Looking ahead to the Fed’s March interest rate meeting: Policy trade-offs and gold market opportunities amid divergent economic data

- 2025年3月20日

- Posted by: Macro Global Markets

- Category: News

Looking ahead to the Fed’s March interest rate meeting: Policy trade-offs and gold market opportunities amid divergent economic data

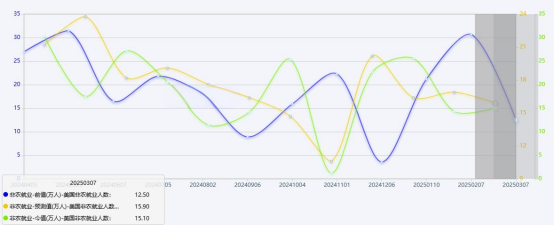

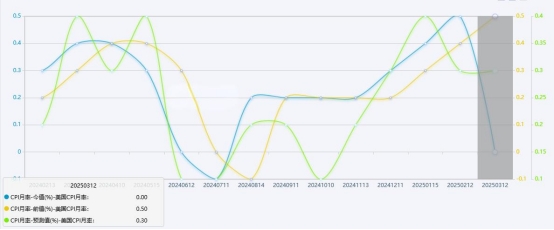

In March 2025, the Federal Reserve faces a complex economic environment: the year-on-year growth rate of the U.S. CPI fell to 2.8% in February, and the core CPI fell to 3.1%, indicating that inflationary pressure has eased; non-farm employment increased by 151,000, the unemployment rate rose to 4.1%, and the labor market cooled marginally.

Note: The Federal Reserve will hold an interest rate meeting from March 18 to 19, and will announce the latest interest rate decision at 02:00 Beijing time on March 20 (Thursday). There may be significant market fluctuations or insufficient market liquidity during the period from 30 minutes before to 15 minutes after the announcement. Please pay attention to grasp and adjust the position points.

2. Prediction of the results of this interest rate meeting and its impact on gold prices

The market generally expects that the Federal Reserve will maintain the benchmark interest rate unchanged at 4.75%-5% at the March 18-19 meeting, but will send a dovish signal: if the statement deletes the expression "continued rate hikes", emphasizes "data dependence" and hints at the possibility of a rate cut in June, the US dollar index may break below the 103 mark, pushing the gold price to break through the historical high of $3,004, with the target looking towards the $3,020-3,050 range.

Institutional analysis pointed out that if the Federal Reserve emphasizes that "inflation is controllable" and hints at the possibility of future interest rate cuts, the US dollar index may come under pressure and weaken, and gold will be supported as a safe-haven asset and anti-inflation tool. The current gold price has broken through the $3,000 mark, and the technical side shows a bullish trend, but we need to be wary of short-term pullbacks caused by hawkish policy wording.

3. Forecasts by relevant institutions or banks

Goldman Sachs: It is expected that the Federal Reserve will cut interest rates by 25BP for the first time in June, with a cumulative rate cut of 75BP for the whole year. It maintains the 12-month target price of gold at US$3,100, and emphasizes the central bank's gold purchases (800 tons of gold are expected to be purchased in 2025) and the trend of de-dollarization.

Morgan Stanley: Lowered the target price of gold to $2,950, believing that the bottoming out of real interest rates will weaken the attractiveness of gold, but the geopolitical risk premium may support prices.

CICC: It is expected that the next interest rate cut window of the Federal Reserve may be in the third quarter, and the year-on-year growth rate of core PCE in 2025 may be 2.9%, maintaining a cautious stance.

Ruida Futures: Geopolitical risks and the downward trend of the US dollar support gold prices, and it is recommended to buy on dips in the medium and long term.

Kaiyuan Securities: The U.S. job market may continue to weaken in the short term, the path of inflation slowdown is tortuous, and the Federal Reserve may start cutting interest rates after June.

4. Officials speak out

Federal Reserve Chairman Powell reiterated that "restrictive interest rates will be maintained to ensure inflation falls," but stressed that policies need to be adjusted flexibly. Several officials have recently expressed caution:

Governor Waller said "a rate cut in March is unnecessary";

Cleveland Fed President Hammack believes that "more data is needed to confirm the inflation trend";

Vice Chairman Brainard hinted that "if the economy worsens, interest rate cuts may be brought forward."

5. Gold trading reminder for this interest rate meeting

Support Bitcoin: $2960 (50-day moving average), $2958 (previous low)

Resistance level: $3004 (historical high), $3020 (upper edge of the channel)

Operation suggestions:

Mid-term strategy: Rely on the stabilization of $2960 to go long, target $3004, stop loss $2958.

Short-term strategy: If the meeting releases a dovish signal, you can chase longs after breaking through $3004, with the target at $3020; if the wording is hawkish, you can short on rallies, with the target down to $2970.

Risk warning: Pay attention to the retail sales data and tariff policy progress on March 17, and be wary of drastic fluctuations caused by fluctuations in market sentiment.

The Federal Reserve’s March meeting will be a key node in the trend of gold. Under the game between the differentiation of economic data and policy expectations, the price of gold may remain volatile at a high level in the short term, and will still benefit from the interest rate cut cycle and geopolitical risks in the medium and long term. Investors need to closely follow the meeting statement and Powell's speech and adjust their positions flexibly.

Transaction risk warning: Any investment involves risks, including the risk of financial loss. This advice does not constitute specific investment advice and investors should make decisions based on their own risk tolerance, investment objectives and market conditions.