A look ahead to the US February CPI report - the complex game between inflation, tariffs and interest rates

- 2025年3月14日

- Posted by: Macro Global Markets

- Category: News

[MACRO Trends] An in-depth analysis of the US February CPI report - the complex game between inflation, tariffs and interest rates

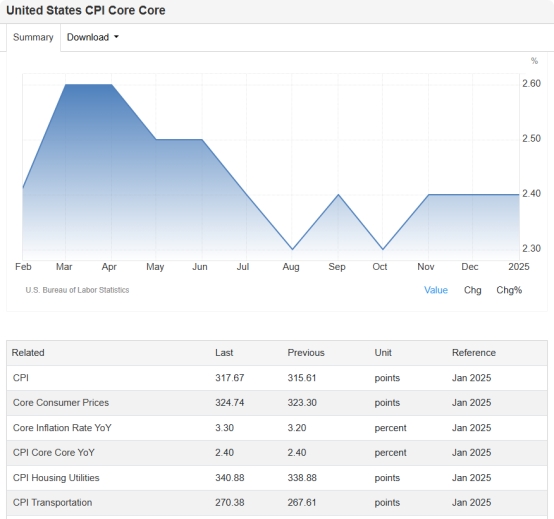

Analysts believe the initial impact of the tariffs will be seen in the report. Against this backdrop, price pressures are likely to remain elevated in the short term, with the Fed keeping interest rates on hold until data show more improvement. According to FactSet's consensus forecast, economists expect consumer prices to rise 0.3% in February from the previous quarter, lowering the annual inflation rate to 2.9% from 3.0% in January; core inflation, which excludes the more volatile food and energy prices, is expected to rise 0.3% quarter-on-quarter and 3.2% year-on-year.

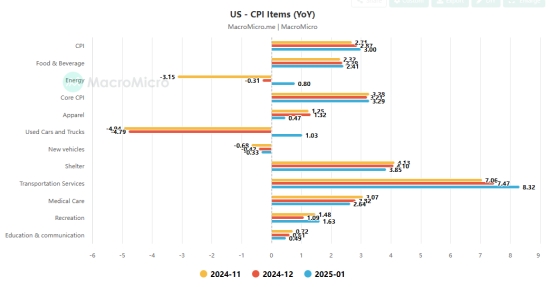

“Commodities have been a reliable, consistent force in the pullback in inflation… but now, with the uncertainty around tariffs, we’re seeing that reversal,” he said, as businesses raise prices or buy inventory ahead of new tariffs. Torres expects prices of new and used cars, as well as food and clothing, to rise in February. Goldman Sachs economists also expect higher prices for airfare and communications, including the internet and used cars.

Torres said some businesses, such as car dealers, were already preemptively responding to tariffs by raising prices. As U.S. trade policy becomes clearer, the impact on inflation is likely to become more pronounced in the coming months. Industries with large import volumes, such as consumer electronics, auto parts and household goods, are likely to feel the most direct price impact. Industry analysts say the tariffs could start showing up more clearly in inflation data as early as April or May, depending on existing inventory levels and companies’ ability to absorb the costs.

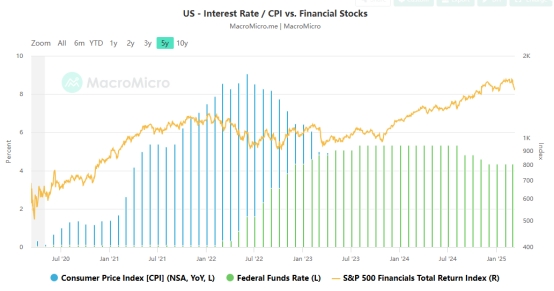

The bond futures market is pricing in a 98% chance that the Fed will keep interest rates unchanged, according to the CME FedWatch Tool. In a speech last Friday, Federal Reserve Chairman Jerome Powell said the Trump administration is making policy adjustments in a number of areas, including trade, taxation, government spending, immigration and regulation, adding that the "net effect" of these changes will have important implications for the economy and the Fed's interest rate policy. As a result, he said the Fed is likely to keep its benchmark interest rate unchanged for the next few months as it waits for the widespread "uncertainty" caused by Trump's policies to settle.

Financial markets have become more sensitive to inflation data, and each release can trigger significant volatility. Higher-than-expected inflation data could trigger a sharp sell-off in stock and bond markets as investors recalibrate their interest rate expectations. Currently, the U.S. stock market is facing a crisis. Trump's tariffs have panicked investors, and concerns about an economic downturn have triggered a stock market sell-off, causing the S&P 500 to evaporate $4 trillion from its high last month. Clearly US economic news is increasingly disappointing relative to baseline forecasts, which could increase the risk of surprises. This is unlikely to be good news for a market plagued by recession fears, with analysts believing that higher-than-expected data will exacerbate concerns about economic stagflation, further hitting stock market performance.