[MACRO Sharp Comment] The key to the US dollar in 2025 is the discount! Where do opportunities and challenges coexist?

- 2025年1月18日

- Posted by: Macro Global Markets

- Category: News

The dollar has been unexpectedly strong as President-elect Trump prepares to return to the White House. Earlier this week, the Federal Reserve's nominal trade-weighted exchange rate index for the dollar was just below 130, the highest level since March 1973. The ICE Dollar Index recently broke through 110, reaching its highest level since November 2022. The dollar index has risen 9% since Election Day and 7.7% in the quarter ended December, its best quarterly performance since the first quarter of 2015.

The rapid strengthening of the U.S. dollar has had a profound impact on the global economy, especially on the performance of U.S. companies. A stronger dollar causes the dollar value of overseas revenue to fall, raising the possibility that currency translation effects could cause companies to miss Wall Street sales and earnings targets, a team of analysts at Goldman Sachs said in a recent research note. The three most vulnerable sectors are information technology, materials and energy stocks.

A stronger dollar could also pose a greater headwind to overseas economies and financial markets. International stocks have significantly underperformed their U.S. counterparts in dollar terms over the past year, especially when their returns are converted to U.S. dollars. Other countries may feel a greater burden as a stronger dollar puts more pressure on their currencies, which could limit the ability of monetary authorities to cut interest rates to boost domestic demand.

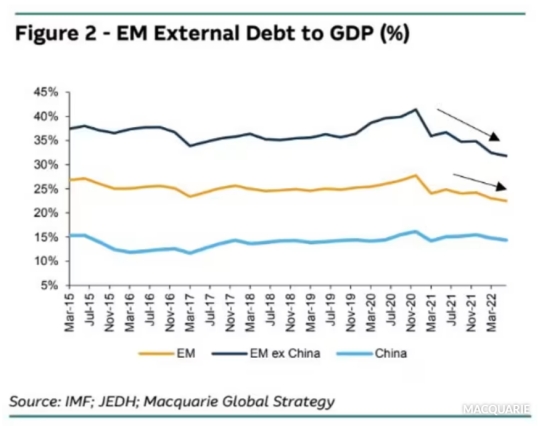

Historically, the strength of the US dollar has triggered many financial crises. In the late 1990s, the Asian currency crisis caused currencies such as the Thai baht to spiral downward, and ultimately international forces had to be relied upon to prevent the crisis from spreading. Similarly, in the early 1980s, a strong dollar triggered a debt crisis in Latin America. Although emerging market economies now have much stronger foreign exchange reserves and lower levels of external debt, the stronger the dollar, the greater the chance that problems will arise somewhere in the global financial system.

Fortunately, the dollar's dominance seems to be about to be shaken. Tavi Costa, macro strategist at Crescat Capital, mentioned in a recent report that 2025 will be a key turning point for the US dollar and emphasized its impact on gold, silver and global markets. Historical dollar cycles provide valuable reference, with long-term cycles alternating between dollar appreciation and depreciation. Aggressive fiscal expansion in the United States is creating vulnerabilities that could accelerate its reversal.

Costa noted that U.S. stock market valuations are higher than they were before the Great Depression in 1929, and he would not be surprised if there was a big shock in early 2025. This will lead to a depreciation of the US dollar and usher in the next chapter of macroeconomics in the next few years. For investors, a possible peak in the U.S. dollar presents opportunities in tangible assets such as gold and silver. Gold's performance as a hedge against irresponsible fiscal policy and currency debasement will only grow as central banks continue to increase their purchases. Additionally, he believes that silver is an undervalued opportunity, with the gold to silver ratio currently at 83 to 84, a ratio that tends not to last when there is a true bull market in gold.

The strength of the U.S. dollar has a profound impact on the global economy, especially on the performance of U.S. companies and the stability of global financial markets. While the dollar’s strength has its drivers, its dominance may not last long. Investors should pay close attention to the trend of the US dollar and its impact on gold, silver and other tangible assets to prepare for possible market fluctuations and policy changes.