US, Russia and Saudi Arabia agreement! Revaluation of gold value amid geopolitical changes

- 2025年2月19日

- Posted by: Macro Global Markets

- Category: News

The significance of the event: the order game in the post-hegemonic era

Macro Global Markets:On February 19, 2025, the desert of Jeddah, Saudi Arabia witnessed a dialogue that rewrote the rules of modern geopolitics - the United States and Russia held secret consultations on ending the three-year war in the absence of Ukraine. This meeting went far beyond ceasefire negotiations and was actually a redistribution of power during the transition period between the old and new international order:

Russia's strategy to break sanctions

The Kremlin accepted the mediation of a third party, which was essentially an exchange of oil and gas technology exports for market access for Saudi Arabia, opening up a "gray corridor" for the troubled economy.

The asymmetric rise of power in the Middle East

The Kremlin accepted the mediation of a third party, which was essentially an exchange of oil and gas technology exports for market access for Saudi Arabia, opening up a "gray corridor" for the troubled economy.

The asymmetric rise of power in the Middle East

Saudi Arabia's involvement in the great power game as a "peace messenger" marks a historic leap for the Gulf countries from a regional role to a coordinator of global affairs.

This "Ukrainian Peace Conference without Ukraine" is essentially a compromise experiment by the leaders of the old order in the face of declining power. Its far-reaching impact may reshape the geopolitical landscape in the mid-21st century.

The binary fission of gold pricing: short-term rationality and long-term anxiety

Short-term logic: a phased retracement of risk discount

If the talks signal a partial ceasefire (such as the establishment of a demilitarized zone in Zaporizhia), the market may react in three ways:

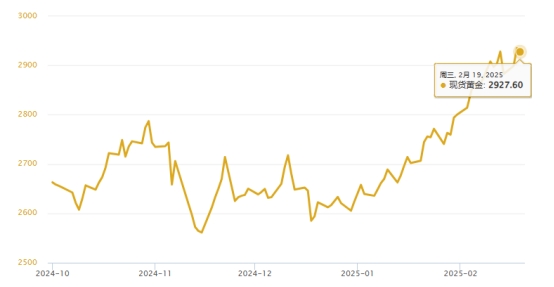

Safe-haven premium squeeze: According to Bloomberg estimates, the gold premium brought about by the war is about US$175 per ounce, accounting for 5.8% of the current gold price. A technical pullback may drop to the US$2,880-2,900 range.

Marginal strengthening of the US dollar: Expectations of US-Russia energy cooperation (such as restarting the Nord Stream pipeline through Saudi Arabia) may push the US dollar index back to 103.5, suppressing the gold price by $5-7.

Program trading impact: If $2,920 (200-period moving average on the 4-hour chart) is breached, it may trigger the trend reversal strategy of quantitative funds and amplify the volatility.

Long-term narrative: anchoring values in an era of disorder

However, from a broader historical perspective, this meeting revealed the deep crisis of the current international system:

The collapse of the spirit of contract: A peace agreement without the participation of sovereign states reproduces the fatal flaw of the 1919 Treaty of Versailles - the logic of power replaces legal justice, laying hidden dangers for subsequent conflicts.

The twilight of monetary credit: When cracks appeared in the SWIFT system due to the game between the United States and Russia, the "depoliticized" attribute of gold was highlighted. In 2024, global central banks' gold purchases hit a record 4,974 tons, and emerging markets are reducing their holdings of U.S. Treasuries and replacing them with gold at an average annual rate of 9%.

Energy-currency decoupling experiment: If the rumored "petroleum riyal settlement mechanism" is implemented, it will shake the hegemony of the petrodollar, and gold may become an implicit guarantee for the multipolar monetary system.

Conclusion: The golden mission during the collapse of the old order

The essence of the US-Russia-Saudi talks is the redivision of major power interests, not the ultimate solution to Ukraine’s sovereignty. The gold market's pricing of this will be highly dependent on the "credibility" of the ceasefire agreement and the possibility of subsequent risk spillover.

After a short-term technical pullback, gold prices will still benefit from the long-term logic of global system disorder and monetary credit reconstruction.