The US dollar plummeted to a three-year low! Multinational US companies launched a "super long defense war"

- 2025年4月22日

- Posted by: Macro Global Markets

- Category: News

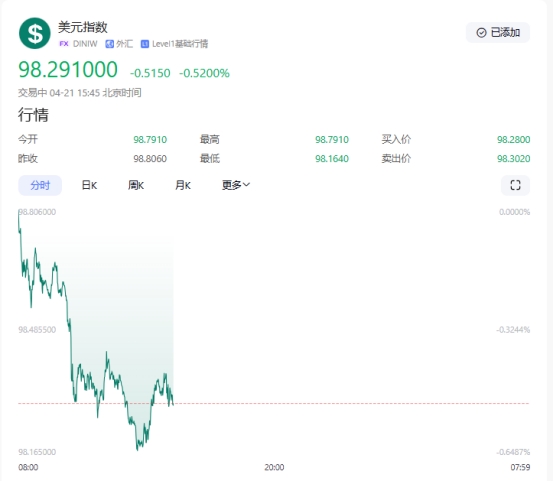

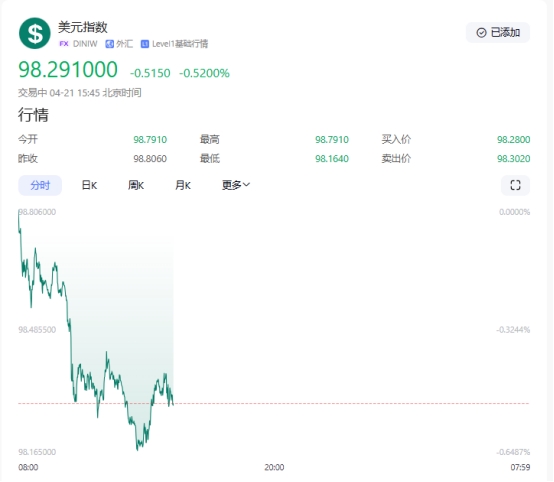

On April 21, 2025, the U.S. dollar index (DXY) continued to fall, hitting an intraday low of 98.164, a sharp drop of 1.03% from the previous trading day's closing price, setting a new three-year low since April 2022. As a result, the euro soared to 1.1485 against the US dollar, the pound broke through 1.3350 against the US dollar, and the yen strengthened to 141.80 against the US dollar due to expectations of intervention by the Bank of Japan. Behind this exchange rate storm is the collective launch of an "extra-long defense war" by multinational American companies - Apple, Tesla and other companies have extended the exchange rate hedging period from the conventional 3-6 months to 2-5 years, setting a rare record in the past decade. The spot gold price broke through $3,390 per ounce, up 1.68% from the previous day, redrawing the historical high, and the market's concerns about the "dollar credit crisis" further intensified.

The "Butterfly Effect" of the Fed's Policy Shift

Market expectations for the Fed's interest rate cuts continue to rise, and federal funds rate futures show that the cumulative interest rate cuts by 2025 will reach 90 basis points. Although Powell emphasized "data dependence" at the April FOMC meeting, the US GDP growth slowed to 1.8% in the first quarter and the core PCE price index rose to 2.9% year-on-year, forcing investors to reprice US dollar assets. Goldman Sachs' latest report pointed out that the US dollar index may fall to the 95 mark before the end of the year, hitting a new low since 2018.

The “shock wave” of Trump’s tariff policy

After the US government announced on April 2 that it would impose a 32% tariff on key areas such as transistors and new energy vehicles, the risk of global supply chain restructuring has intensified. Demand for the U.S. dollar as a trade settlement currency has declined, with data from the Chicago Mercantile Exchange (CME) showing that open interest in U.S. dollar futures fell 12% in a single week. What is even more troublesome is that trading partners such as Japan and the European Union have launched retaliatory tariffs, forming a vicious cycle of tit-for-tat.

Global central banks’ “de-dollarization” actions

The People's Bank of China increased its gold holdings by 29 tons in April, and its total reserves exceeded 2,292 tons; the Reserve Bank of India announced that it would reduce the proportion of its U.S. dollar asset allocation from 65% to 58%. This "de-dollarization" trend is particularly evident in emerging markets, and countries such as Brazil and Argentina have included the RMB in their foreign exchange reserves. A report by the Bank for International Settlements (BIS) shows that the US dollar's share of global foreign exchange transactions has dropped from 88% in 2022 to 83%.

The “extreme extension” of hedging strategies

Data from Mizuho Bank shows that its corporate clients generally extended the hedging period of forward contracts from 6 months to 2-5 years. This "ultra-long-term defense" is the first since the 2008 financial crisis. Apple disclosed in its latest financial report that its foreign exchange hedging has reached US$42 billion, covering its overseas revenue for the next three years. Tesla locked in its profits in the European market before 2027 by purchasing euro call options.

“Geo-reorganization” of supply chains

General Motors announced that it would increase the production capacity of its Mexican factory by 50% to avoid the impact of fluctuations in the US dollar exchange rate on the North American supply chain; Boeing accelerated the layout of maintenance centers in Southeast Asia to reduce its reliance on US dollar settlement. A survey by Boston Consulting Group (BCG) shows that 68% of multinational companies plan to complete the "regionalization" adjustment of their supply chains by 2025.

“Currency switching” in financing channels

Technology giants such as Microsoft and Amazon have turned to the euro bond market for financing. In April, the issuance of euro-denominated corporate bonds reached 38 billion euros, a year-on-year surge of 210%. This strategy of "borrowing low-interest currency and earning high-interest assets" not only reduces exchange rate risk but also increases the rate of return on funds.

The “critical point” of central bank intervention

Japanese Finance Minister Katsunobu Kato issued a rare warning on April 21 that if the yen exchange rate falls below the 142 mark, he will consider launching "emergency intervention." In 2024, Japan intervened in the market four times, consuming a total of more than 15 trillion yen in foreign exchange reserves. At the same time, the European Central Bank announced a 25 basis point interest rate cut on April 18, pushing the euro/dollar exchange rate to break through 1.14, further squeezing the dollar's space.

“Tool Innovation” for Enterprises to Avoid Risk

Data from the London Stock Exchange showed that the volume of foreign exchange options trading by eurozone companies increased by 47% in a single week, of which "digital options" (effective only within a specific exchange rate range) accounted for 31%. This tool can both reduce hedging costs and provide "unexpected gains" when exchange rates fluctuate violently.

A ‘structural shift’ in capital flows

Data from the U.S. Treasury Department showed that foreign capital sold U.S. Treasuries worth $68 billion in March, the highest level since 2020. The flow of funds was polarized: safe-haven funds poured into gold ETFs (SPDR gold holdings increased by 19 tons in a single week), while risk-seeking funds flowed into emerging market stocks, with the MSCI Emerging Markets Index rising 3.2% in a single week.

The continued plunge of the US dollar and the "super long defense" of multinational companies are essentially a microcosm of the reconstruction of the global monetary system and supply chain. For investors, we are currently in a triple variation period of "dollar depreciation - gold safe haven - corporate restructuring": in the short term, we need to be vigilant against overbought pullbacks and policy sudden changes; in the medium term, we can allocate gold ETFs and physical gold bars on dips; in the long term, we need to pay attention to the "time difference" between the global central bank's gold purchase speed and the Federal Reserve's policy turning point.