【Macro Insight】The two sides of the U.S. economy: the dual challenges of slowing inflation and fiscal deficits

- 2025年3月18日

- Posted by: Macro Global Markets

- Category: News

【Macro Insight】The two sides of the U.S. economy: the dual challenges of slowing inflation and fiscal deficits

Slowing inflation: a silver lining?

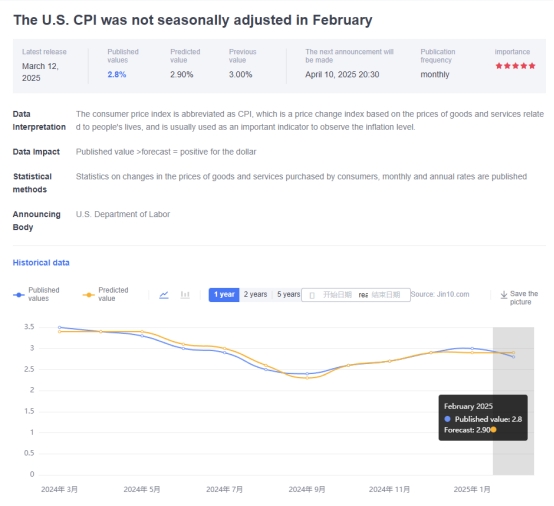

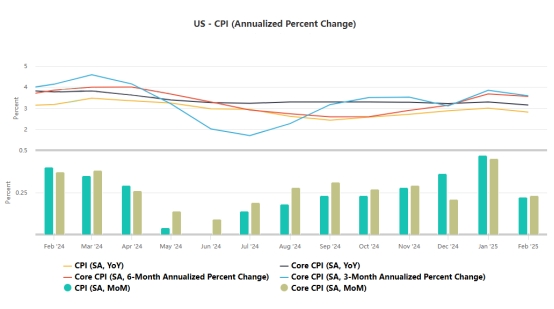

The US CPI inflation data for February brought a glimmer of hope to the anti-inflation process that has lasted for several months. Data from the U.S. Bureau of Labor Statistics showed that CPI rose 0.2% year-on-year in February, lower than the expected 0.3% and the lowest since October last year. The year-on-year growth rate also slowed to 2.8%, the lowest level since November last year, lower than the previous value of 3% and the market expectation of 2.9%. Core CPI also showed a slowing trend, with the quarterly increase falling to 0.2% from 0.3% last month, the lowest level since December last year. The year-on-year growth rate also slowed to 3.1%, lower than the previous value of 3.3% and market expectations of 3.2%, the lowest level since April 2021.

Despite this, several indicators still show that there is a risk of inflation rising again. Trump's raft of tariffs is expected to raise prices on everything from food to clothing, testing the resilience of consumers and the broader economy. Trump described the expected price increases from tariffs as "a minor disturbance that the country should be able to overcome" in his speech to Congress last week, but uncertainty surrounding his trade policy has contributed to a recent stock market plunge and reignited fears of a recession.

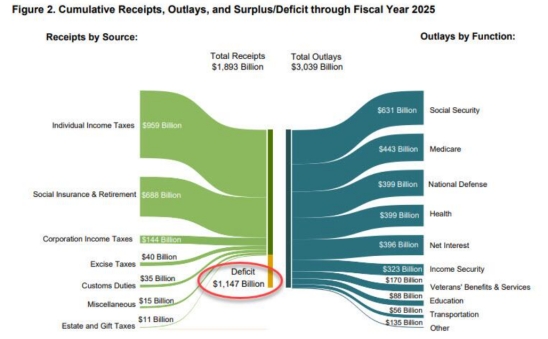

Although there is gradually some light at the end of the tunnel on the inflation problem, the US fiscal deficit problem is like a giant ship that cannot easily change its course. The latest data from the U.S. Treasury Department showed that federal government spending increased to a record $603 billion in February, while tax revenue was only $296 billion, resulting in a budget deficit of $307 billion that month. This means that the United States spent more than twice its revenue in February, and the deficit in February this year was close to a record high, second only to the post-epidemic impact in 2021, pushing the total cumulative deficit for 2025 to US$1.147 trillion, accounting for 38% of the total US spending in fiscal year 2025.

Musk’s Department of Government Efficiency (DOGE) claims to have saved more than $100 billion, but only a few departments saw spending declines in the first full month of the new administration. Compared to the same period last year, spending increased by $40 billion, or 7%. At the current rate of development, it will take several hundred years for DOGE to have a real impact.

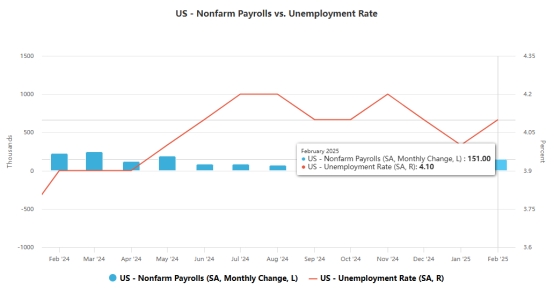

The dual game of inflation and finance

The slowdown in inflation has provided the U.S. economy with a chance to breathe, but the fiscal deficit problem continues to loom, posing a major hidden danger to the sustainable development of the economy. In the future, the US economy will advance amidst the game between these two forces. The future direction of inflation is full of uncertainty. Although current data shows that inflation is slowing down, factors such as Trump's tariff policy, changes in the global economic situation, and supply chain issues may have new impacts on inflation. The Fed will face difficult decisions on interest rate policy, having to consider the potential risk of a rebound in inflation while balancing economic growth and job market stability.

This is not only a challenge to government policies, but also a test of market confidence. The future direction of inflation and the path to solving the fiscal deficit are full of uncertainty, but what is certain is that the balance between the two will determine the short-term stability and long-term sustainability of the US economy. The future of the U.S. economy depends not only on the wisdom and determination of policymakers, but also on the patience and confidence of the market. How to win this economic game will be a major issue facing the US economy.