Tariffs strangle inflation VS immigration tears apart employment - the US economy is trapped in a policy paradox trap

- 2025年6月13日

- Posted by: Macro Global Markets

- Category: News

As the Trump administration's tariff policy and immigration restrictions are affecting the U.S. economy at the same time, a set of seemingly contradictory data is causing the market to think deeply about the true health of the economy. The changes in the consumer price index (CPI) and the job market in May are essentially a microcosm of the distortion of economic signals under policy intervention, and this phenomenon is making the Federal Reserve's monetary policy regulation fall into an unprecedentedly complex situation.

The May CPI data, which will be released on Wednesday, June 11, Beijing time, is regarded by economists as a key node to test the economic impact of tariff policies. It is predicted that the annual CPI growth rate in May may rise to 2.5%, and the core CPI may reach 2.9% year-on-year, with quarterly growth rates expanding compared with April. The core driving force of this rebound comes from the price transmission of the new round of tariffs launched by Trump in April to the consumer end.

However, the structural contradiction of inflationary pressure still exists: service industry inflation continues to reflect stable consumer demand, while fluctuations in the commodity sector are more vulnerable to policy shocks. Jose Torres, senior economist at Interactive Brokers, pointed out that although commodity prices may rebound periodically, the US economic structure tilted toward the service industry (the proportion of commodities in GDP has declined) will buffer the overall impact of trade frictions. The PCE inflation level of 2.1% in April is still close to the Fed's target, suggesting that overall inflation has not yet gotten out of control.

2. Immigration restrictions distort the job market: “False tension” masks real slowdown

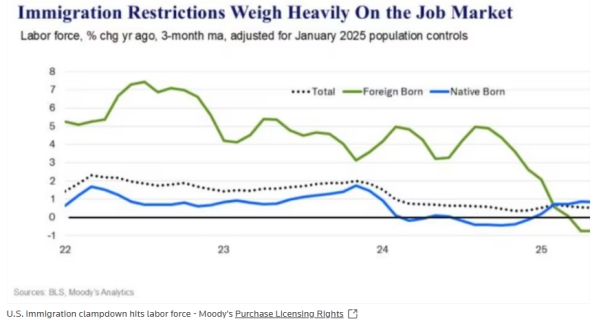

The inflation data also sparked controversy because of the "contradictory signals" from the job market in May: nonfarm payrolls increased by 139,000, the unemployment rate remained at a low of 4.2%, but total employment decreased by 696,000, the largest monthly drop since 2020. Economists generally believe that the Trump administration's immigration policy is the driving force behind this - when the labor supply shrinks due to a decrease in the influx of immigrants, the market's "break-even" employment growth value (the number of new jobs needed to keep the unemployment rate stable) is accelerating its decline.

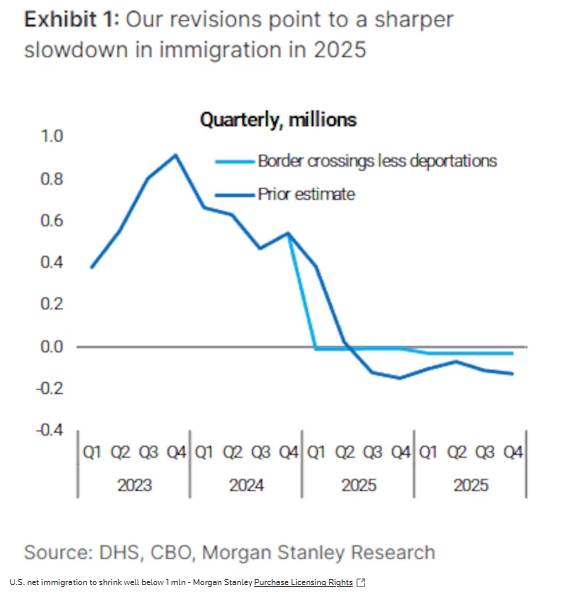

"The unemployment rate may remain low, but for the wrong reasons." Ryan Sweet, chief economist at the Oxford Economics Institute, pointed out that the reduction in labor supply caused by immigration restrictions is causing the market to misread the true tightness of the labor market. Although Federal Reserve Chairman Powell emphasized that the labor market is "solid," policymakers have realized that they need to use a "huge indicator system" to penetrate the data fog. The nonpartisan Congressional Budget Office originally predicted 2 million net immigrants in 2025, but under Trump's stricter policies, Morgan Stanley has significantly lowered it to 800,000, and there may be only 500,000 jobs next year, which may mean 100,000 jobs in the future.

3. The Fed’s Double Dilemma: Policy Trade-offs Under Distorted Data

The synchronous distortion of inflation and employment data is pushing the Fed into a policy dilemma. On the one hand, if the rebound in CPI in May confirms the tariff transmission effect, core inflation that continues to be above 2% may force the Fed to maintain high interest rates; on the other hand, the "false tension" in the labor market caused by immigration may mask the risk of economic slowdown, and the signal of interest rate cuts should also be cautious.

The deeper challenge lies in data reliability: tariff-induced advance purchases may temporarily push up inflation, while immigration restrictions leading to a contraction in labor supply distorts job market indicators. The question the Fed has to face is: How much of the current inflation is temporary? Is the "resilience" of the job market built on the sand of policy intervention? As some economists have pointed out, the combined impact of trade and fiscal policies is making it difficult for the Fed to judge economic fundamentals based on surface data alone, and policy uncertainty itself has become a potential risk that suppresses corporate investment and consumption.

Conclusion: When will the policy-driven economic "fog" dissipate?

As tariffs and immigration policies become the core variables that influence economic data, the US economy is entering a special cycle of "policy-driven rather than market-driven". For investors and policymakers, the ability to penetrate the surface of data and identify structural changes and temporary disturbances has never been so important. The Fed's policy balance between "false inflation" and "illusion" of employment not only affects the direction of interest rates, but will also test its regulatory wisdom in an era of policy uncertainty. In the coming months, as CPI and immigration data continue to be revealed, this policy-induced economic reconstruction will continue.