[March Interest Rate Report] The Federal Reserve kept interest rates unchanged and hinted at a rate cut

- 2025年3月24日

- Posted by: Macro Global Markets

- Category: News

[March Interest Rate Report] The Federal Reserve kept interest rates unchanged and hinted at a rate cut

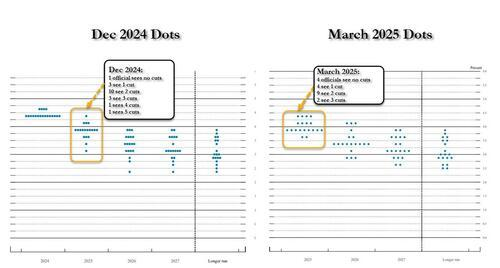

In its latest quarterly economic outlook, the Fed significantly lowered its GDP growth forecast for 2025 from 2.1% to 1.7%, while raising its core PCE inflation forecast from 2.5% to 2.8%. This adjustment reflects policymakers' dual concerns about slowing economic growth and rising inflationary pressures. The dot plot shows that 9 out of 19 officials support two rate cuts this year, 4 believe in one rate cut, and 2 prefer three rate cuts, indicating that internal differences on the policy path have widened.

2. Institutional perspective: Dove signals and differences coexist

Zheshang Securities pointed out that in this meeting, Powell called the inflation caused by tariffs "transitory", which was regarded as a dove signal. The bank believes that although the dot plot shows two interest rate cuts this year, the actual number of interest rate cuts may depend on whether the impact of tariff policies is short-term. CICC said that the Fed maintained its expectations for interest rate cuts, indicating that its concerns about economic downside risks exceed inflationary pressures, and it is expected that the next interest rate cut may be in the third quarter.

Huatai Securities analyzed that the Fed's decision to cut interest rates will depend on Trump's policies and economic data from March to April. If the growth momentum declines rapidly, interest rates may be cut in the middle of the year; if the economy does not decline, the rate cut may not exceed two times this year. CITIC Securities reminded that under the current combination of "temporary inflation + slowing growth + high uncertainty", the number of interest rate cuts may be less than expected, and we need to be vigilant against tariff policies disturbing the market again.

3. Market reaction: Gold hits new high, dollar weakens

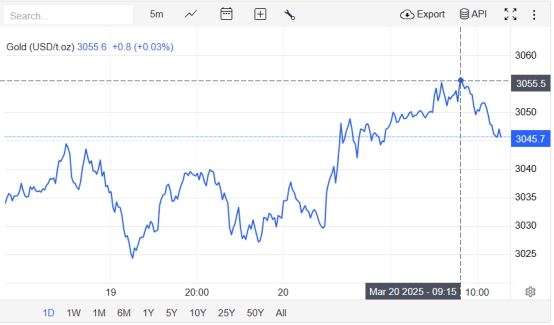

After the resolution was announced, the three major U.S. stock indexes surged in the short term, with the Nasdaq rising by more than 2% at one point. Technology stocks and precious metals performed well. Spot gold continued to rise, with COMEX gold futures closing up 0.43% at $3,054.4 per ounce, while silver fell slightly after fluctuating at a high level. The U.S. dollar index fell under pressure, and U.S. bond yields fell across the board. The 2-year U.S. bond yield fell 6.96 basis points to 3.9681%, and the 10-year yield fell below the 4.25% mark.

IV. Future Outlook: Policy Path Depends on Data and Tariff Trends

The market's pricing of the Fed's rate cut has been reflected in interest rate futures in advance. CME data shows that the probability of a rate cut in June has risen to 62.1%, but there is still an over 80% probability of keeping the interest rate unchanged in May. Institutions generally believe that the future policy direction will depend on the actual impact of inflation data and tariff policies. If tariffs push up inflation and economic data continue to be weak, the Fed may be forced to speed up the pace of rate cuts; conversely, if inflation falls beyond expectations, the pace of rate cuts may slow down.

For the precious metals market, short-term geopolitical risks and easing expectations will continue to dominate gold prices, while silver may see more volatility due to its strong industrial content. Investors need to pay close attention to the US first quarter GDP data to be released in April and the details of the Trump administration's tariff policy to grasp the market direction.

The Fed's decision this time released a cautious dove signal, but the policy path is still highly uncertain. Against the backdrop of tariffs and geopolitical risks, the value of gold as a safe-haven asset is prominent, but we need to be wary of the risk of a short-term pullback caused by market sentiment fluctuations. In the future, data orientation and policy trends will become key variables affecting gold and silver prices, and investors need to pay close attention to changes in this regard.