[MACRO Sharp Comment] The Federal Reserve maintains interest rates stable: carefully weighing inflation and unemployment risks under the impact of tariffs

- 2025年5月9日

- Posted by: Macro Global Markets

- Category: News

Federal Reserve officials unanimously agreed on Wednesday to keep interest rates steady and warned of the risks of rising unemployment and inflation from tariffs. The decision reflects the Federal Reserve's cautious approach in the face of the complex economic situation brought about by the Trump administration's tariff policy. This article will analyze in detail the Fed’s latest policy trends, market reactions, and possible future policy paths.

Federal Reserve Chairman Powell emphasized at a press conference after the meeting that if the announced sharp increase in tariffs continues, it could lead to higher inflation, slower economic growth and higher unemployment. Tariffs act as a shock that reduces an economy's ability to supply goods or services, causing prices to rise. This uncertainty may cause companies to delay new investments until they understand their underlying cost structure, thus weakening profits.

The policy change presents the Fed with a dilemma: whether to focus more on the possibility of rising inflation or the risk of rising unemployment. Powell used the word "wait" many times at the press conference, emphasizing that the Fed believes the cost of waiting to learn more economic information is "quite low" and said officials believe there is no need to rush to adjust policy.

Market reaction and analyst views

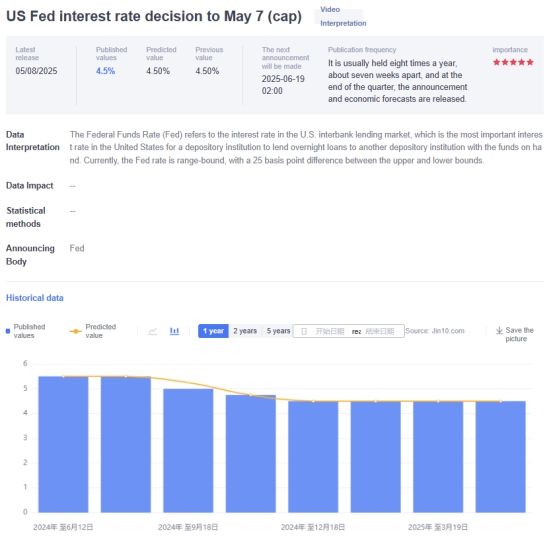

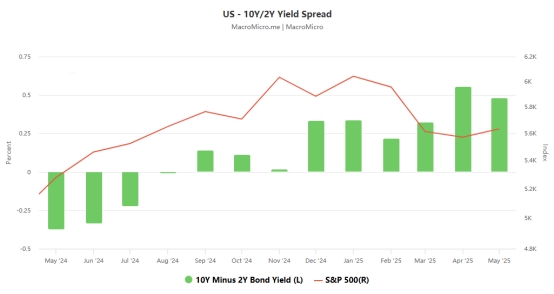

The Fed’s decision and Powell’s remarks have attracted widespread attention and interpretation from the market. After the policy statement was released, the US dollar index fell first and then rose by 0.35%, the euro fell by 0.51%; the S&P 500 index briefly fell and then rose slightly by 0.17%; the 10-year US Treasury yield fell to 4.2791%, and the 2-year yield first fell and then rose to close at 3.793%.

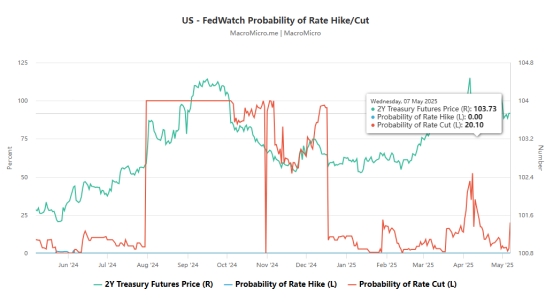

Matthias Scheiber, head of the multi-asset team at Allspring Global Investments, believes that the Federal Reserve has adopted the "wait-and-see" strategy that is widely expected by the market, and expects that September or later may be the window for interest rate cuts. Garrett Myerson, portfolio strategist at Natixis Investment Managers, pointed out that if economic growth continues to cool, the possibility of launching a rate cut before July is increasing, and this may become a continuous operation.

Policy divergence between the Fed and other economies

Monetary policy in the United States faces unique challenges compared to other economies. Other economies have not imposed large tariffs on imports and are therefore seeing the impact of weaker demand and labor markets without having to deal with rising price pressures. The ECB has cut its benchmark interest rate seven times in the past year, a cumulative reduction of 1.75 percentage points, to 2.25% last month. Investors and economists expect the Bank of England to cut its base rate by at least 25 basis points on Thursday.

Renaissance Macro Research head of economic research Dutta pointed out that Europe's economy was not particularly strong to begin with, so they have more reason to worry about the impact on economic growth. The Federal Reserve, by contrast, would cut rates only if it saw evidence of a sharp economic slowdown, and that could happen quickly.

The Fed's future policy path

Looking ahead, the Fed's policy path will depend on the evolution of inflation and unemployment. Some economists worry that rate cuts will stoke inflation, while others argue that the Fed's decision to keep rates steady as the economy slows could lead to a sharper downturn.

Peterson Institute for International Economics President Paul Posen said accelerating rate cuts now would increase the risk that the Fed would have to reverse course by raising rates in a few months. He pointed out that it is contradictory for people in or close to the government to criticize the Federal Reserve for having too high an inflation rate while arguing that the tariff shock will not have any impact on inflation.

English, a professor at the Yale School of Management, believes that although the market expects an economic slowdown, the hard data has not yet shown it. Some economists note that today’s situation is fundamentally different from the inflation shock that gripped the Federal Reserve and other central banks in 2021. Now, the labor market is cooling and wage growth is slowing, leaving less fuel to sustain inflation after initial tariff-driven price increases.

Summarize

The Federal Reserve chose to keep interest rates steady at its meeting on Wednesday, reflecting its cautious approach in the face of complex economic conditions brought about by the Trump administration's tariff policy. Powell's "wait-and-see" strategy underscores the importance of waiting for more economic data, while revealing the Fed's difficult trade-off between inflation and unemployment risks.

Markets reacted positively to the Fed's decision, but analysts were divided on the future policy path. Some believe the Fed may start cutting interest rates in July or September, while others worry that cutting interest rates too early could exacerbate inflationary pressures. Compared with other economies, U.S. monetary policy faces unique challenges in finding a balance between slowing economic growth and inflation risks. In the future, the Fed’s policy direction will depend on the further development of economic data. Market participants should closely monitor indicators of inflation, unemployment and economic growth to better predict the Fed's next move.