The Fed has kept interest rates unchanged for 5 consecutive months, and expectations of rate cuts have cooled! Under the pressure of tariffs and inflation, Powell sends a signal of flexible policy

- 2025年6月20日

- Posted by: Macro Global Markets

- Category: News

The Fed has kept interest rates unchanged for 5 consecutive months, and expectations of rate cuts have cooled! Under the pressure of tariffs and inflation, Powell sends a signal of flexible policy

In the early morning of June 19th, Beijing time, the Federal Open Market Committee (FOMC) of the Federal Reserve announced that it would maintain the federal funds rate at 4.25%-4.50%. This is the fifth consecutive suspension of interest rate hikes since December 2024, which is in line with market expectations. The resolution statement pointed out that the US economic activity is "soundly expanding" and the unemployment rate "remains low", but at the same time emphasized that inflation is "still slightly high" and mentioned for the first time that "net export fluctuations affect the data", suggesting that the Federal Reserve is vigilant about the transmission effect of tariff policies and external risks.

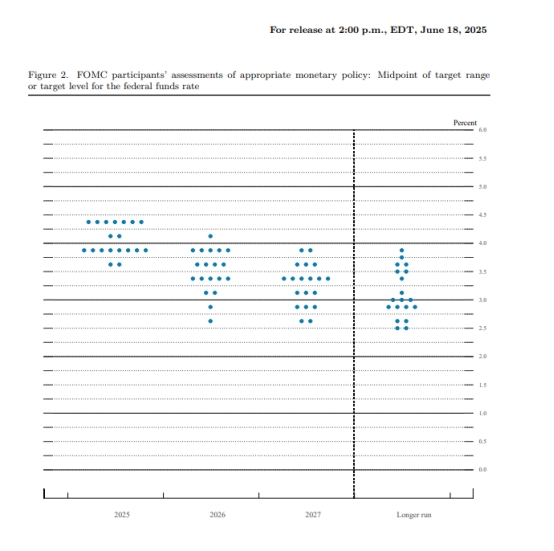

The divergence of the dot plot has intensified, and the expectation of interest rate cut has cooled down.

The latest dot plot shows that the Fed's internal opinions on the path of interest rate cuts in 2025 are significantly divided: among the 19 dot officials, 7 do not think there is no need to cut interest rates (4 in March), 10 support two cuts, and 2 support one. The median expectation is still maintained at two cuts (50 basis points cumulatively), but it is more conservative than the March meeting. It is worth noting that the expectation of interest rate cuts in 2026 has been reduced from 4 in March to 1, and the final value of long-term interest rates has been raised to 3.1%, highlighting the Fed's concerns about the "higher interest rates for longer" scenario.

The Federal Reserve significantly revised its economic outlook in the Summary of Economic Projections (SEP): the GDP growth forecast for 2025 was lowered from 1.7% in March to 1.4%, the core PCE inflation forecast was raised from 2.8% to 3.1%, and the unemployment rate forecast was raised from 4.4% to 4.5%. Powell bluntly stated at the press conference that the tariff policy may lead to a "significant increase" in inflation pressure this summer, and consumers will inevitably bear part of the cost, and the Federal Reserve needs to wait for more data to verify the inflation transmission path.

2. Policy logic: the difficult balance between anti-inflation and anti-recession

1. Tariff shock and inflation stickiness

The Trump administration's massive tariff policy (involving imports worth more than $500 billion) implemented since April 2025 is reshaping inflation expectations. Powell pointed out that although the current inflation data is mild, the lagged impact of tariffs on the supply chain will gradually emerge in June and July, especially in the fields of electronics and industrial equipment. There are signs of price increases. The Federal Reserve expects that the core PCE inflation rate will rise to 3.1% in 2025, 1 percentage point higher than the current level, forcing policymakers to postpone interest rate cuts to avoid inflation expectations from de-anchoring.

2. Data dependence and flexible response

Powell repeatedly stressed the principle of "data dependence" at the press conference, saying that the Fed needs to observe the evolution of the labor market, inflation data and tariff impacts before making decisions. He specifically pointed out that if inflation continues to be higher than the target due to tariffs, it is not ruled out to restart interest rate hikes; if the risk of economic recession increases, interest rate cuts may be accelerated. This "two-way flexibility" statement provides the market with policy buffer space, but also exacerbates short-term uncertainty.

3. Geopolitical risks and market sentiment

The situation in the Middle East (such as the conflict between Israel and Iran) and the escalation of global trade frictions have further complicated the policy path. Although geopolitical risks usually boost the safe-haven demand for gold, the current market is more concerned about the medium- and long-term impact of the Fed's policy path and economic data on gold. Short-term pulse-type safe-haven demand is unlikely to continue to support gold prices.

3. Impact on the gold market: Technological breakthrough and strategy selection under the game between long and short

Short-term pressure: Hawkish signals suppress gold prices

Short-term pressure: Hawkish signals suppress gold prices

Nomura Securities Chief Strategist Nakataka Matsuzawa pointed out that the Fed's decision this time highlights the "anti-inflation priority" position. In the short term, gold will face the pressure of a pullback, but in the medium- and long-term stagflation environment, gold is still a "core allocation asset." Goldman Sachs believes that if the inflation data in September falls below 2.8%, the Fed may cut interest rates in advance, and gold is expected to break through $3,400 again in the fourth quarter.

The Federal Reserve has stopped raising interest rates for five consecutive months, but expectations for rate cuts have cooled significantly due to tariff inflation risks. In the short term, hawkish signals and a stronger dollar suppress gold prices, but medium- and long-term stagflation risks, expectations for rate cuts and geopolitical uncertainties still provide support for gold.