U.S. February CPI data outlook: Beware of unexpected risks, bull-bear game in the gold market

- 2025年3月13日

- Posted by: Macro Global Markets

- Category: News

1. Data Forecast and Market Expectations

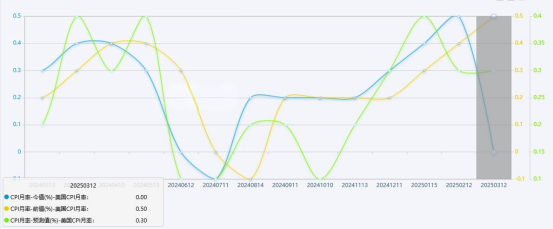

At 20:30 Beijing time on March 12, the U.S. Bureau of Labor Statistics will release the Consumer Price Index (CPI) for February. The market generally expects that, supported by the rebound in energy prices and housing costs, the year-on-year growth rate of CPI in February may rise slightly to 3.2% from 3.1% in January, and the core CPI will increase by 3.8% year-on-year, with a month-on-month increase of 0.4%.

However, recent high-frequency data show that inflation stickiness exceeds expectations. Coupled with Trump's tariff policy pushing up the cost of imported goods, there is a risk that the actual data will exceed expectations.

Energy and food prices rebound:International oil prices rose by more than 5% in February, and coupled with Saudi Arabia's extension of the production cut agreement, the energy sub-item CPI rose by 2.3% month-on-month; avian influenza caused egg prices to hit a record high, and the prices of meat, fruit and other foods continued to rise.

Housing costs remain stubborn:The housing index rose by 0.4% month-on-month in February, and the growth rate of rents and owners' equivalent rents remained high, contributing more than 60% of the core CPI increase.

Tariff pass-through effect:Higher tariffs on imports from Asia have pushed up prices of furniture and clothing, while steel and aluminum tariffs that took effect on March 1 may further increase manufacturing costs.

If the CPI data exceeds expectations, market bets on the Fed's interest rate cut will cool significantly. The current CME FedWatch tool shows that the probability of the first rate cut in June has dropped from a high of 68% to 60%. Goldman Sachs' latest report pointed out that if inflation continues to be higher than the target, the Federal Reserve may postpone the interest rate cut to September and only cut interest rates by 50 basis points for the whole year. On the contrary, if the data is in line with expectations, the probability of a rate cut in June will increase, and the US dollar index may continue to be weak, supporting the upward trend in gold prices.

4. The long and short game in the gold market

Bullish factors

Safe-haven demand heats up:Geopolitical conflicts (Russia-Ukraine situation, tensions in the Middle East) and volatility in U.S. stocks (the S&P 500 index fell 8.6% in February) have driven funds into gold ETFs. During the Asian session on March 12, retail investors increased their holdings by 8.2 tons.

Central bank gold buying spree:In the first two months of 2025, global central banks net bought 78 tons of gold. The People's Bank of China has increased its holdings for 15 consecutive months, and its reserve ratio has risen to 5.2%.

Real interest rates fall:The current real interest rate has dropped to -1.2%, the lowest level since 2020, enhancing the attractiveness of gold.

Negative factors

Risk of a US dollar rebound:If CPI exceeds expectations and pushes up U.S. Treasury yields (10-year yields remain around 4.1%), the U.S. dollar index may strengthen temporarily.

Technical retracement pressure:The RSI of gold price on the daily level is close to the overbought area of 70, and there are profit-taking orders at the key resistance level of $2,930.

V. Risk Warning

Data exceeded expectations:If the year-on-year CPI growth rate exceeds 3.3%, it may trigger the market to reprice the Fed's policy shift.

Geopolitical easing:If the US, Ukraine and Saudi Arabia reach a long-term ceasefire agreement, safe-haven demand may cool down temporarily.

US stock liquidity crisis:If the S&P 500 falls below key support, it could trigger passive selling in gold.

Conclusion:(1) If CPI is higher than expected, the Fed’s interest rate cut expectations will be delayed, U.S. Treasury yields will rise, and gold prices will be under pressure in the short term and may fall below $2,900 per ounce.

(2) If CPI meets or falls short of expectations, expectations for a Fed rate cut will remain, the U.S. dollar index will weaken, and the gold price will remain above $2,900 per ounce or even rise to $2,930 per ounce.

Transaction risk warning: Any investment involves risks, including the risk of financial loss. This advice does not constitute specific investment advice and investors should make decisions based on their own risk tolerance, investment objectives and market conditions.