London gold market under pressure as supply constraints and emerging market hoarding create a squeeze

- 2025年2月20日

- Posted by: Macro Global Markets

- Category: News

[MACRO Trends] London gold market under pressure, supply constraints and emerging market hoarding create a squeeze

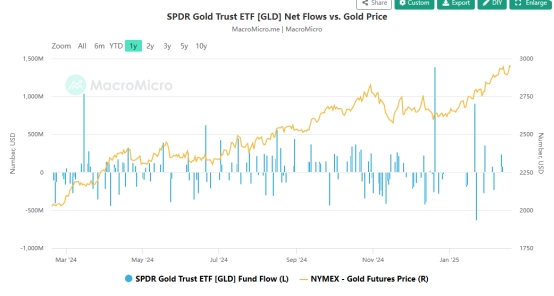

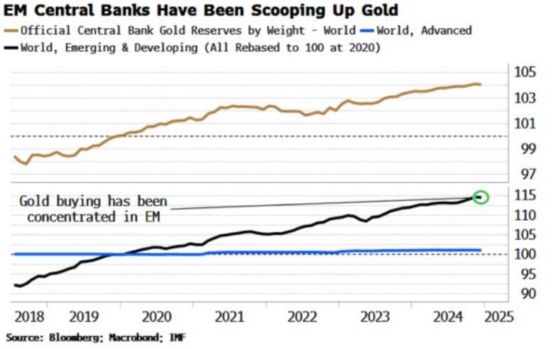

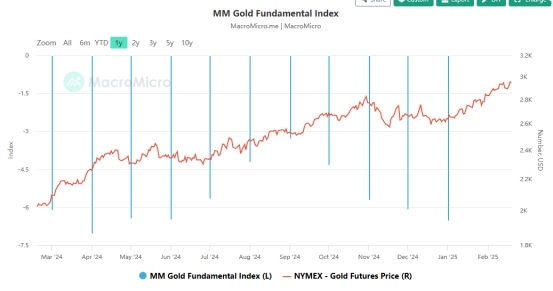

Gold prices are currently hovering near all-time highs, with a one-year return of 44%, far exceeding the S&P 500. White believes the most plausible explanation is a shortage of physical gold in European vaults, driven mainly by hoarding by emerging market central banks. Central banks in Asia and the Middle East have been actively accumulating gold and shipping it back home from London since the global financial crisis, and especially since the outbreak of the Russia-Ukraine conflict. It is worth noting that the same dynamic applies to silver, whose price has begun to catch up with gold's gains after a period of lag.

Asian buyers generally prefer to hold physical metal rather than paper certificates. China and India are the two largest sources of demand for gold bars, coins and jewelry, according to the World Gold Council. While Western retail investors have been lukewarm about gold’s recent gains, perhaps due to greater attention paid to “Mag 7” stocks and Bitcoin, Asian buyers are holding on to the yellow metal, a strategy that has been successful so far.

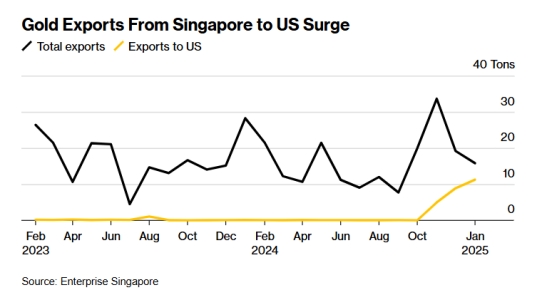

Bank of England Governor Andrew Bailey was grilled on January 29 about the liquidity of gold reserves in London, but his evasive response only fuelled market speculation. Gold spot prices are surging as supply tightens and delivery delays increase, with buyers scrambling for fewer available bars, pushing spot prices higher. Analysts warn that the tensions are only just beginning and that gold prices could climb further in the coming months as central banks, institutions and retail investors compete for dwindling supplies. Meanwhile, Singapore’s gold exports to the United States climbed to their highest level in nearly three years in January. Data from the Singapore Economic Development Board showed that the amount of gold shipped from Singapore to the United States last month grew 27% from the previous quarter to about 11 tons, the highest level since March 2022.

The huge premium between gold futures prices on the New York Mercantile Exchange (Comex) and the spot gold price in London has attracted some of the world's largest financial institutions to arbitrage in the gold market. JPMorgan Chase and HSBC were identified as the two largest players in the transatlantic gold migration. The banks often lend their gold, much of which is stored in London, to borrowers who need the bullion as collateral, hedging against a fall in the price of the underlying asset by selling gold futures in New York. This means that the banks are effectively short gold, even as the price of the metal has surged by around 45% over the past 12 months.

To sum up, the global gold market is undergoing significant dynamic changes. From the hoarding behavior of central banks in emerging markets to the liquidity crisis in the London gold market, to the surge in gold exports from Singapore to the United States, these phenomena all show that the supply and demand relationship in the gold market is undergoing profound adjustments. Whether this crisis escalates or stabilizes, one thing is clear: the demand for real, tangible gold has never been stronger.