New US tariffs hit global markets - Global markets react

- 2025年2月17日

- Posted by: Macro Global Markets

- Category: News

Macro Global Markets:New US tariffs hit global markets - Global markets react

The new import taxes would be tailored for each country and aimed at offsetting taxes those countries impose on U.S. goods, as well as non-tariff barriers such as unfair subsidies, regulations, value-added taxes, exchange rates and weak intellectual property protections, according to a memo circulated by the White House. Trump emphasized that reciprocal tariffs will be imposed on various countries, that is, the United States will impose the same tariffs as each country imposes on the United States.

But the policy has injected uncertainty into the global economy, with businesses and consumers waiting to see what happens. Reciprocal tariffs are expected to hit less developed economies with higher average tariffs on U.S. products hard, a departure from the general tax on all imports that Trump proposed during his 2024 presidential campaign, though he did not rule out a move to global unified tariffs in the future. Trump specifically mentioned Japan and South Korea, believing that these two countries are taking advantage of the United States and may become his latest targets. He also criticised India's high tariff barriers and the European Union's value-added tax.

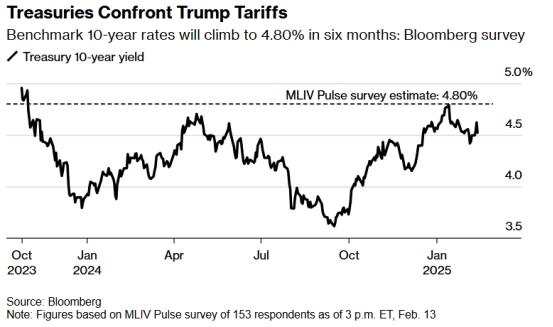

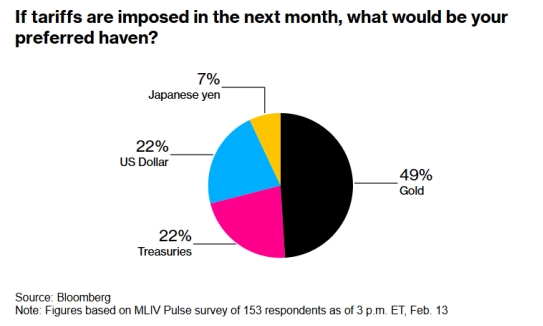

On Thursday, the 10-year Treasury yield fell to about 4.53%. Whatever form the trade war takes, most investors agree it would likely be an unwelcome development for the $29 trillion U.S. Treasury market. Historically, U.S. debt has been a popular safe haven for investors in turbulent times because it is backed by the U.S. government. But tariffs have heightened concerns about persistently high U.S. inflation, prompting bets the Federal Reserve will not cut interest rates anytime soon, keeping yields elevated and weighing on bond prices. Concerns about the fiscal health of the United States have also plagued the asset class in recent years.

A system of reciprocal tariffs would mark a dramatic change in the way the United States approaches trade and would undermine one of the founding principles of the global trading system that the United States established after World War II. The United States has long advocated so-called "most favored nation treatment" for tariffs, but Trump's policies will change that.

As the reciprocal tariff policy was not imposed immediately, the dollar took a hit and U.S. stocks were close to all-time highs. Investors and markets began to speculate whether Trump's remarks were a negotiating tactic rather than a final action. But in any case, Trump's reciprocal tariff policy has brought significant uncertainty to the global economy and financial markets. Investors and market participants are closely watching the U.S. government's next moves and how countries respond to these potential tariff changes. The market is likely to continue to experience volatility in the coming months as research is completed and policies are gradually implemented. Businesses and consumers need to prepare for possible changes in the trade environment and economic impacts.