policies, investors can better understand market dynamics, formulate more scientific and reasonable investment strategies, and move forward steadily on the road to wealth growth.