U.S. inflation rose across the board last month, exceeding expectations, supporting the Fed's cautious stance on rate cuts.

- 2025年2月14日

- Posted by: Macro Global Markets

- Category: News

Macro Global Markets: U.S. inflation rose across the board last month, exceeding expectations, supporting the Fed's cautious stance on rate cuts

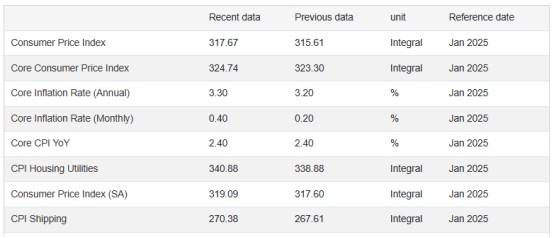

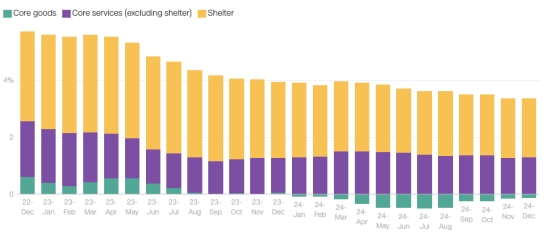

The Bureau of Labor Statistics said housing costs continued to be a problem for inflation, rising 0.4% for the month and accounting for about 30% of the overall CPI increase. Home prices across the country are still rising faster than overall inflation, which is spooking homebuyers. Federal Reserve Chairman Powell previously stated when talking about inflation that housing is the main source of the gap between inflation and the target. The unadjusted annual rate of housing inflation in the United States in January was 4.4%, compared with 4.6% in the previous month. This is one of the important reasons why overall inflation has failed to fall to the Federal Reserve's ideal target of 2%.

Last fall, when the Fed began cutting interest rates from a 23-year high, some experts were ready to declare victory in the fight against historic inflation. However, the U.S. government’s two main inflation measures, CPI and PCE inflation, have remained stubbornly above 2% since the Fed’s first rate cut in September last year. Housing inflation measures the value of rents that homeowners would receive if they lived in their homes. These two indicators measure inflation for owned and rented homes in the United States, respectively, and together account for more than 33% of the total CPI weight.

After the data was released, spot gold fell more than $10 in the short term, and then rebounded strongly to return above the $2,880 mark; the U.S. dollar index rose 50 points in the short term and basically remained strong; non-U.S. currencies generally fell, with the euro falling 40 points against the U.S. dollar in the short term; the pound fell nearly 70 points against the U.S. dollar in the short term; the U.S. dollar rose against the yen by 120 points; the Bureau of Labor Statistics said that food prices rose 0.4%, driven by a 15.2% increase in egg prices. The bureau said this was the largest increase in egg prices since June 2015, and about two-thirds of the increase in domestic food prices was caused by eggs. U.S. egg prices have soared 53% over the past year.

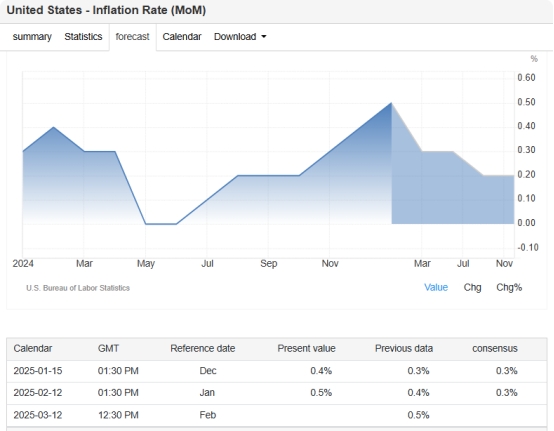

Wednesday's CPI report provided further evidence that the current U.S. disinflationary march is in danger of reversing, which, combined with a strong labor market, is likely to keep the Federal Reserve on hold for the foreseeable future. Policymakers are also awaiting more clarity on U.S. President Donald Trump’s policies, particularly tariffs, which have already led to a rise in consumers’ inflation expectations. The report came a day after Federal Reserve Chairman Jerome Powell said the central bank may take a break from interest rates. Currently, traders have adjusted their expectations for the next Fed rate cut from September to December. Interest rate futures traders are currently pricing in just 26 basis points of rate cuts from the Fed by December, down from about 37 basis points before the data was released, meaning the Fed will make just one 25 basis point cut this year.

To sum up, the unexpected performance of the US inflation data in January, especially the continued rise in housing costs, has become the main factor pushing up overall inflation. This situation not only puts pressure on homebuyers, but also makes the Federal Reserve more cautious in formulating monetary policy. Although the Fed has begun to cut interest rates, inflation levels have not yet reached its ideal target, which limits the room for further rate cuts. In the future, the Fed will closely monitor changes in inflation data while considering the uncertainty of the Trump administration's policies to decide whether it is necessary to adjust interest rate policy. Market participants also need to pay attention to these developments in order to respond to possible economic and financial risks.