US CPI report triggers market volatility: Analysis of Fed policy and economic outlook

- 2025年1月17日

- Posted by: Macro Global Markets

- Category: News

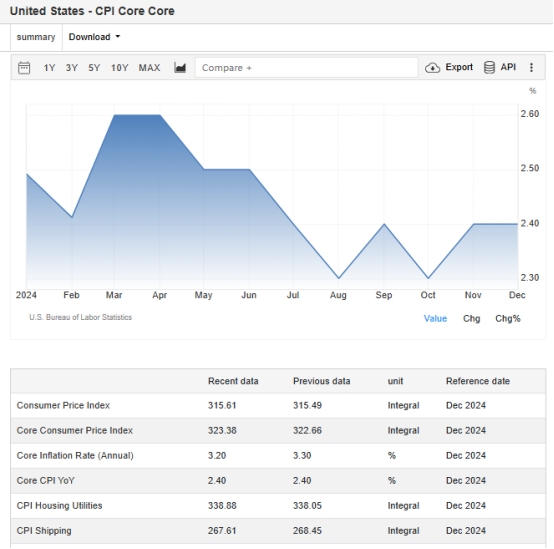

The latest U.S. inflation report released on Wednesday showed that the headline CPI in December was largely in line with expectations, while the core CPI eased. The U.S. CPI monthly rate in December was 0.4%, the highest since March 2024, higher than market expectations and the previous value of 0.3%; the U.S. CPI annual rate in December was 2.9%, in line with expectations and higher than the previous value. There has been a slight increase of 2.7%. The monthly rate of the unadjusted core CPI in December was 0.2%, in line with market expectations and lower than the previous value of 0.3%. The annual rate of the unadjusted core CPI in December was 3.2%, the lowest since August 2024. Market expectations Unchanged at 3.3%.

After the CPI data was released, interest rate futures traders bet on the Fed to cut interest rates in June and expected about a 50% chance of a second rate cut by the end of 2025. The U.S. dollar index fell more than 40 points in the short term, and spot gold rose nearly $10 in the short term, once standing above the $2,690 mark. Non-US currencies generally rose, with pound sterling rising more than 60 points against the US dollar in the short term, euro rising more than 50 points against the US dollar in the short term, US dollar falling more than 60 points against the Japanese yen in the short term, and US dollar falling nearly 40 points against the Canadian dollar in the short term. The three major U.S. stock index futures rose sharply in the short term, with Nasdaq futures up 1.52%, S&P 500 futures up 1.31%, and Dow futures up 1.26%.

Details of the report also showed that housing inflation also remained mild last month, increasing at a quarterly rate of 0.3%. In addition, super core services rose only 0.21% month-on-month, the lowest level since July last year. Bloomberg Industry Research (BI) analysts Ira F. Jersey and Will Hoffman said that the market's knee-jerk rebound after the CPI report was more or less "in line with expectations" clearly showed that those who were worried about the upward inflation data had relieved. Tone. "Given the strength of the economy, we continue to think it's more likely that the Fed is nearly done cutting rates, with the final cut likely to come in March given the incoming data," Jersey said. Consumption, the Federal Reserve can continue to cut interest rates.

Some Fed officials welcomed the latest data showing a smaller-than-expected rise in consumer prices in December, giving them confidence that inflation will continue to weaken. At a separate event in Annapolis, Maryland, Richmond Federal Reserve Bank President Barkin told reporters that the newly released price data "continues the trend we've been seeing, which is that inflation is moving down toward target. Like Williams, he warned that policymakers had a job to do. “I still think we need to do something to get that last mile, back to 2%,” he said.

Although the overall CPI rose faster than expected in December, the market focused on the core CPI, which rose 0.2% month-on-month in December last year after rising 0.3% for four consecutive months. U.S. stocks surged after the CPI report, with the benchmark S&P 500 index rising 1.8%. The benchmark 10-year U.S. Treasury note reversed losses following last Friday's strong nonfarm payrolls report.

U.S. Treasury yields have risen sharply in recent weeks after the Federal Reserve in December downplayed the outlook for rate cuts and predicted that inflation will be firmer in 2025 than previously forecast. Concerns about the potential negative impact Trump's policies could have on inflation remain a concern. Federal Reserve officials on Wednesday noted heightened uncertainty in the coming months as they await initial glimpses of the incoming administration's policies, even as they said Wednesday's data showed inflation was continuing to ease.

Market volatility and economic data releases will continue to influence investor sentiment and the Federal Reserve's policy decisions. CPI and PPI data will provide the market with important clues about inflation and economic health, while the performance of the job market will further affect the Fed's path of interest rate cuts. Investors need to pay close attention to these key data in order to respond to possible market fluctuations and policy changes.