[MACRO Sharp Comments] US Treasury volatility, the Federal Reserve policy game and global central banks' gold hoarding: dual challenges under the US dollar system

- 2025年6月5日

- Posted by: Macro Global Markets

- Category: News

In the first half of 2025, the U.S. economy is deeply trapped in the shadow of stagflation of "low growth and high inflation". The International Monetary Fund (IMF) lowered its GDP growth rate from 2.8% in 2024 to 1.8%, and the OECD further dropped it to 1.6%. Consumption-side data deteriorated across the board: the consumer confidence index fell to 50.8 in May (the lowest since June 2022), and households lost an average of $1,700-8,100 in disposable income annually due to tariffs, with low-income groups suffering 4%; at the same time, the core PCE inflation rate is expected to exceed 3.2% by the end of the year, far exceeding the Fed's 2% household price index of 2.2% outside of imports.

The labor market presents structural contradictions: although the unemployment rate briefly fell to 4.0%, the number of job vacancies fell to the second lowest level in four years, and corporate recruitment demand continued to cool. Economists warned that the unemployment rate could soar to 4.4% by the end of the year. The manufacturing PMI rebounded to the expansion range of 52.3, but it was mainly driven by companies' advance stockpiling to avoid tariffs. The growth rate of purchasing inventory hit a new high since 2009, while actual new orders grew weakly. Supply chain bottlenecks intensified, delivery time extended to the worst level in 31 months, and tariffs pushed up import costs. Manufacturers' sales prices and input costs recorded the largest monthly increases since September and August 2022, respectively.

2. U.S. Treasury market volatility and the Treasury Department’s aggressive market support

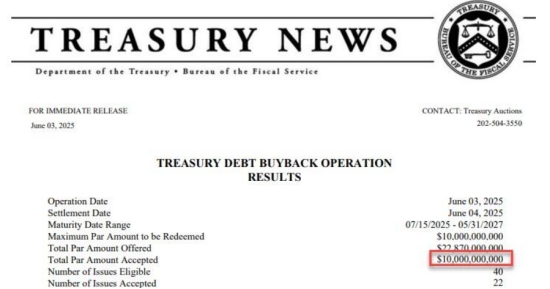

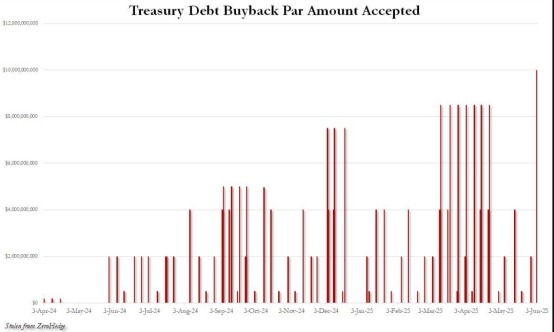

Faced with such a severe situation, U.S. Treasury Secretary Benson decisively released a strong signal on April 14, suggesting that "expanding U.S. bond repurchases" would be the core means of stabilizing the market. This news was like a bombshell, causing a thousand waves in the financial market. Six weeks later, the U.S. Treasury Department fulfilled its promise with practical actions and set a record for bond repurchases with a repurchase scale of US$10 billion. It is worth noting that the scope of this repurchase operation is no longer limited to the previous short-term bonds, but has been further expanded to long-term bonds with a term of 10-20 years, and the scale has doubled compared with similar operations in May.

3. Global trust crisis and the rise of gold under Trump’s tariff policy

The Trump administration's erratic tariff policy has become a catalyst for economic stagflation and has shaken the world's trust in the dollar reserve system. Although the "reciprocal tariff" was suspended in June 2025, the 10% "base tariff" and the high tariff of 125% on China are still retained, leading to an intensified split in the global industrial chain. Atlanta Federal Reserve Bank Chairman Bostic warned that the price increase caused by tariffs will be apparent in the coming weeks, and if it continues, it may lead to "solidification" of inflation expectations; Chicago Federal Reserve Bank Chairman Goolsbee bluntly stated that the central bank lacks a response script under the risk of "stagflation".

