[MACRO Sharp Comments] The "Golden Moment" of Financial Markets: A Symphony of Trade Policy, Economic Data and Gold Prices

- 2025年5月6日

- Posted by: Macro Global Markets

- Category: News

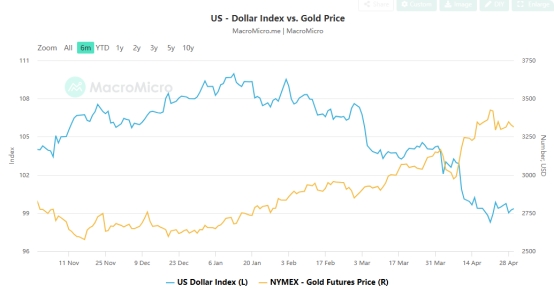

Recently, the gold market has presented a complex pattern due to the interweaving of multiple factors such as policies and economic data. On the one hand, the price of gold remains stable to some extent; on the other hand, the market is full of cautious optimism and potential uncertainty about the future trend of gold.

On Wednesday, spot gold prices continued to fluctuate in a narrow range, falling below $3,310 an ounce. Market concerns over trade policy have eased, limiting gold's ability to move. At the same time, the US's trade policy actions sent a "cooling" signal to the market. Trump signed two executive orders on Tuesday aimed at mitigating the impact of previous auto tariff policies on the market through tariff credits and reductions in tariffs on some materials. Although the aftermath of the trade friction is still brewing, these measures have temporarily eased the market's anxiety about the volatility of US trade policies.

Economic data focus: PCE and non-agricultural guidance

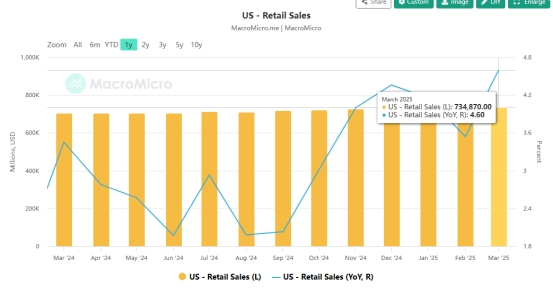

On the economic data front, a slew of data that could move the market will be released on Wednesday, including U.S. ADP employment for April, U.S. gross domestic product (GDP) for the first quarter and U.S. personal consumption expenditures (PCE) for March. The performance of these data could have a significant impact on the market.

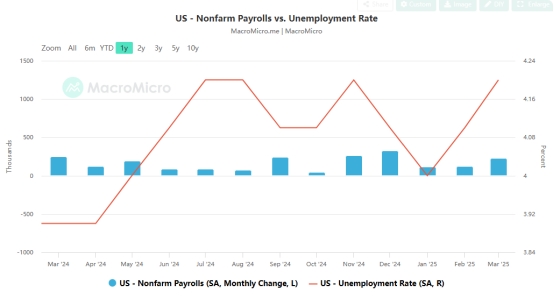

From the perspective of the job market, the number of JOLTS job vacancies in the United States last month fell to 7.19 million from the revised 7.48 million in February, the lowest level since September last year. The figures suggest demand for labor is weakening as employers put spending plans on hold until they have more clarity on Trump’s policies. However, the quits rate rose to its highest level since July last year, pointing to improved labor market activity.

Still, the PCE report may not have a significant impact on the outlook for monetary policy. The median forecast of investment bank analysts based on CPI, PPI and import data shows that the month-on-month growth rate of U.S. core PCE in March is expected to slow to 0.08% from 0.4% last month, while the overall PCE will fall slightly by 0.1% month-on-month, almost flat.

Long-term forecast and risk warning for gold prices

In the long term, the gold market is expected to continue to maintain strong safe-haven demand amid uncertainty, tensions and concerns about volatility in major financial markets. The World Bank significantly revised its gold forecasts in its latest commodity outlook, predicting that the average price of gold will reach $3,250 an ounce this year, up 36% from last year's average price. Looking ahead, gold prices are expected to average around $3,200 an ounce in 2026, down 1.5% from this year's forecast.

However, if tensions and policy uncertainty become more pronounced, gold prices could exceed current forecasts. In addition, the outlook for silver is also worth paying attention to. Driven by industrial demand, the World Bank expects silver prices to average around $33 an ounce this year, up 16.7% from last year's average. Silver prices are expected to rise to $34 an ounce in 2026, up 3% from this year.

If U.S. economic growth unexpectedly contracts, it would heighten market concerns about a recession and could push gold prices back to all-time highs. On the other hand, if U.S. economic growth cools less than expected, it could provide a brief respite for the overall market and the dollar, allowing gold bears to take action as prices retreat.

In any case, traders will remain cautious and avoid making new directional bets ahead of the release of U.S. non-farm payrolls data on Friday. The impact of other data will be similarly limited. The U.S. dollar remained firm as markets assessed recent tariff headlines. An executive order signed by Trump on Tuesday and discussions surrounding progress on a trade deal between the United States and some of its Asian trading partners provided some comfort to markets.

From a technical perspective, technical indicators on the gold daily chart remain in the positive zone, which is favorable for gold bulls. If the gold price falls below the immediate support of $3,300-3,290, it is likely to find suitable support around $3,265-3,260. However, a break below the latter could extend the downside trajectory to the 50% Fibonacci retracement level of the range around $3,225, leading to the $3,200 mark.

In the current market environment, gold investors need to pay close attention to the developments in US trade policy, economic data releases and the policy direction of the Federal Reserve. These factors will largely determine the future trend of gold prices. Although there may be fluctuations in the short term, in the long run, the value of gold as a safe-haven asset is still recognized by the market.