The market reacted strongly to the Fed’s third rate cut, and expectations for future rate cuts showed negative growth !

- 2024年12月19日

- Posted by: Macro Global Markets

- Category: News

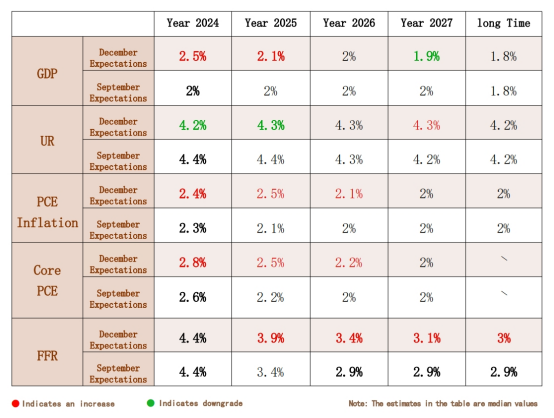

At the policy meeting on December 19, the U.S. Federal Reserve (Fed) announced its third interest rate cut this year, a 25 basis point cut, adjusting the federal funds rate target range to 4.25%-4.5%. This decision was in line with market expectations, bringing the Fed's cumulative interest rate cuts this year to 100 basis points.

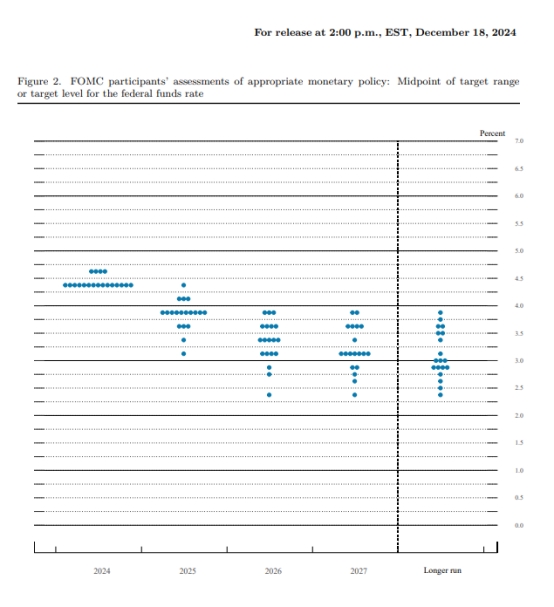

The rate cut was supported by 11 of the 12 Federal Open Market Committee (FOMC) members, with Cleveland Fed President Hammack voting against it, preferring to keep interest rates unchanged. In its policy statement, the Fed emphasized that it will carefully evaluate the latest data, the changing outlook, and the balance of risks to determine additional adjustments to the federal funds rate target range in the future . It is worth noting that the latest dot plot shows that the Fed expects to cut interest rates twice in 2025, a decrease from the four times expected in September.

Analysts believe that the Fed's forecast for next year is more hawkish than expected, with the median forecast of Fed officials currently predicting only two rate cuts next year, while most market forecasts are three. This forecast is consistent with the expectation that the Fed may pause in January because the Fed needs time to assess the economic situation and the impact of any new policies introduced by the new president.

The Trump administration's promised tax cuts, tariff increases, and reduced regulations and immigration are likely to have an interactive impact on the outlook for growth, employment, and prices. Goldman Sachs economists estimate that tariffs implemented after Trump took office could push core inflation up by 0.3 percentage points next year, and while most of the impact will fade by 2026, this could cause discomfort within the central bank because it would cause inflation to be meaningfully above the 2% target within five years.

During Powell's speech, the US dollar index stood at 108, a new high since November 22, and rose by more than 1% on the day. Spot gold fell below the integer mark of $2,600 per ounce for the first time since November 18, and fell sharply by nearly $60 unilaterally during the session, and the intraday decline widened to more than 2%.

The yield on the 10-year U.S. Treasury bond reached its highest level since the end of May, rising 11.3 basis points to 4.5% during the day. Bitcoin fell more than 4% during the day. The three major U.S. stock indexes continued to fall, with the Nasdaq falling more than 3% in late trading and the S&P 500 falling more than 2% (this was the largest drop in the S&P 500 on the day of the Federal Reserve's interest rate decision since 2001). The Dow fell more than 1,000 points and closed down 2.59%, falling for the 10th consecutive trading day. This is the longest single-day streak of declines for the Dow since it fell for 11 consecutive trading days in October 1974.

Overall, the Fed's latest decisions and forecasts show a prudent assessment of current economic conditions and flexible adjustments to future policy paths. As the new government's policies gradually become clear, the Fed's pace of interest rate cuts and inflation expectations may be further adjusted. The Fed will continue to monitor economic data and global developments to ensure that its monetary policy decisions are consistent with the goals of achieving maximum employment and price stability.