US trade barrier assessment report released, countdown to equal tariff policy

- 2025年4月3日

- Posted by: Macro Global Markets

- Category: News

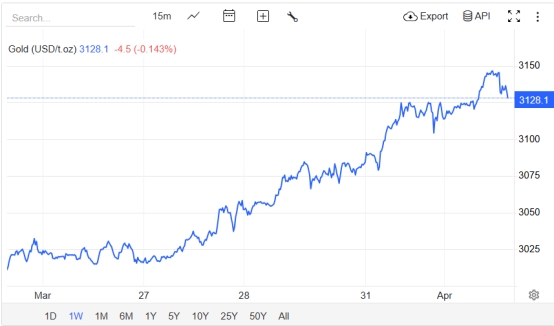

The Office of the United States Trade Representative (USTR) today released the "2025 National Trade Estimates Report", providing detailed basis for the "non-discriminatory and reciprocal tariffs" policy that will take effect on April 2. The report systematically sorts out the tariffs and non-tariff barriers on more than 5,000 commodities in 186 countries and regions, and clearly states that countermeasures will be taken against "unfair trade practices" such as Canadian dairy product management and EU agricultural product approval. Affected by this, the international gold price broke through $3,148.94 per ounce in the early trading, setting a record high, with a year-to-date increase of 19%. Silver also strengthened to $34.5 per ounce. However, there was volatility in the afternoon, fluctuating around 3130.

1. Policy logic

Tariff reciprocity: The United States will implement a "mirror tariff rate" based on the tariff levels of its trading partners, cancel tariff preferences for developing countries, and increase the average tariff level by 10-15 percentage points.

Non-tariff barrier countermeasures: Establish a "trade distortion index" and implement targeted tariffs against non-tariff measures such as food safety standards and renewable energy subsidies.

The exemption mechanism is tightened: tariff exemptions for allies such as Canada and Mexico will be cancelled, and applications for duty-free products from companies will no longer be accepted.

2. Impact on key areas

Automobile industry: Starting from April 3, a 25% tariff will be imposed on imported cars. Combined with the original tax rate, China's electric car tariff will reach 125%, and the EU's car tariff will rise to 50%.

Agricultural products: Canadian dairy products, EU alcohol, etc. will face high tariffs, and American farmers may lose $12 billion in income due to retaliatory tariffs.

Transistors: Imposing secondary tariffs on companies that use Iranian energy will accelerate the construction of factories by TSMC and Samsung in the United States.

2. Global Response: Escalation of Trade War and Countermeasures

1. Ally counterattack upgrade

EU: Plans to impose retaliatory tariffs on US Visa cards, motorcycles, etc., totaling US$3.5 billion.

Canada: Announced to impose a 25% tariff on U.S. steel, aluminum and agricultural products, involving an amount of US$12 billion.

Japan: Considering imposing tariff countermeasures on U.S. beef and corn, while accelerating the internationalization of the yen.

2. Emerging markets under pressure

India: With an average tariff of 17% on its products from the United States, India is one of the economies most affected. Its software exports may face a 30% tariff.

Southeast Asia: Vietnam's textile industry and Malaysia's electronic components industry are dependent on the US market, and supply chain costs are expected to rise by 18%.

3. Gold market: safe-haven demand and the US dollar game

1. Analysis of driving factors

Risk aversion sentiment intensifies: The tariff war increases the risk of a global recession. The World Bank lowers its forecast for global growth in 2025 from 3.1% to 2.8%. Gold ETF holdings increase to 931.94 tons.

Dollar credit crisis: The United States has suspended its dues to the WTO, many countries are accelerating the de-dollarization, the RMB's share in global payments has risen to 4.5%, and the strategic value of gold as a "non-sovereign currency" has become prominent.

Rising inflation expectations: Tariffs push up U.S. consumer prices by 1.7%, adding $17,000 to $22,000 to the cost of building a new home, and the downward trend in real interest rates (-0.8%) strengthens gold’s anti-inflationary properties.

2. Technical and institutional perspectives

Gold price trend: Spot gold broke through USD 3,130, RSI on the daily chart reached 77, KDJ was overbought (82), and the risk of a short-term pullback was accumulating, but the bullish trend remained unchanged.

Institutional forecast: Goldman Sachs raised its gold price target to $3,300 by the end of 2025. The China Banking Research Institute believes that if the tariff war gets out of control, the gold price may exceed $3,500.

Ding Shuang of Standard Chartered Bank: "Tariff policy will push up US inflation and delay the Fed's pace of rate cuts, but the rebound of the US dollar may suppress the short-term performance of gold prices." Jeffrey Currie, head of commodities research at Goldman Sachs: "The central bank's gold buying wave (Asian central banks may purchase 800 tons of gold per year) and the energy crisis (oil prices may exceed $150) will form long-term support for gold." Experts from the China Gold Association: "The scale of domestic gold ETFs has exceeded 200 billion yuan, and residents' hedging needs and the diversification of central bank reserves have jointly pushed gold prices up."

Investors should be wary of the risk of a short-term pullback and the impact of Trump's tariff policy implemented on Wednesday.