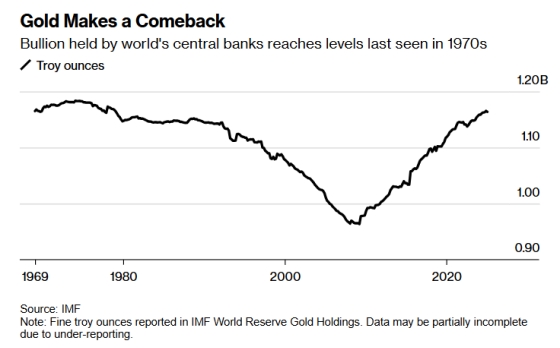

4. The wave of de-dollarization: the logic of gold as a "de-risking" asset

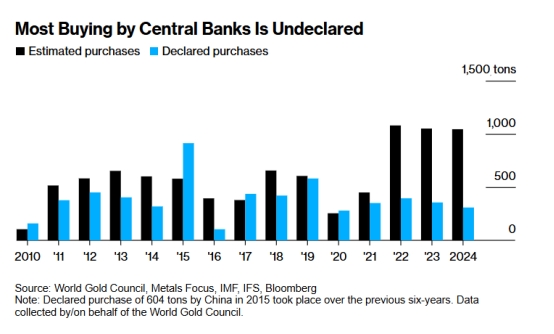

The gold buying spree is essentially a hedge against the risk of "weaponization" of the U.S. dollar. Since the outbreak of the Russia-Ukraine conflict in 2022, Russia's foreign exchange reserves of more than $300 billion have been frozen by Western countries. This unprecedented financial sanctions event has completely overturned the global central bank's perception of the security of international reserve assets. Data shows that after the outbreak of the conflict, the annual net gold purchases of global central banks surged from 450 tons in 2021 to 1,136 tons in 2022, setting a record high since 1950, and the gold purchase rate will double. This panic buying behavior reflects the deep concerns of various countries about the fragility of concentrated holdings of U.S. dollar assets. The divergence between price and trading volume can better provide insight into the undercurrent of the gold market.

These covert operations are essentially emerging market countries implementing a "progressive gold reserve strategy" - according to the International Monetary Fund (IMF), India, Turkey and other countries are trying to gradually increase the proportion of gold reserves to foreign exchange reserves from the current 10% to the "safety threshold" of 20%. The forward-looking judgment of international investment banks further verifies the rising potential of gold. In its first quarter 2025 strategy report, Goldman Sachs maintained its year-end target price of $3,700 per ounce, believing that factors such as geopolitical conflicts and the US debt ceiling crisis will continue to boost risk aversion demand. JPMorgan Chase's quantitative model gives a more radical forecast: if foreign investors convert 0.5% of their $7.4 trillion in US assets into gold, according to the current supply and demand structure, the gold price may reach a historical extreme of $6,000 per ounce in 2029. This deduction based on asset allocation transfer reveals the huge potential demand gap in the gold market.

5. Deep Cracks in the US Dollar System and Policy Linkage Effects

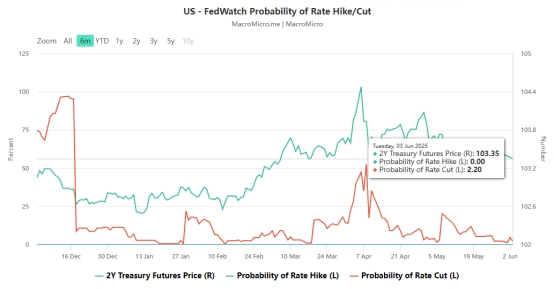

In the short term, the Federal Reserve's interest rate meeting on June 17 and the scale of Treasury repurchases will become key windows for policy shifts; but in the long term, the stagflationary pressure of the US economy and the global wave of de-dollarization have resonated. When the US bond market relies on fiscal support and the Federal Reserve is caught in a policy dilemma, the strategic value of gold as a "de-risking" asset is reshaping the global financial landscape - this is both a response to the disorder of US policies and an inevitable choice for the diversification of the international monetary system.