Revealing the meaning behind the " US stock Christmas rally " - potential " five major trends "

- 2025年1月6日

- Posted by: Macro Global Markets

- Category: News

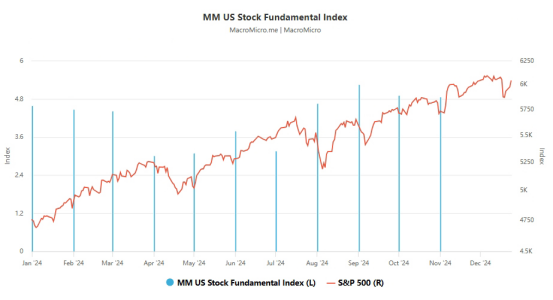

There is a well-known phenomenon in the US stock market, the "Christmas Rally", a seasonal trend that brings optimistic returns to investors in most years. In 2024, the development of artificial intelligence technology drove the stock market to one of its best annual performances in two thousand years !

However, the Fed's tough stance has brought challenges to the market, causing the three major U.S. stock indexes to plummet. Investors can't help but wonder whether this year's "Christmas miracle" can reverse the sell-off and put a perfect end to 2024. The Bank of America report shows that the second half of December is usually the second strongest period for U.S. stocks.

Analysis by LPL Financial shows that December is the second-best month for the S&P 500 since 1950 (after November). The S&P 500 has risen 74% of the time in December since 1950, more than any other month. In election years, that number rises to 83%, according to Bank of America. These gains tend to be concentrated in the second half of December, earning them the nickname "Santa Claus Rally."

However, there have been historical instances where the absence of a Christmas rally could signal a difficult period ahead for U.S. stocks. For example, market declines during typical holiday rallies in 1999 and 2007 served as precursors to the dot-com bubble and the 2008 financial crisis, respectively.